What you can learn from the Chinese stock market crisis

By Randell Tiongson on July 20th, 2015

While the world had its eyes on Greece and the Eurozone, something big was happening closer to our doorstep — a 30% drop in the Shanghai Composite Index in the span of just three weeks. Hundreds of companies stopped trading, and the Chinese government brought the hammer down to try to stop the skid, even threatening to arrest people who short sell. Many analysts think that these actions may have just made things worse.

(Photo from HERE)

The Chinese stock market, before this drop, had been having a ridiculously good run, soaring on the wings of individual investors. These small investors started buying a lot of stocks over the last year with borrowed money (also known as margin financing), encouraged by the government to invest in the stock market. Because of this borrowing, more than 80% of Chinese investors are small-time individuals; in most other markets, investors are mostly institutes. The influx into the stock market sent valuations skyrocketing. The Shanghai index increased over the last three years without matching the growth rate of the Chinese economy.

But what goes up must come down, and that’s exactly what happened. Because the growth was being driven by momentum and not fundamentals, people began to fear that it was unsustainable, and began to sell, triggering the steep drop in stock prices. In the long term, the real value of these stocks will be and should be reflected by the market.

So what does this mean for the regular Filipino? At the moment, the Chinese economy’s downturn won’t have lasting effects on us for the short term. The companies listed in the Chinese stock markets are not directly connected to the Philippine economy. This means that ordinary Chinese are taking most of the impact of the crash.

And even after the stock market plunge, China’s economy is still growing at the predicted pace. They already released their second quarter 2015 growth at 7% — although there are questions about the validity of this figure.

However, it’s the threat of a slowed-down Chinese economy that would be a problem for us. If China’s growth falls below 7%, that could affect many of manufacturers in ASEAN including the Philippines — since our region provides a portion of the intermediate goods for China to finish or complete.

There are a few lessons you as an individual investor (or one trying to be) can take from the Chinese stock market crash, though:

1. Don’t sell in a panic. A lot of people’s first instinct, when faced with a crash, is to sell, which just makes the crash worse. Don’t panic; always have an eye on the medium- to long-term. With the strong fundamentals of the Philippine economy, more likely than not any dip caused by panic about the Chinese stock market will ease over time.

2. Focus on the internal strength of the economy. Many of the infrastructure projects are limited to local blue chip firms. They should be setting the stage for future returns once these projects go online. Hopefully these projects funnel and facilitate the movement of income from these big firms to the smaller ones.

3. Don’t borrow money to invest. I would recommend that you only invest money you already have and won’t need in the medium- to long-term instead of getting margin loans to make investments. When you buy stocks with borrowed money, you can’t afford to ride out a crash by holding on to your stocks until prices climb back up; you have to sell what you can so you can pay back your lender. And if the market has fallen by a lot, you might lose all your money and can’t repay your debt. Only invest what you can afford to lose.

All these economic crises hitting at once may make you worry about your own investments. But the Philippines, despite being exposed to China’s volatility, is still targeting 7 – 8% growth, according to Economic Planning Secretary Arsenio Balisacan. We still don’t know how we’ll be ultimately affected by what’s happening in China right now, but the effects should be manageable in general.

If you’re an investor, remember to stick to your investment timeline and long-term goals, and keep an eye on the China story as it develops over the next few weeks and months but do not be in fear.

——————

Get my best-selling book in discounted book bundles and comes with free shipping!

No Nonsense Personal Finance is at P500.00 and Money Manifesto at P600.00. If you get the both books, it will now be just P1,000.00 and comes with free shipping!

Here’s how you can order:

1) Deposit to BPI # 0249-1113-09 (John Randell Tiongson)

2) Send copy of deposit slip to mia.tiongson08@gmail.com with your full address and telephone number.

Investing in good and bad times

By Randell Tiongson on November 20th, 2014

To a great degree, investments are generally affected by economic cycles. You always hear people encouraging you to make investments because the economy is good. You also hear businessmen complain a lot when the economy is bad. The economy goes through changes from time to time which we normally refer to as economic cycles.

Economic cycles are fluctuations in the economy between periods of expansion or growth and contraction or recession. Factors that determine cycles are usually Gross Domestic Product (GDP), interest rates, employment numbers, consumer spending and the like. Investopedia further explains: “An economy is deemed to be in the expansion stage of the economic cycle when gross domestic product (GDP) is rapidly increasing. During times of expansion, investors seek to purchase companies in technology, capital goods and basic energy. During times of contraction, investors will look to purchase companies such as utilities, financials and healthcare.”

People are more likely to invest their money during when the economy is in its growth cycle and they are likely to stay away from investing when the economy contracts. What should be the right investment approach during the economic cycles? Should you stop investing when the economy is down and invest when it’s growing?

Economist and finance advocate Dr. Alvin Ang’s position is as follows:

“My take on business cycles is that they are closely related to productivity growth. Sustained growth of productivity usually predicts expansion. The investment strategy during this phase should be aggressive commensurate to the growth of productivity. It’s a time for accumulation as household capacities are expanding as well. During slowdown of productivity growth, leading to Decline, investment strategy should mimic the rate of productivity slowdown. During recession productivity falls sharply. Investment becomes least priority but the strategy is to continue with an established base amount at least 10% of the rate invested at aggressive phase. This should go up commensurate to the rate of recovery.”

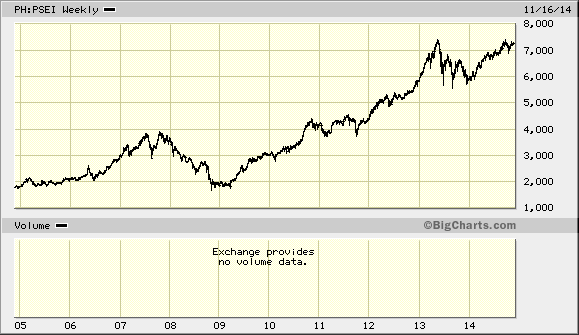

Seasoned stock market investors, especially the more aggressive ones like Marvin Germo may take a contrarian approach when it comes to investing in economic cycles. Stock prices usually would go down prior to any economic decline so they will start to stay away from the market even if the economy is still not yet at a decline. The stock market will usually be at it’s lowest during a recession which is a signal to investors to start accumulating good quality stocks at a bargain. I once heard a stock market expert say to ‘start selling stocks at the sound of bells and start buying at the sound of alarms’; in other words, buy when people are afraid to buy and sell when people have been buying like crazy. This approach is typical of many who have a trading strategy. Recessions to them are opportunities to make a killing in the market. Interestingly enough, many of SM’s major investments were also done during bad economic times (SM North EDSA, Mega Mall, etc.) since cost of land, labor, etc. are much cheaper. In 2013, the economy was doing really well, and yet there was a big correction in our local markets. In the short term, prices may not always be a true representation of real value. The chart below shows the performance of the PSEi in 2013:

Other investments such as fixed income are also economy sensitive but not as anticipatory like stocks. When the economy is in a decline, prices of bonds normally go down and with that, yields of bonds will go up as a result. Although not as volatile as stocks, capital losses can also be experienced if you have a short-term orientation.

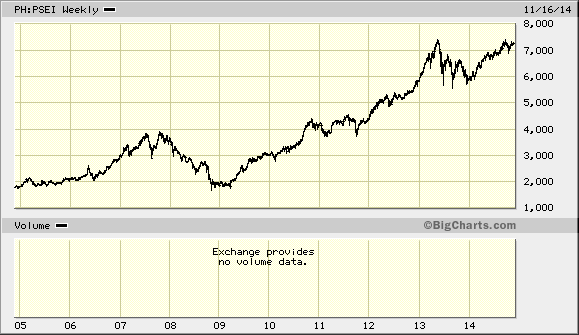

If you are a long-term investor and you are investing according to long-term objectives such as retirement, education funding, etc., cycles should not have an adverse effect on you. In a longer period, say 10 years and while markets will go up and down, and even experience crashes such as the 2008 crash, it is expected that markets will recover and will still go up despite volatility. For long-term investors, the issue is not so much on volatility but really on time. I often remind people that stock market investing is not just about timing, it is also about time. The general rule in investing is this: the longer, the better. The chart below shows the PSEi in a 10-year period. You can see that the market, though very volatile is on an upward trajectory in the long term:

Fixed income investments (Bonds) will not have any capital loss and yields will be realized if it is held up to its maturity. Just like stocks, bonds will do well in a long period, with less volatility.

When investing, it is very important to determine your investment objectives and time frame first. It is generally a good idea to hold on to your investments up until the time you need it and if your horizon is rather long, say 10 years, you should not be too nervous every time you hear negative news about the economy. A properly diversified investment strategy should allow you to hit your objectives even with the different economic cycles if you in the long run. Opportunities are also there for the taking when economy goes down, as long you are patient enough to wait when the economy rebounds and you have the appetite to take risks.

But alas, always remember that money and investments are just tools and they are not the end goal. In God’s economy, there are no recessions.

“But lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal.” – Matthew 6:20, ESV

Learn more investment strategies at the Money Manifesto Conference. To register, CLICK HERE.

Before investing your money

By Randell Tiongson on November 12th, 2014

A lot of people have always asked me about investing – where to put their money, how much to invest, do they buy stocks or mutual funds, etc. They are all great questions and those are important issues to address. However, before even thinking about putting your money somewhere, there are a few things that you need to take care of first:

1) Money Management – proper management of your finances is the foundation of your quest for wealth. If you are like most of us, your money doesn’t come in just one shot – they come in and go regularly and your investments will do well when you can add to those investments pretty regularly. You can only keep on adding to your investments if you know how to save properly… and you can only save properly if you know how to spend properly. Create and stick to your budget, as that will be your most important weapon in building your wealth.

2) Emergency fund – I cannot emphasize enough the importance of building a buffer fund before investing. Investments are volatile, well at least the good ones are and there is always a danger that when you liquidate your investment, it may have not earned yet or worse, its lower than its original amount. The buffer fund will allow you to keep your investment funds untouched since you have another fund to dip your hands into when emergency strikes. 3 to 6 months worth of expenses is a good emergency buffer fund.

3) Investment objectives & time frame – what are you investing for? Many people invest without really know why they are investing in the first place. Knowing your objectives and time frames will allow you to match the right investment instruments that will be best for you.

4) Risk tolerance – it is good to determine your risk appetite before jumping into any investment. A lot of people invest money into risky instruments and yet they are not prepared to handle investment risks which causes a lot of frustration that leads to a lot of stress. Never invest without knowing the risks.

5) Time – think long-term. There are no short-cuts to wealth and you need to be patient in building your wealth over time. Do not take short cuts and do not be in a hurry as those actions can cause you to make a lot of financial mistakes.

Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty. – Proverbs 21:5, NLT

—————

Get finance & investing tips from the Money Manifesto Conference this Nov. 29, 2014 at the SMX Aura! For inquiries, visit HERE