A closer look at Philippine mutual funds, part 1

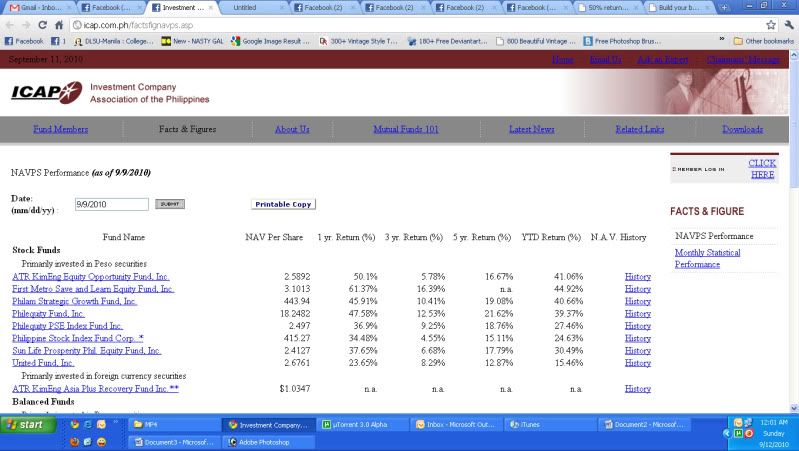

By Randell Tiongson on September 12th, 2010I was just reviewing the performance of local mutual funds courtesy of their helpful site, http://icap.com.ph. When you look at the year-to-date (YTD) performance of the equity funds, you will notice that nearly all funds trump the PSEi benchmark. The top 3 funds registered over 40% growth for their YTD numbers. It is also interesting to note that the 5 year YTD marks of the funds all beat the PSEi benchmark, with the exception of just 1 fund.

There is a view in many countries that investing in the index of the funds is the way to go as they perform better than most of the actively managed funds. However, this is not the case for the Philippine equity laced funds. By comparison, the top earner for the 5 year period is Phil Equity Fund, outperforming the index by as much as 6%.

Mutual funds are very convenient for those who do not have the competence and the time to manage their own stock portfolios. While many stock investors can claim to experience better return for their portfolios, the practicality of investing in the stock market through properly managed mutual funds (or UITF) is a better alternative to many – especially those who have better things to do than watch the market on a daily/weekly basis.

I am also encouraged by the relative good performance of many funds: the 5 year period showed many of the equity funds doing somewhere between 16 % to as much as 21% p.a. growth despite the disastrous financial crisis of 2008. Here’s another good thing: most local equity funds outperformed overseas funds! When you take into account the strengthening of the Peso, the growth of our local funds puts a greater distance to overseas funds. Investing in a USD denominated fund in 2005 will cost you about P53:$1 as compared to P45:$1 today. Not bad eh?

The big question in the minds of many: ‘will the local market continue with its good run in the months to come?’ …

… to be continued.

If you conclude that managed mutual funds are better than index funds, your data is wrong and defective.

@ IR, I do not conclude such… I’m just stating that in the Philippine experience, managed funds performs better than the index as per the report of ICAP. You can see that in the YTD, 1 year and 5 year data.. maybe be an aberration or what not. As to future experience of local managed funds one can’t say if it will perform better, at par or worse than the index.

@ IR, in the YTD experience, one can see that PLDT and Globe underperformed which is probably the reason why the index was beaten by the local funds.

ICAP’s information on funds’ performance is inadequate and lacking in substance. Dependence of funds’ information solely on this resource may not be helpful for the reader to make an intelligent statement or provide him the true picture about the managed mutual fund industry in the Philippines.

In fact, ICAP shows vague figures because these are not clear as to how such figures were arrived at because it failed to provide full disclosures and the mechanics for the readers to better understand which are very fundamental when making investment performance presentation.

ICAP is the organization of most mutual fund companies in the Philippines. Thus, the institution itself couldn’t be fully relied upon because its independence doesn’t exist. Technically, there is a conflict of interest given the nature of its existence.

Unlike in the U.S., we do not have an independent body in the Philippines that provides comprehensive information, review and rating of mutual fund companies. So, we are left to depend on one source, the ICAP.

Due to limited information, we now ask, what is the best option left for Filipino investors ? Thanks, he can find free and invaluable lessons from the findings of developed countries like the U.S. Here we see many rich academic studies.

Nobel laureates and the best minds in finance (no biases and independent studies) are telling investors the hype of managed funds whose performance through statistics are very frustrating and inferior vis-a-vis market or index performance over the long run.

Although your post is very informative, I would like to point out that the numbers NOW look very rosy. But what if you wrote this article with the numbers back when the financial crisis was happening? What if the investors at that time needed the money? I would think that the money he/she would get in 2008 (lets say he invested 2-5 years beforehand) would be very disappointing.

@ Mike Tan, yes the performance of the equity funds looks good because of the surge in the market this year. The picture was different in 2008 and up to 2009 but 2010 has been a good year for the market, hence, the numbers. It is prudent to look at the fund’s CAGR for a longer term, like 3 or 5 years. Still, a reversal in the market will reflect on the NAVP’s of the funds as they are marked to market funds. Diversification of asset classes is prudent.

I was right then….YTD is just performance of mutual funds companies. I thought it was interest per year or per annum in the bank. Thanks for sharing this information.