Why are interest rates so low?

By Randell Tiongson on July 20th, 2011

Question: Why are interest rates in the banks so low? Will it go up anytime soon and what are the alternatives so my money can earn better?—Dennis Poliquit, Radio DJ

Question: Why are interest rates in the banks so low? Will it go up anytime soon and what are the alternatives so my money can earn better?—Dennis Poliquit, Radio DJ

Answer: Dennis, your question is one that you can call a ‘loaded’ question, so to speak (pun intended). Let me try to simplify my answers because the way most people explain it can cause many a nosebleed, me included. In economic terms, interest rates are largely a function of the government’s monetary policy with the central bank as its chief implementor. The government, through the central bank, tries to influence the economy by manipulating interest rates according to the direction of its economic managers. When the government wants money to circulate in the economy, it tries to keep interest rates low with the belief that money will be spent and invested in businesses that drive economic growth. When interest rates are low, people are discouraged from keeping their money with the government, which is the safest and largest borrower through the sale of government securities (debt instruments).

When the government wants to control the cash circulating in the economy, it increases interest rates and you can expect the market to start putting more money in government debt paper because of its low risk. The interest of government securities, also called treasuries (bills, notes and bonds), is also the basis…

To read full column, visit http://business.inquirer.net/7863/why-are-interest-rates-so-low

A closer look at Philippine mutual funds, part 2

By Randell Tiongson on September 14th, 2010

The big question in the minds of many: ‘will the local market continue with its good run in the months to come?’ Some sectors are claiming that we are headed into a ‘bull’ territory and see the market continue to gain further; while others are cautioning that the market is in a ‘bubble’ and it will correct itself, if not crash soon. Analysts using fundamental and technical techniques can argue hard for both ways. I’ve spoken to someone who is dead serious that the market is in for an imminent crash because them Elliott Wave Theory says so. On the other hand, you can read that the markets will continue to ride to growth territories because the economy is growing.

Here’s my take on all these: past performance is never an indication of future performance! While historical data can be helpful in determining which investment route to take, I wish to caution the readers not to rely too much on historical data. Many factors can affect future performance like taking too aggressive or too conservative positions in their investment policies. The argument by many advocates of index investing is that they can trust the index better than active managers. Experience in many countries supports such an argument but clearly, the same argument is not the case in the Philippines – another “only in da pilipins” claim we can make.

When investing, regardless of what instrument you chose, always invest according to your investment objective, risk tolerance and time frame. If you are still unsure of the 3 factors I mentioned, take time to find out first before letting go of your hard-earned money. Further, when you do invest in instruments such as mutual funds or UITF (available in Banks), pay particular attention to the fee structure; some funds charge more than the others.

Oh, one more thing (last na!) – whenever you are investing, never invest in something you don’t understand. Take time to learn about the investment which you are planning to take and don’t worry, investing need not be rocket science and try to practice being prudent in as much as you can.

A simple man believes anything, but a prudent man gives thought to his steps. – Proverbs 14:15, NIV.

A closer look at Philippine mutual funds, part 1

By Randell Tiongson on September 12th, 2010

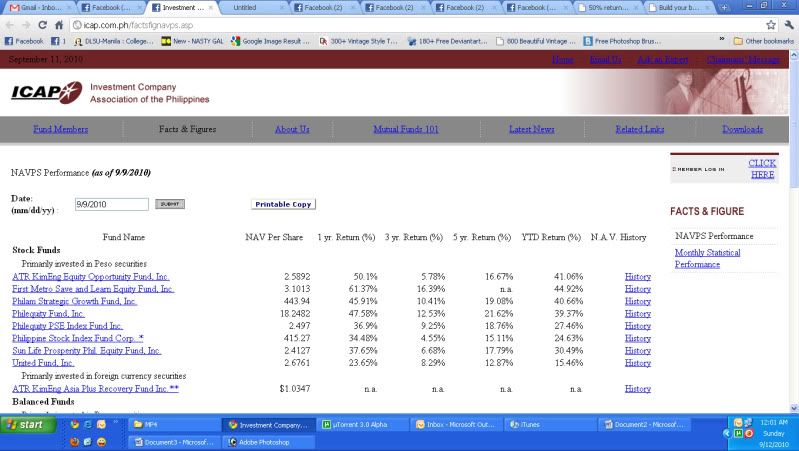

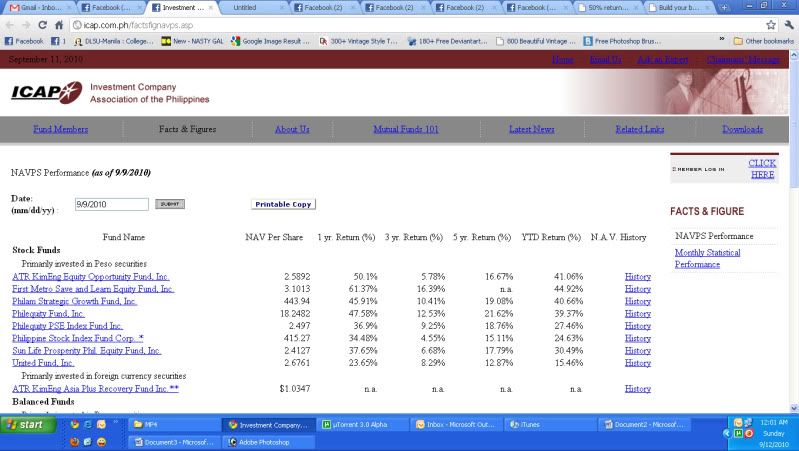

I was just reviewing the performance of local mutual funds courtesy of their helpful site, http://icap.com.ph. When you look at the year-to-date (YTD) performance of the equity funds, you will notice that nearly all funds trump the PSEi benchmark. The top 3 funds registered over 40% growth for their YTD numbers. It is also interesting to note that the 5 year YTD marks of the funds all beat the PSEi benchmark, with the exception of just 1 fund.

There is a view in many countries that investing in the index of the funds is the way to go as they perform better than most of the actively managed funds. However, this is not the case for the Philippine equity laced funds. By comparison, the top earner for the 5 year period is Phil Equity Fund, outperforming the index by as much as 6%.

Mutual funds are very convenient for those who do not have the competence and the time to manage their own stock portfolios. While many stock investors can claim to experience better return for their portfolios, the practicality of investing in the stock market through properly managed mutual funds (or UITF) is a better alternative to many – especially those who have better things to do than watch the market on a daily/weekly basis.

I am also encouraged by the relative good performance of many funds: the 5 year period showed many of the equity funds doing somewhere between 16 % to as much as 21% p.a. growth despite the disastrous financial crisis of 2008. Here’s another good thing: most local equity funds outperformed overseas funds! When you take into account the strengthening of the Peso, the growth of our local funds puts a greater distance to overseas funds. Investing in a USD denominated fund in 2005 will cost you about P53:$1 as compared to P45:$1 today. Not bad eh?

The big question in the minds of many: ‘will the local market continue with its good run in the months to come?’ …

… to be continued.

Question: Why are interest rates in the banks so low? Will it go up anytime soon and what are the alternatives so my money can earn better?—Dennis Poliquit, Radio DJ

Question: Why are interest rates in the banks so low? Will it go up anytime soon and what are the alternatives so my money can earn better?—Dennis Poliquit, Radio DJ