What to consider in buying an investment property?

By Randell Tiongson on March 28th, 2016

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.

Especially in school and central business districts (CBD), there’s no shortage of rental properties. This is because continuous demand directly relates to the flow of income. If your property is near a university, every four or five years, there’s always a new batch of students looking for a place to stay. You can expect there’s always an individual eyeing a home near one’s workplace if your rental property is in a CBD.

Are you thinking of buying an investment property? Here are four questions to ask when buying an investment property. If you answer ‘yes’ to the following questions, you’re on the right track in becoming a real estate investor.

- Is the property location strategic?

Easy access to malls, parks, hospitals, and accessibility to public transportation increase the profitability of university towns and central business districts.

Quezon City, Makati City, and Paranaque City are the three most searched cities in the Philippines according to Lamudi’s 2015 white paper report. Why?

- Quezon City has many universities and colleges, research institutes, and commercial developments.

- Makati City is the financial center of the country with the highest concentration of local corporations and multinational companies.

- Paranaque is close to Makati City and Pasay City but offers more affordable housing options.

Ask yourself how close is the area from schools, offices, hospitals, malls, and main roadways and public transport if you are planning to buy a property investment.

- Will the area develop and grow in the coming years?

The search traffic for properties in CALABARZON, Central Luzon, and Central Visayas continues to increase in the same Lamudi white paper report. Search traffic in CALABARZON surged 130% from the 4th quarter of 2014 to the 1st of 2015. The reason for this is current and future developments in the region, namely in Cavite and Laguna.

The developments in these two areas show no signs of stopping. Nuvali, in Sta. Rosa, Laguna, has easy access to numerous commercial establishments, schools, leisure areas such as a wakeboarding park, and residential properties where the price per square meter is starting to match Metro Manila’s. Ayala Land, Inc.’s vision for Nuvali is to make it the next financial district south of Makati. This area will continue to grow and thus makes it a strategic location to invest in.

The area is a good investment opportunity if the area is situated in a less developed area that is primed to grow and progress in the future. Don’t join the race when it has already started; invest in properties in the early stages of development.

- Can you handle the monthly amortization?

Having enough to make the downpayment is one thing, paying your monthly amortization is another. Your payment terms, interest rate, and timeframe varies on your personal preferences. The only thing that stays permanent is the necessity to keep up with the monthly payments. Avoid late payments as this leads to paying more in interest. Do the math first and ensure you can afford the monthly amortization before you decide to invest in real estate.

You can use MoneyMax.ph’s comparison portal for housing loans to give you an idea at how much you can expect to pay on a monthly basis depending on your time frame and loan amount.

- Do you have savings for emergency situations?

As the landlord, you are liable to cover for unnecessary situations that may arise (unless otherwise stated in the contract). You should shoulder expenses for water leaks, roof repairs, and floor re-tiling among many other repairs. You’ll also be covering for utility bills and the homeowner’s association fees f your property is left vacant for several months.

The importance of having savings or an emergency fund is to cover for emergency situations in relation to your rental property.

You’re on the right track in buying a profitable property if you find yourself saying ‘yes’ to the questions above. Remember that when you invest in real estate, your intention is to earn and make money because you are investing. Make sure that the property you’re eyeing is profitable before you make a down payment.

———

Learn from the experts at iCon2016 this May 28, 2016. Hear the country’s leading experts: BSP Deputy Gov. Diwa Guinigundo, Rex Mendoza, Marvin Germo, Paulo Tibig, Dodong Cacanando and Reina Pama.

For details, visit HERE

House buying or renting habits of Pinoys

By Randell Tiongson on March 10th, 2015

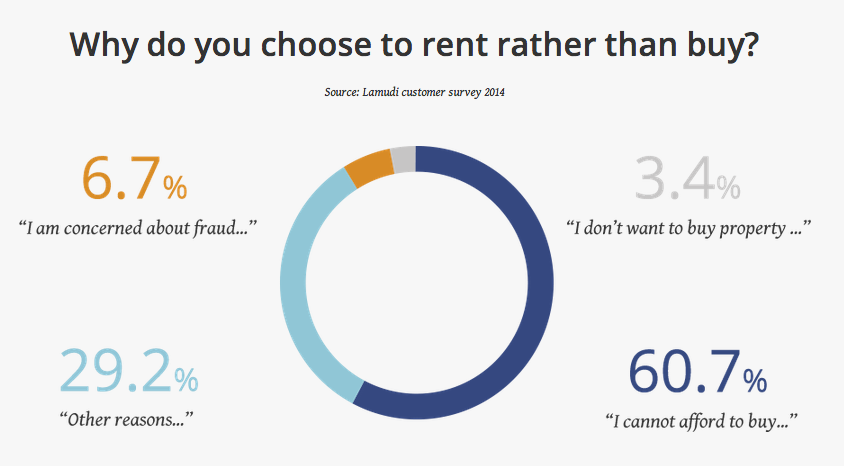

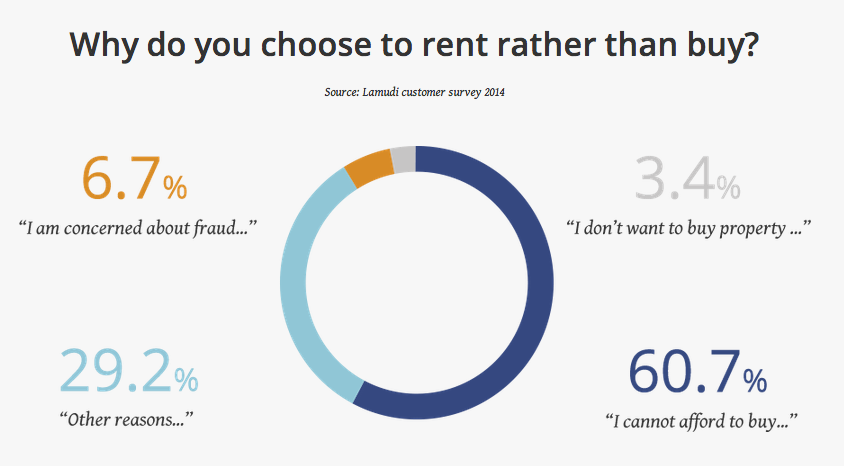

Affordability is top of mind for Filipinos who choose not to buy property, with more than 60 percent of renters in a recent survey of online house-hunters citing cost constraints as the primary reason they leased their home.

The findings are contained in new research from global property website Lamudi, which has recently released its first report on real estate in the emerging markets. The report, Real Estate in the Emerging Markets, provides a comprehensive overview of the property sector in 16 emerging countries, including the Philippines.

The report is based on a series of online surveys conducted with house-hunters and real estate agents in each country, as well as onsite data from Lamudi’s global network of websites. The research examines the habits of online property-seekers, while offering insights into the future of the property sector based on interviews and surveys with local property experts.

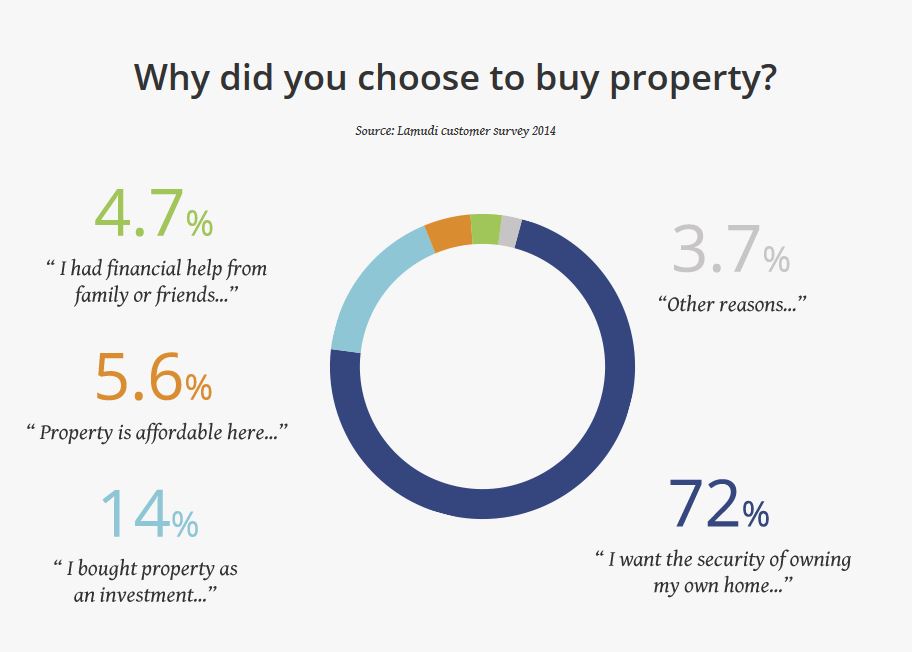

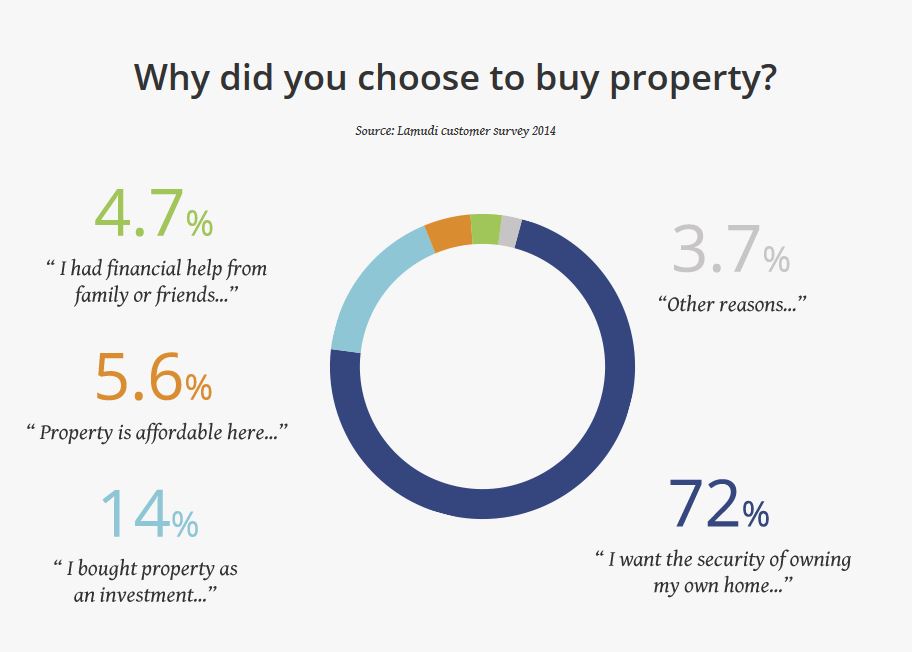

The customer survey examined house-hunting habits among buyers and renters. For renters, affordability emerged as the key reason why many Filipinos choose not to buy their own home. More than 60 percent of renters surveyed said they could not afford to buy property. For buyers, the main driver for owning property is security. Nearly three-quarters of buyers cited security as their primary motivation for purchasing a home.

According to the survey of real estate agents, the country’s economic outlook is seen as the top constraint on the property market, reflecting current concerns about a potential slowdown. However, agents and brokers remain overwhelmingly optimistic about the future of the market. More than 90 percent describe their outlook for the next 12 months as positive.

Lamudi’s Global Co-Founder and Managing Director, Kian Moini, said: “The primary conclusion that we have drawn from our research is that the future for the Philippine property sector is extremely bright. In fact, two-thirds of the real estate agents we surveyed are expecting growth of eight percent or higher in the property market this year. The country’s real estate market has emerged as one of the most promising in the Asia Pacific region.”

The report features a series of in-depth interviews with key figures from the property industry of each country, including Jose Romarx Salas, Head of Research and Consulting at Pinnacle Real Estate Consulting Services. Mr Salas said the key challenge for the Philippine property market was finding enough land to accommodate development. “In Metro Manila, that’s the challenge: looking for suitable land. Some developers are even willing to bid high, which pushes up already skyrocketing land prices in the capital,” he told Lamudi.

The 16 countries covered in the report are: Indonesia, the Philippines, Myanmar, Bangladesh, Pakistan, Sri Lanka, Jordan, Saudi Arabia, Nigeria, Kenya, Tanzania, Morocco, Ghana, Ivory Coast, Mexico and Colombia.

The full report is presented in an easy-to-read online format, available for viewing here.

ABOUT LAMUDI

Launched in 2013, Lamudi is a global property portal focusing exclusively on emerging markets. The fast-growing platform is currently available in 28 countries in Asia, the Middle East, Africa and Latin America, with more than 700,000 real estate listings across its global network. The leading real estate marketplace offers sellers, buyers, landlords and renters a secure and easy to-use platform to find or list properties online.

Starting in real-estate investing

By Randell Tiongson on April 14th, 2014

A lot of people would want to invest in real estate and yet many are wondering the right way to do so. Carl Dy, an experienced real-estate investor and one of the leading resources on real-estate investing gives you a few tips that will make you understand how to build your wealth through the use of properties.

A lot of people would want to invest in real estate and yet many are wondering the right way to do so. Carl Dy, an experienced real-estate investor and one of the leading resources on real-estate investing gives you a few tips that will make you understand how to build your wealth through the use of properties.

4 STEPS TO GET STARTED IN REAL ESTATE by Carl Dy

One of the paths to take to becoming wealthy is to make your money work as hard as you do. There is one thing that both the rich and the poor have equal amounts of. That is time, we all have 24 hours a day, and how much money you make (and save) in that daily 24 hour cycle will determine how early you are able to reach your financial goal.

With that in mind, they key strategy is to make sure you maximize your 24-hour cycle and create as much income stream as you can. You can categorize your income stream in 2 main categories: Man at Work, and Money at Work.

Man at work obviously refers to what you do with your physical self. Your talents, skills and creativity in being a solution to a problem allow you to charge a certain fee. This can be in the form of your salary or business profits.

Money at work refers to your money kept in a product that gives you a certain amount in return or simply put, what we call investments. This can be your investment in bank products, in equities, in a business, in bonds and in real property. The speed at which money is given back to you is what we call rate of return.

Property has been known to be a classic and proven product that gives a good return on your investment. Ask your elders about the price of the land in which you live now and compare it to how it was priced before. It would have most likely gone up double, triple or 10 times the original price depending on how far back in time you compare the prices to.

How do you get started in investing in real estate? Here are 4 major steps that you should go through, to get yourself familiarized before you make your first purchase:

1. STUDY

2. DEVELOP A STRATEGY

3. SIMULATE YOUR PURCHASE

4. CHECK YOUR FINANCES

Want to learn more about these 4 steps ? Catch property investor Carl Dy at ICON 2014 this May 17 at SMX Pasay City as he talks more about the 4 steps in getting started in real estate. For more information on iCON 2014, visit http://brandspeakasia.com/randell-tiongsons-icon/

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.

1 in 6 Filipinos owns real property other than the primary home. This is according to the 2012 Consumer Finance Survey of the Bangko Sentral ng Pilipinas (BSP). While others may use the second or third properties either as a halfway or vacation home or for the rich a ‘pamana’, others use additional real estate as an investment opportunity.