Free mutual fund starter funds for raffle

By Randell Tiongson on November 24th, 2014

Great news to those attending the Money Manifesto Conference this Saturday (Nov. 29, 2014). Our sponsor, Sun Life will be raffling of Sun Life Prosperity Funds worth P5,000.00 each to the lucky winners!

Great news to those attending the Money Manifesto Conference this Saturday (Nov. 29, 2014). Our sponsor, Sun Life will be raffling of Sun Life Prosperity Funds worth P5,000.00 each to the lucky winners!

What are Sun Life Prosperity Funds?

Sun Life Prosperity Funds

Simplicity, Accessibility, Affordability and Returns. These are only a few of the benefits that a Sun Life Prosperity Fund investor receives.

- Affordability: For a minimum of Php 5,000, one can jump start an investment account and be on his/her way to prosperity

- Higher potential returns*: The Sun Life Prosperity Funds is a family of funds that caters to various risk appetites and investment horizons. Whether you’re a conservative or aggressive, short term or long term investor, at least one fund is suitable for you to achieve your investment goals.

- Diversification: For as low as Php 5,000, your investment is instantly diversified among different financial vehicles in order to minimize risk.

- Flexibility: Risk appetite tends to change over time and should you feel like changing where your funds are placed, you can do so accordingly up to four times in a year at no charge!

- Liquidity: Sun Life offers the option to redeem fund shares any time on a business day at the current fund value.

- Professional Portfolio Management: The Sun Life Prosperity Funds are managed by top notch investment professionals who are dedicated to ensuring that the funds generate the best returns over the long term.

- Global Expertise: Sun Life Asset Management Company, the fund manager and distributor of the Sun Life Prosperity Funds is a member of the Sun Life Financial Group of Companies operating in Canada, the United States, United Kingdom, Hong Kong, China, India, the Philippines and Indonesia.

For more information on Sun Life Prosperity Funds, visit http://j.mp/174yGXG

To know more about the conference, CLICK HERE.

See you this Saturday!

Should you invest on stocks or equity funds?

By Randell Tiongson on May 2nd, 2014

QUESTION: I am ready to start investing and I would like to invest in equities. Is it better to invest in stocks directly or through pooled stock funds like UITF or mutual funds? —Name withheld per request, asked via e-mail

QUESTION: I am ready to start investing and I would like to invest in equities. Is it better to invest in stocks directly or through pooled stock funds like UITF or mutual funds? —Name withheld per request, asked via e-mail

Answer: As a financial and investment planner, we need to subscribe to the principle of suitability. Without sufficient information, it wouldn’t be prudent of me to categorically say one would be better than the other. The answer really depends on you—if you are knowledgeable enough to select your own stocks, size of funds, and if you have enough time for investing.

However, to help you make a more informed decision, let’s discuss the advantages and disadvantages of both types of investing.

On individual stocks

Advantages :

Control—Buying your stocks directly gives you control over what and when to buy or sell.

Residual income—If you buy a stock with a good dividend payout, then you don’t have to watch the price movement anymore. As long as the company is earning and declares dividends, you will get dividends.

Maximized returns—individual stocks that are growing may beat the market and can give you better-than-average returns. Jollibee beat the market last year, moving from P100-P170 while the entire market was down.

Potentially better returns—with proper selection and assuming that you are very good at selecting market performers, the growth of your own stock portfolio can outperform the stock market index and many stock funds.

Fees—buying your stocks directly from brokers usually means lower fees as fund managers charge a higher investment management fee compared to stock brokers.

Disadvantages :

Time-consuming—before investing, you should spend enough time thoroughly understanding how stock market investing works. You should also accumulate enough knowledge of both fundamental and technical analysis. Fundamental analysis means you must be able to read and understand financial reports of the companies you would like to invest in, the general condition of the industries and market trends to which these companies belong to, general knowledge of macroeconomics and even the management of the corporations you would like to own shares of, etc. Technical analysis will require you to constantly study charts on price averages, trading volumes and a multitude of technical market theories like Dow theory, Relative Strength Index, Elliott Wave theory and more. While fundamental and technical analysis is not rocket science, it takes considerable time for you to learn them properly. Enrolling in a class like Marvin Germo’s Stock Smarts is a good way to start.

Diversification—all investment professionals will always recommend you to diversify. No amount of study and good performance in the past will guarantee the performance of a particular stock in the future so having several and properly selected stocks is always a prudent thing to do. Unless you have a very big capital for investing, you will be limited to the variety of stocks you can carry in your portfolio.

On stock funds

Advantages :

Professional fund management—this is perhaps the biggest advantage of pooled funds like UITFs and mutual funds. There is a dedicated team of investment experts that looks at investment opportunities and is investing the money according to the investment objectives of the fund. It is common to see CFAs or Certified Financial Analysts leading or being part of these investment teams. Good fund managers are clinical and logical investors and are not easily swayed by emotions as compared to individual investors.

Capital requirements—most of pooled stock funds have low capital entry requirements. One can invest in a fund for as low as P 5,000 to P10,000, with other providers requiring a monthly contribution of as low as P1,000 per month.

Diversification—all stock funds carry well-diversified stocks in their portfolio, usually blue chip or premium stocks. Since these are pooled funds, there are economies of scale in place; fund managers will be able to purchase different shares. Proper diversification will ultimately result in reduced portfolio risk.

Disadvantages :

Fees—While not all stock funds charge the same range of fees, these fees are usually much more than broker fees as there are costs involved in managing funds. Some funds even charges entry and exit fees, which can reduce the returns of your investments. Some funds are being sold through agents and advisors and commissions would need to be paid to them.

Control—you have no say on which funds you want or don’t want in your fund as this is already delegated to the fund managers. You also can’t modify the weight of the stocks inside a stock fund as fund managers follow maximum exposure limits per stock to ensure proper risk management practices. Even if you want more PLDT or Jollibee shares in your portfolio, your fund will only have a limited exposure to said stocks, like 10 percent.

The answer to your question is dependent upon you knowing the pros and cons of individual stock investing or through a pooled equity or stock fund. If you are a new investor, I recommend you invest in a stock fund first and as you get to understand how the stock market works and develop your competency in investing, you may want to start investing in individual stocks.

Do not forget, whether investing in stocks by yourself or through a fund, it pays to invest first in investment education.

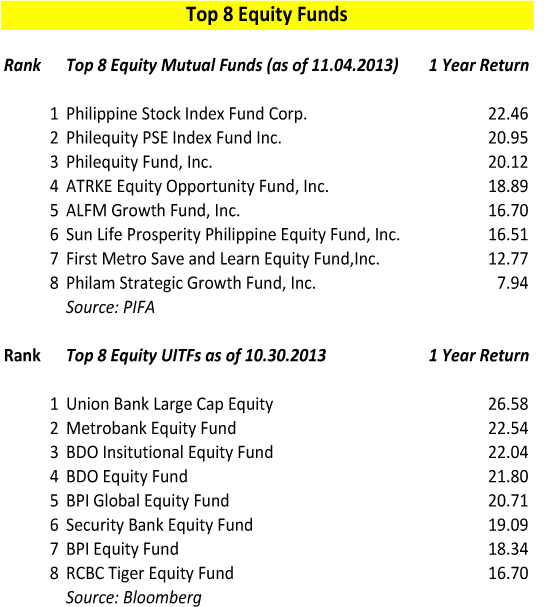

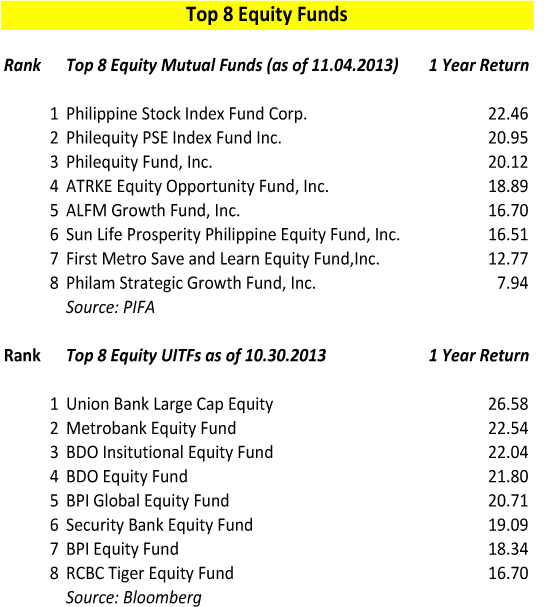

Top 8 Equity Fund Performances

By Randell Tiongson on November 5th, 2013

The year is almost over and this has been a whirlwind of a year for the Philippine Stock Markets. The start of the year saw a tremendous surge of the market pushing the Philippine Stock Index beyond the 7000 mark. Towards the middle of the year, massive correction and decline was seen as foreign funds took profits but our market seems to be more resilient than ever. Some recovery was seen pushing the market up again and refusing to enter a bearish market. Our market has yet to go back to the 7000 mark but many analysts are confident we will be back to those levels sooner than later, perhaps early next year?

For those who invested in equity pooled funds like mutual funds or Unit Investment Trust Funds (UITF), it is good to know that there continues to be good returns although not as substantial as 2012. I have collated the 1 year returns of the top 8 equity funds, both mutual funds and UITFs. On the mutual funds side, the 2 index funds rose to be the top performers for the 1 year period lead by the Philippine Stock Index Fund and the Philequity PSE Index Fund. Customarily, managed funds outperforms the index, but that’s not the case for this 1 year period. On the other hand, some UITFs performed better than the index funds and 5 of those UITFs registered above 20% returns for 1 year led by Union Bank, Metro Bank and BDO and BPI. The UITF equity funds seems to be performing better than their mutual fund counterparts for the 1 year period.

Let me repost what I earlier said in an earlier post: “I need to caution readers, however, that returns are not the sole factor if selecting a fund. Aside from fees, it will be good to check on how volatile the funds are, experience of the fund manager and size of fund. Bigger funds are usually less volatile but may not have the best performance. Further, equity funds that are more diversified and having more variety in the fund is generally less risky.”

Mutual Funds are available through Mutual Funds Companies and are regulated by the SEC. UITFs are available through banks and are regulated by the BSP.

Great news to those attending the Money Manifesto Conference this Saturday (Nov. 29, 2014). Our sponsor, Sun Life will be raffling of Sun Life Prosperity Funds worth P5,000.00 each to the lucky winners!

Great news to those attending the Money Manifesto Conference this Saturday (Nov. 29, 2014). Our sponsor, Sun Life will be raffling of Sun Life Prosperity Funds worth P5,000.00 each to the lucky winners!