Know your investment objective first

By Randell Tiongson on August 6th, 2011Sharing my column at the Inquirer last Wednesday

http://business.inquirer.net/10159/know-your-investment-objective-first

Question: I have some extra money that I can invest. What’s the first thing I should consider before I invest?—Raymond Sison, businessman

Question: I have some extra money that I can invest. What’s the first thing I should consider before I invest?—Raymond Sison, businessman

Answer: It is admirable that you are considering investing your money. The majority of Filipinos do not invest their money and just keep their money locked in savings, which is better than those who do not even save at all.

Before you do anything with your hard-earned moohla, I would recommend that you first consider what your investment objective is. In my seminars, I always tell people that our objectives will determine nearly every action we make with regard to finance. It is paramount that you determine the reason for the investment first and foremost. What is the investment intended for? What do you wish to achieve in making such an investment? Is it for retirement, future education needs of your children, purchase of an asset, or a general fund? Knowing what your objectives are will help you choose appropriate investment instruments and asset classes.

To simplify objectives, one can categorize general purposes of investments as those that will result in capital growth, provide income or both. Certain investments will yield according to your desired purpose. For instance, people buy real-estate properties because of capital appreciation while some people buy them for income purposes. Investment objectives can also change according to one’s situation. Let me use real estate again as an example. When you were younger, you bought a piece of real-estate property because you want to have capital growth. Many years after, say during your retirement years, capital growth is now overshadowed by your need for income and the rent you can get from said property becomes your objective.

Investments in the stock market are generally done for capital appreciation and although it can also provide income through dividends, the general purpose of investing in the stock market is for growth.

Investing in fixed income securities (treasuries, bonds) are made for income purposes as it provides steady flow of interest payments. Even if fixed income is sometimes traded for capital growth, the main purpose for it is still income. An asset class or investment instrument can also provide both capital growth and income at the same time. However, and as a general principle, capital growth and income provision would be relatively diminished for instruments that provide both growth and income. Don’t you just wish you can invest in something that will give you both substantially? Don’t we all?

If you are looking at pooled funds like mutual funds, UITF or unit-linked (variable) insurance, it is very important to first know your purpose or your objective before investing in them. Just like any other investment instrument or asset class, pooled funds can give you capital growth (those invested primarily in equities), income (those invested primarily in bonds) or both (balanced funds).

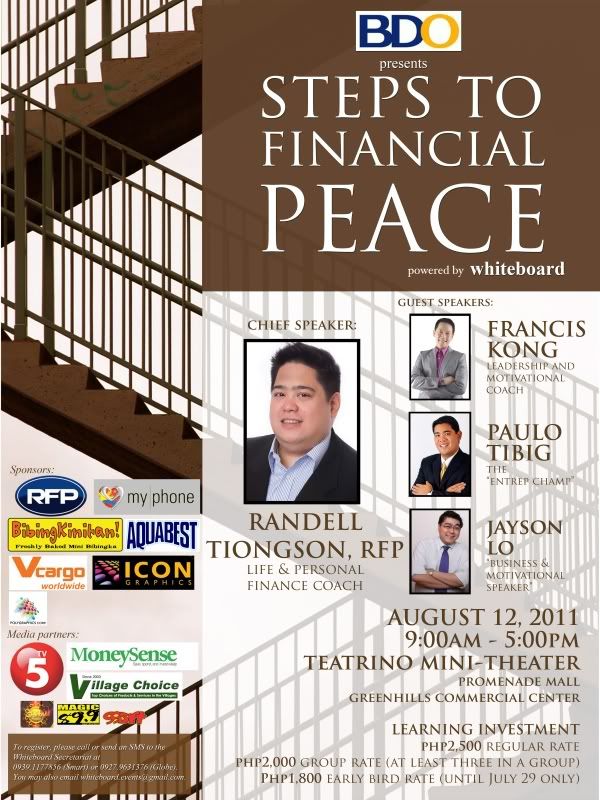

It is good to first check what your intended purpose for making an investment and then look at instruments or asset classes that is a best fit. Also, investment objectives should not be your only criteria whenever you are choosing where to invest. Other factors are just as important such as time frame and risk tolerance, but let’s leave those for future discussions. To learn more about better investing and learning more on personal finance, let me invite you to my seminar “Steps to Financial Peace” on Aug. 12, 2011, at the Teatrino in Promenade, Greenhills. I will be joined by my friends, Francis Kong, Paulo Tibig and Jayson Lo. You can find out about the event through https://www.randelltiongson.com/steps-to-financial-peace/.

(The author is an advocate of life and personal finance and a director of the Registered Financial Planner Institute (Phils.) and has over 20 years’ experience in the financial services industry. To know more about becoming a registered financial planner (RFP), visit www.rfp.ph or e-mail info@rfp.ph.)