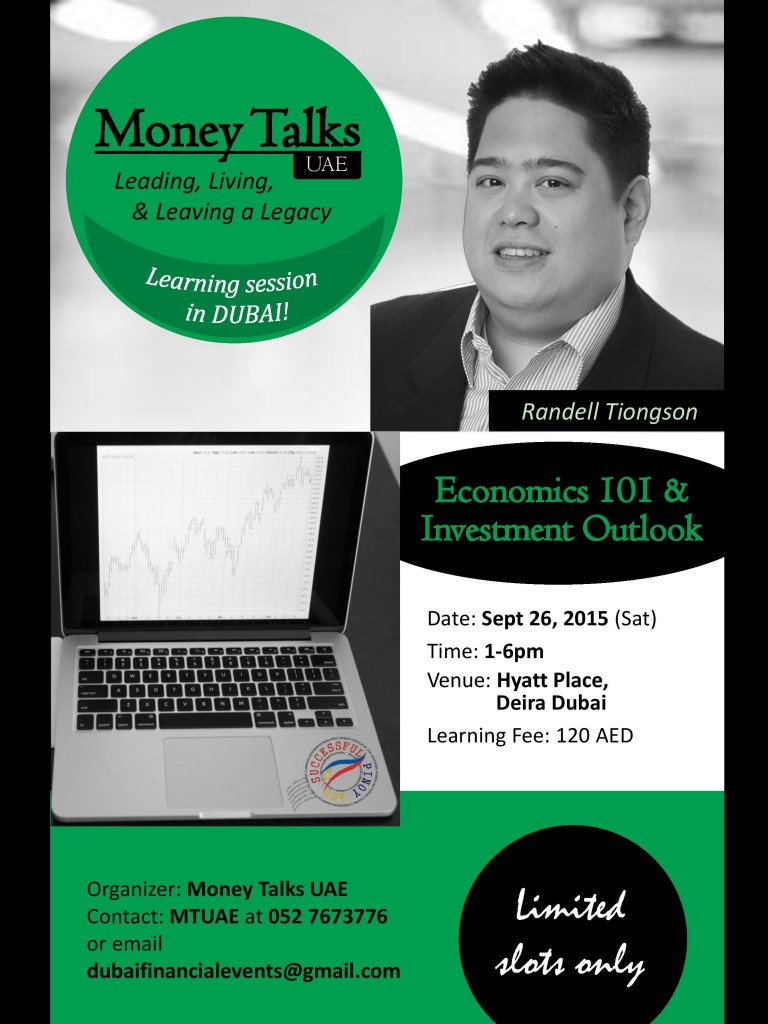

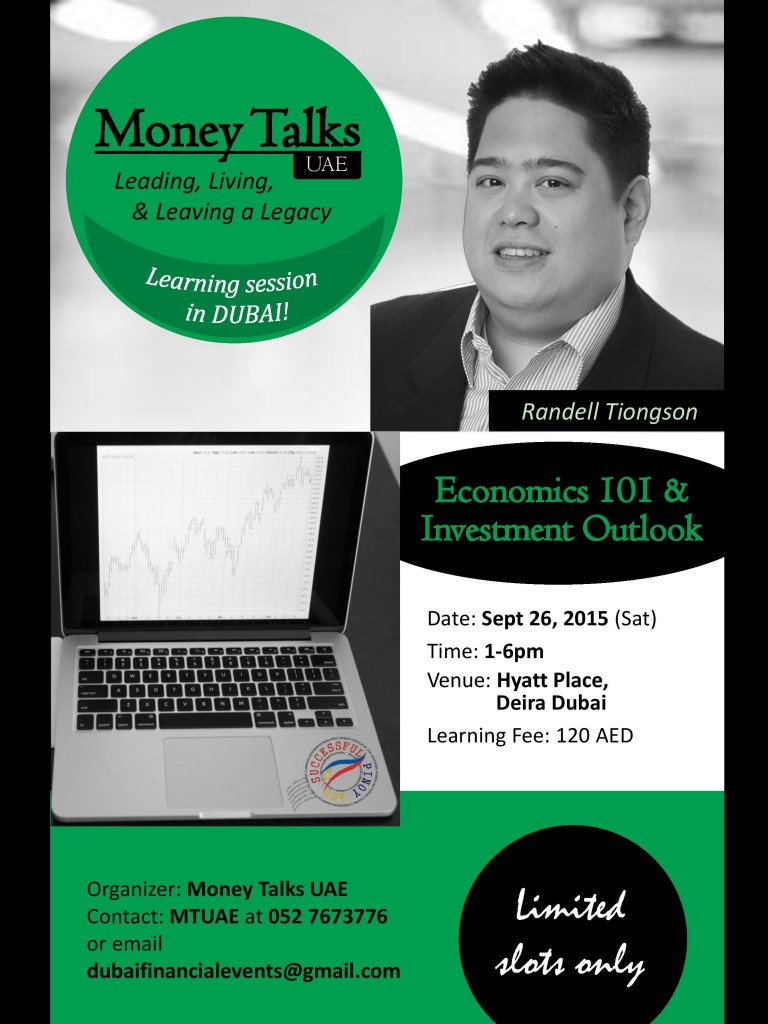

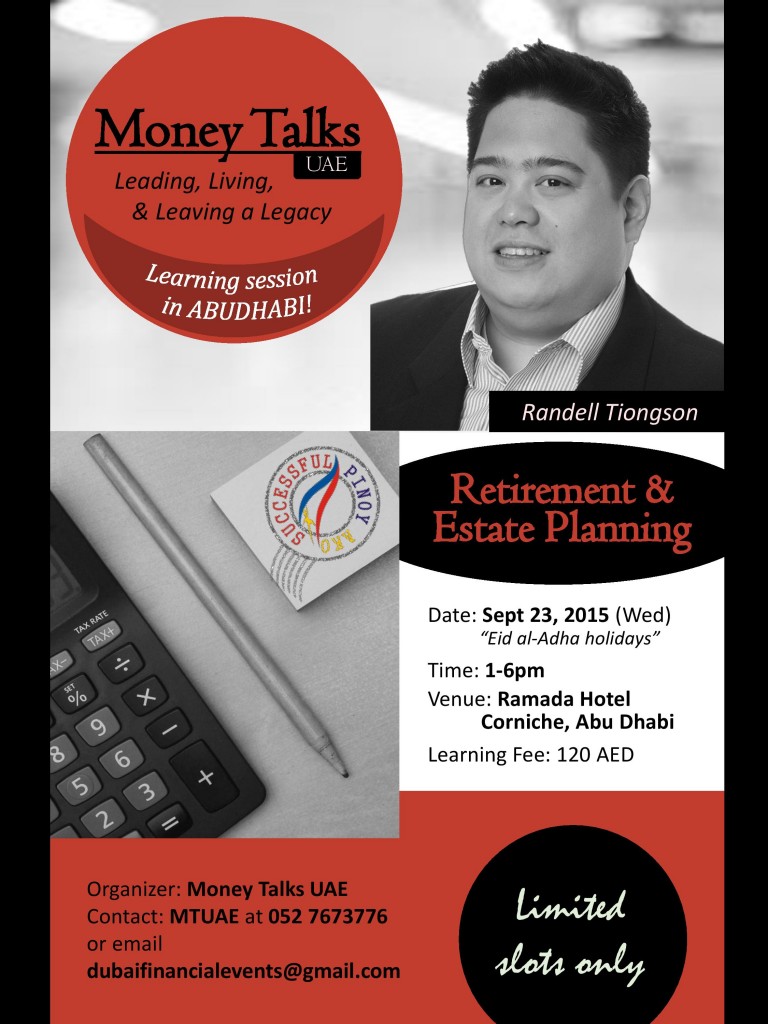

Special finance events for Dubai & Abu Dhabi OFWs!

By Randell Tiongson on August 18th, 2015

I will be back in the UAE for a series of training for the OFWs this September! It’s time to level up learning and be on your way to financial peace!

1) Economics 101 & Investment Outlook (Dubai) — this program will discuss the rudiments of economics especially matters that will have an effect to investors. How does interest affect investments? How does inflation play a factor in growing your wealth? How does monetary policies used to spur the economy?The program will touch up on basic macroeconomic learning as well as a thorough look on the Philippine economy as a bonus feature of the event. It is high time that we all understand economics and how it affects our everyday lives!

To register, click HERE or email dubaifinancialevents@gmail.com

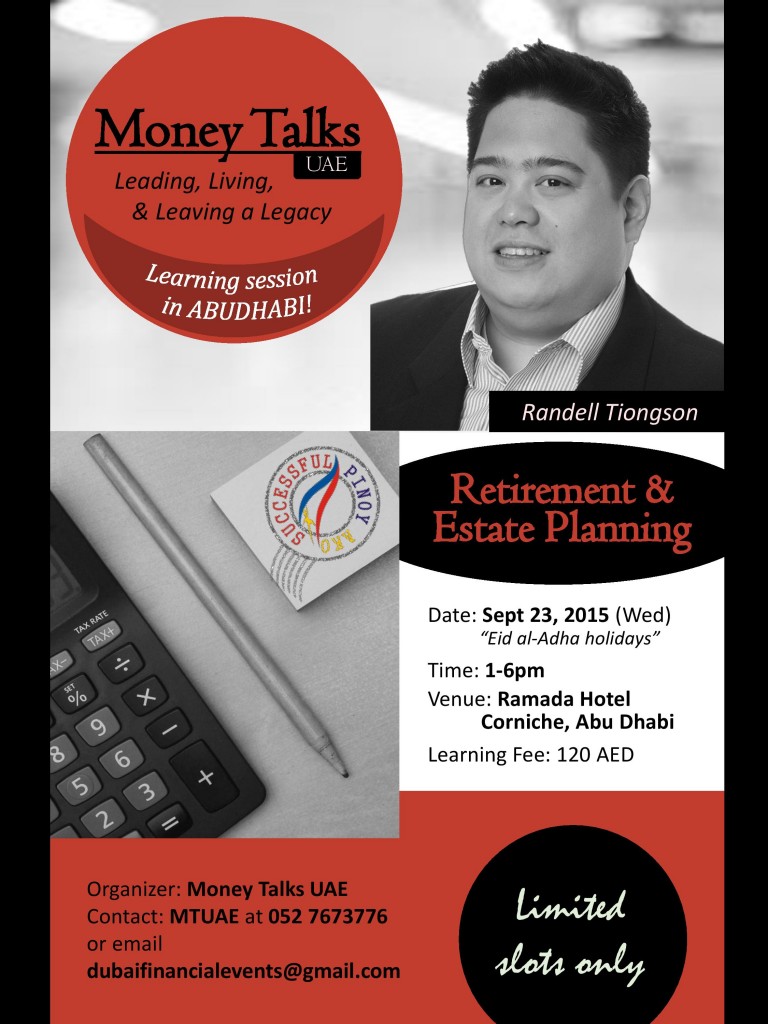

2) Retirement & Estate Planning (Abu Dhabi)

Studies shows that only 1 to 2 out of 10 Filipinos prepare for retirement. Studies also reveals that the few who prepare for retirement, most of them will only exhaust their retirement funds halfway through retirement. Filipinos are experiencing longer life expectancy but unfortunately, huge costs are needed to live a life of comfort during those years.

Consider this: If you can generate 75% of your pre-retirement income during your retirement years, you will live a life of comfort; if you can only generate 30-50%, you will live a life of struggle. For a 20 year retirement, you need at least 20 years of preparation — if you plan to retire at 60, then you should start preparing at 40.

As and added feature, I will also discuss basics of estate planning under the Philippine setting. Many Filipinos are unaware of why estate planning is important to them.

To register, click HERE or email dubaifinancialevents@gmail.com

HURRY! We are only limiting this offerings through limited slots only.

I’m only 30, should I be saving for retirement?

By Randell Tiongson on April 29th, 2015

QUESTION: Hi Randell, I am married with a 2-year old kid, and our household income is enough for our needs while letting us save for my daughter’s future. Should I be saving for retirement even though I’m only 30? –Paolo, asked from Facebook

ANSWER: It is a downright YES for that question, Paolo. Unlike investing, which depends on a person’s financial and household situation, retirement is something that must be planned as early in life as possible.

ANSWER: It is a downright YES for that question, Paolo. Unlike investing, which depends on a person’s financial and household situation, retirement is something that must be planned as early in life as possible.

I do not intend to make you feel regret for the past decade, but it is actually ideal to have started retirement planning during your 20s, when you still had no full-time responsibilities and had all your salary to yourself. But you are not alone. The fact is that 9 out of 10 Filipinos do not plan for retirement at all. Some of us enjoy our younger years living from paycheck to paycheck to buy and do things we want, while some might still need to help their parents and siblings especially those coming from large families. These things should not hinder us from setting aside at least a small portion of your income for your seed savings plan.

The sooner you start putting away money for your future, the more time there is for your financial portfolio to grow. Now that you’re 30, the next decade for you is crucial and you must take planning and goal-setting very seriously. If you’re not sure what specific steps to take, here’s a quick plan of action you can follow:

Identify how you want your retirement to be. Retirement is all about living a life of comfort. If you’re planning to retire at 60, you need at least 20 years of preparation, so starting now will make it easier for you in the future. List down the most realistic things you want to have by then, and identify how much it’s going to cost. It is estimated that in order to achieve a life of comfort, you need to generate at least 75 percent of your preretirement income. The key is to picture yourself 20 or 30 years from now and decide that you and your children will have a comfortable life.

Continue saving. It’s good to hear that you have already started saving up for your daughter. Carry on! The next steps for you is to increase the amount you save per month.

Learn about government services on retirement. The agency responsible for social security in the Philippines is the SSS (Social Security System) and GSIS (Government Service Insurance System) for government employees. According to the SSS website, your contributions since you started working will be transformed into a retirement benefit when you retire. A retirement benefit is “a cash benefit either in monthly pension or lump sum paid to a member who can no longer work due to old age.” The pension, is usually, no enough to provide you with a comfortable life during retirement years, and this is a problem experienced by most of our fellow Filipinos.

Consider other savings and investment opportunities. From a short survey on retirement I conducted a few years ago, I learned that most Filipinos’ top 3 retirement instruments are real estate, time deposits and savings accounts. There were few mentions of more sophisticated mediums like life insurance, mutual funds, government bonds and stocks. Take into consideration your income-expenditure plan every year, average inflation rate, and identify which investment opportunities best suit you. The amount you will have at retirement depends largely on the types of investments you commit to.

Consider learning about different types of investments and identify which ones suit you best. Reduce your risk and maximize returns by diversifying your financial portfolio. Take a look at investments like mutual funds, UITF or the stock market as these investments are generally great for capital accumulation in the long term. Here’s a tip — auto-debit arrangements that is used towards a mutual fund or a UITF is an excellent way to build funds that can come handy during retirement.

Be consistent and don’t lose momentum. From the survey I mentioned earlier, one insight came up about Filipinos’ culture of tending for our ‘extended families’. That’s one of the reasons why doing retirement planning is easier said than done. Make sure you do not touch your retirement savings earlier than planned. When you step in to your retirement years, avoid using up your finances quite early.

Start now! Paolo, your 30s is most important decade for retirement planning. At this age, you’re now focusing on providing for your small family. But as the head of the household, your family depends on you to have a long-term plan to support the kinds up until independence and retire without being a burden to them. You are still on time to start, so congratulations!

—-

Attend the biggest investment conference of the year, iCon2015! Speaking at the conference this year will be Marvin Germ, Efren Cruz, Chinkee Tan, Mike Manuel, Jess Uy, Dr. Alvin Ang, Francis Kong and yours truly. It will be held on May 30, 2015 at SMX Mall of Asia. For inquiries, email deniece@brandspeakasia.com

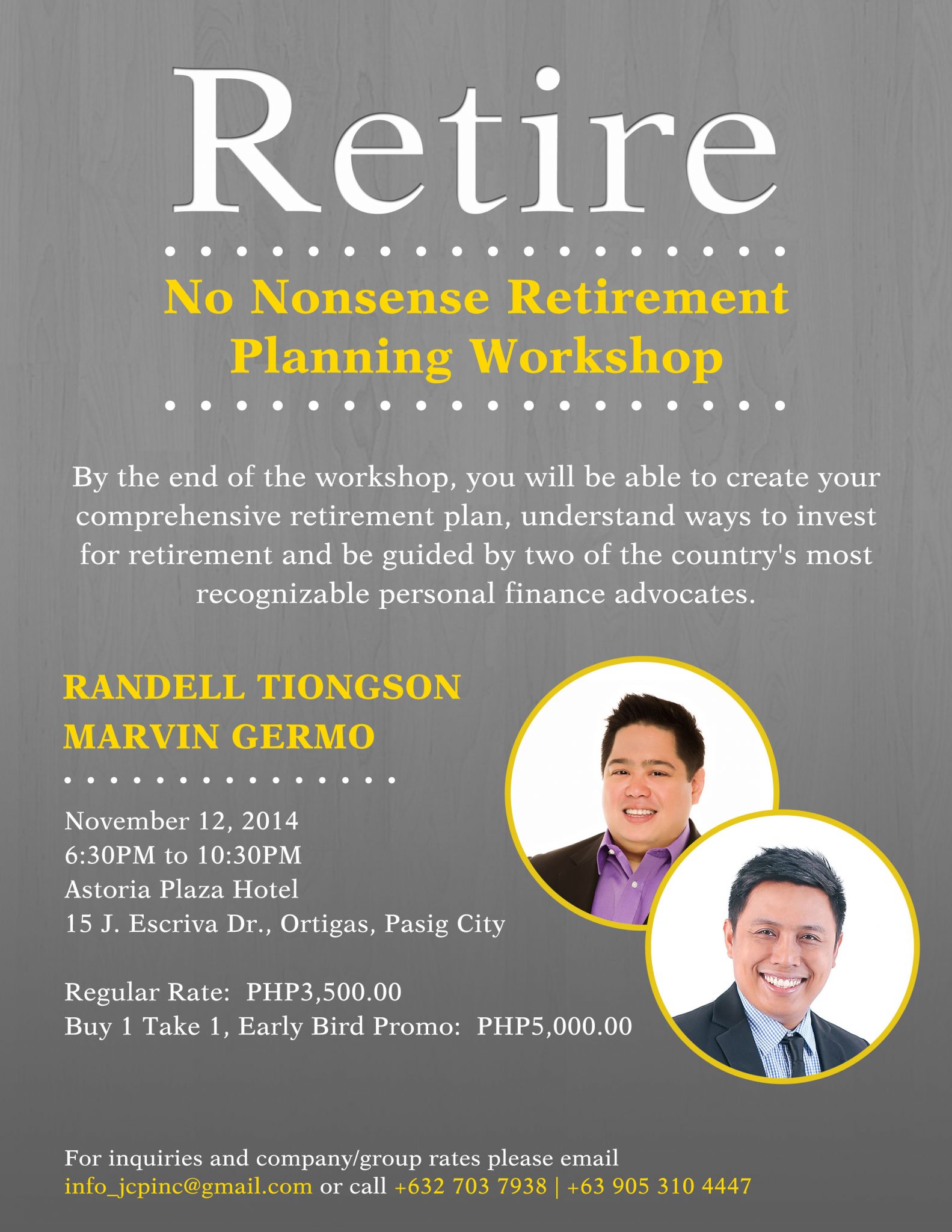

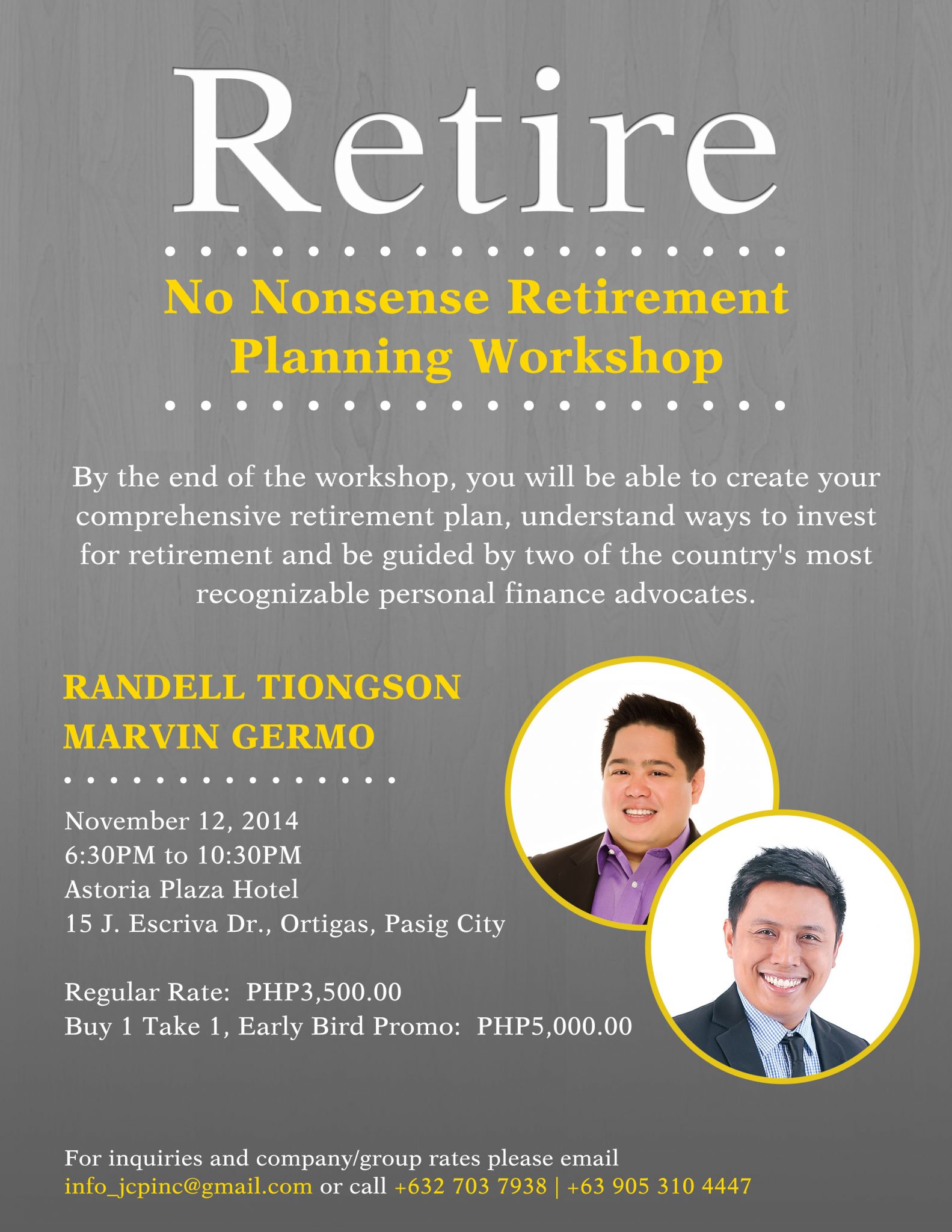

Retire 2014 Reload

By Randell Tiongson on October 28th, 2014

Studies shows that only 1 to 2 out of 10 Filipinos prepare for retirement. Studies also reveals that the few who prepare for retirement, most of them will only exhaust their retirement funds halfway through retirement.

Filipinos are experiencing longer life expectancy but unfortunately, huge costs are needed to live a life of comfort during those years.

Consider this: If you can generate 75% of your pre-retirement income during your retirement years, you will live a life of comfort; if you can only generate 30-50%, you will live a life of struggle. For a 20 year retirement, you need at least 20 years of preparation — if you plan to retire at 60, then you should start preparing at 40.

Attend RETIRE: No Nonsense Retirement Planning Workshop and learn how to properly prepare for your retirement. At the end of the full day workshop, you will be able to prepare a comprehensive retirement plan that is suited for you and a plan that really works. Find out how you can truly live a life of comfort & learn about the proper investments that is best suited for your needs objectively from two of the most recognizable finance advocates of the country.

For inquiries and registration, email info.jcpinc@gmail.com