Top 8 Equity Fund Performances

By Randell Tiongson on November 5th, 2013

The year is almost over and this has been a whirlwind of a year for the Philippine Stock Markets. The start of the year saw a tremendous surge of the market pushing the Philippine Stock Index beyond the 7000 mark. Towards the middle of the year, massive correction and decline was seen as foreign funds took profits but our market seems to be more resilient than ever. Some recovery was seen pushing the market up again and refusing to enter a bearish market. Our market has yet to go back to the 7000 mark but many analysts are confident we will be back to those levels sooner than later, perhaps early next year?

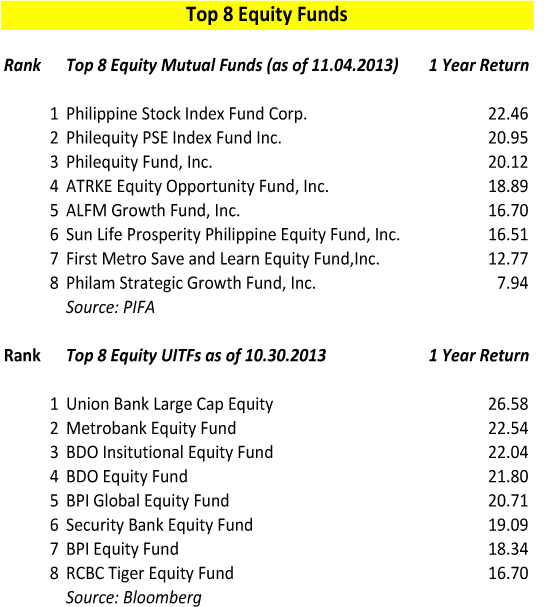

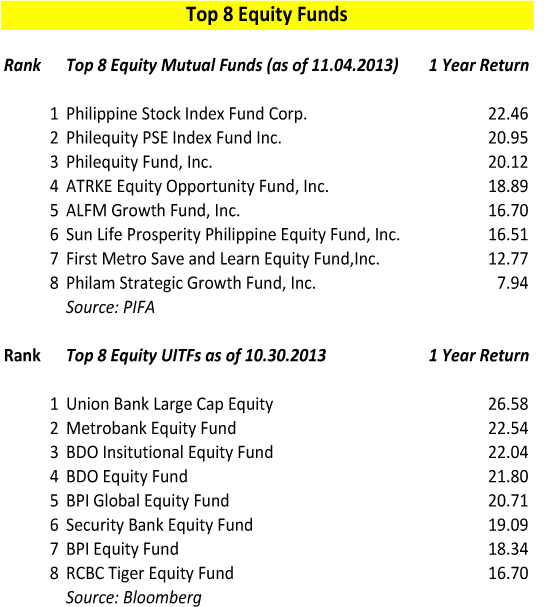

For those who invested in equity pooled funds like mutual funds or Unit Investment Trust Funds (UITF), it is good to know that there continues to be good returns although not as substantial as 2012. I have collated the 1 year returns of the top 8 equity funds, both mutual funds and UITFs. On the mutual funds side, the 2 index funds rose to be the top performers for the 1 year period lead by the Philippine Stock Index Fund and the Philequity PSE Index Fund. Customarily, managed funds outperforms the index, but that’s not the case for this 1 year period. On the other hand, some UITFs performed better than the index funds and 5 of those UITFs registered above 20% returns for 1 year led by Union Bank, Metro Bank and BDO and BPI. The UITF equity funds seems to be performing better than their mutual fund counterparts for the 1 year period.

Let me repost what I earlier said in an earlier post: “I need to caution readers, however, that returns are not the sole factor if selecting a fund. Aside from fees, it will be good to check on how volatile the funds are, experience of the fund manager and size of fund. Bigger funds are usually less volatile but may not have the best performance. Further, equity funds that are more diversified and having more variety in the fund is generally less risky.”

Mutual Funds are available through Mutual Funds Companies and are regulated by the SEC. UITFs are available through banks and are regulated by the BSP.

Where to put your money

By Randell Tiongson on February 3rd, 2013

Question: Where should I put my money? In a bank, property, business or stocks?—Miccael Ibarra Naig via Facebook

Answer: I always believe that investing is a great idea and I pray that all Filipinos think and act the way you do. Before I answer your question, I encourage you to first consider three things: your investment objective (the reason why you are investing), time frame (how long you will keep the investment) and risk tolerance. It is critical that you know these three things before even selecting an investment option.

There is no such thing as a “best” investment. The investment instruments you mentioned have their advantages and disadvantages, their own merits and flaws. Let me discuss those choices that you are considering.

Banks are the most popular choice of many. Banks are everywhere and this makes depositing your money in banks a convenient option. When you say “bank,” I’m assuming that you are referring to traditional bank products like savings accounts and time deposits. These bank products are among the most liquid investments you can make and the risks are also among the lowest. The downside, however, are the yields. They may be the safest options but they give the lowest returns. As they say, low risk, low returns. Having low returns, especially if below inflation rates, will erode the value of your money in the long run. Banks today offer other products other than the usual deposit products. You can invest in the instruments they offer like Unit Investment Trust Funds, mutual funds, bonds and insurance. Take time to know what your bank offers other than traditional deposit products.

Banks are the most popular choice of many. Banks are everywhere and this makes depositing your money in banks a convenient option. When you say “bank,” I’m assuming that you are referring to traditional bank products like savings accounts and time deposits. These bank products are among the most liquid investments you can make and the risks are also among the lowest. The downside, however, are the yields. They may be the safest options but they give the lowest returns. As they say, low risk, low returns. Having low returns, especially if below inflation rates, will erode the value of your money in the long run. Banks today offer other products other than the usual deposit products. You can invest in the instruments they offer like Unit Investment Trust Funds, mutual funds, bonds and insurance. Take time to know what your bank offers other than traditional deposit products.

Property is the investment every Filipino wants. Your parents and grandparents had probably told you that the best investment was land. However, saying that land is the best investment may be too ambivalent. Real estate’s greatest attraction is its being a tangible investment—you can see and use it unlike paper investments. Land usually appreciates in value giving you capital growth, or it can generate a steady flow of income through rentals and capital gains, when you decide to sell it. There are times, however, when real estate investments do not appreciate or, in some cases, their appreciation does not meet your expectations. Also, there are recurring costs in property investments such as real estate tax, administrative or association dues and common area charges. When you sell a property, you will be slapped a hefty capital gains tax on top of the broker’s fees. When you sum up all the money you need to spend during the time you are holding your real estate investment, you will realize that your gains are not as substantial as you thought it would be. Another downside in real estate investment is its cost—you need to spend a huge sum to buy land. If you decide to borrow money to finance your real estate investment, the interest that you have to pay may just eat up the gains you will make. Buying real estate because you need to live in it is another story as it is not an investment.

Business—another Filipino dream. Everyone wants to be an entrepreneur and why not? Businesses can potentially give you the highest returns. A business that succeeds can make one a millionaire, even a billionaire. There are many success stories of people who started with little but are now very wealthy because of their businesses. However, business endeavors are the riskiest among all these investment options, as they are speculative in nature. There are more businesses that fail rather than succeed, which is not encouraging for a “newbie” in the business world. Further, putting up a business requires more than just capital—competence, passion, timing, market and a lot of studying are needed when you are considering to do business.

Stocks—today’s rising star. There is so much attention to the stock market today as more and more Filipinos are being enticed into investing in equities because of its stellar performance in the last two to three years. Many investors are very optimistic with our local stock market and you will find many experts predicting that our stock market will further go up this year. Investing in equities today is also more convenient. Even with only a small amount, you can buy stocks through brokers (and also online) or through pooled funds such as mutual funds or UITFs. Let me reiterate the risk-return relationship here—high returns, high risks, and vice-versa. While it is true that the stock market has been giving extremely good returns lately, there were also times when investors lost a lot of money. The stock market is not as predictable as people think it is and all the gains over the last three years can also be wiped out in a short period of time. More so, investing in the stock market, especially when you plan to trade, requires a lot of competency and time. If you don’t have the competency and the time to trade in the bourse, you should keep your day job.

My advice is for you to consider all the pros and cons of all the investment options you mentioned and choose those that will suit your objectives the most. I also recommend that you diversify your investments. All these options have their advantages (and disadvantages), but if you have a diversified portfolio, you are spreading your risks. A common but very wise saying we often hear with regard to investing is this: “Do not put all your eggs in one basket.” Here’s an even wiser advice for you: “But divide your investments among many places, for you do not know what risks might lie ahead.”—Ecclesiastes 11:2, NLT

Appears at Inquirer

The best performing UITFs in 2012

By Randell Tiongson on January 25th, 2013

Are you considering investing in UITFs?

UITFs or Unit Investment Trust Funds are pooled funds offered by the trust department of the major banks of the country.

But what is a UITF? As per the Trust Officers Association of the Philippines (TOAP), they defined it as “an open-ended pooled trust fund denominated in pesos or any acceptable currency, which is operated and administered by a trust entity and made available by participation. Each UITF product is governed by a Declaration of Trust (or Plan Rules) which contains the investment objectives of the UITF as well as the mechanics for investing, operating and administering the fund. Most UITFs are considered medium to long term investments. Clients considering to invest in UITFs must have the financial resources to stay invested in them for a reasonable period of time in order to maximize earnings potentials. If the funds to be invested will be needed by the client in the immediate future, the UITFs may not be a suitable investment vehicle for such client.”

UITFs are very good investment instruments for investors with a longer time horizon and are comfortable with the volatility typical of pooled funds. Pooled funds can be high risk when invested in equities, low risk when invested in fixed income (bonds) or moderate when invested in a balanced fund.

Before jumping into UITFs, it is best that you understand the nature of this instrument. Further, it is advisable that you check on the fees associated with pooled funds — they are not all the same. Some funds require entry and exit loads and some funds have higher management fees. Fees will ultimately affect your yields.

2012 was a good year for investments, particularly for equities so it is expected that equity UITFs will do really well. I need to caution readers, however, that returns are not the sole factor if selecting a fund. Aside from fees, it will be good to check on how volatile the funds are, experience of the fund manager and size of fund. Bigger funds are usually less volatile but may not have the best performance. Further, equity funds that are more diversified and having more variety in the fund is generally less risky. Let’s compare two funds even if they are both equity funds — a fund that is invested in only 10 companies might perform better than a fund that is invested with 20 to 30 companies since certain calls are easier to make. However, the fund with fewer companies are riskier since one bad call of the fund manager can have a large impact on the fund.

My advise — talk to your bank and do your homework. Regardless, I am a fan of UITFs because in the long run, these investments will help me achieve my financial goals. Personally, I go with bigger sized funds that offers the lowest fees offered by the larger and more stable banks.

To know more about UITFs, please read my earlier blog HERE. You can also check out performance of Philippine funds at Bloomberg’s SITE.