2015 Outlook, part 6

By Randell Tiongson on January 16th, 2015

Is the Philippines now entering a turning point? Is the Philippine economy in a bubble or have we achieve a self-sustaining economic growth? Presenting the views of Business Mirror columnists, investment advocate and seasoned stock market expert John Mangun!

Is the Philippines now entering a turning point? Is the Philippine economy in a bubble or have we achieve a self-sustaining economic growth? Presenting the views of Business Mirror columnists, investment advocate and seasoned stock market expert John Mangun!

The 2015 Outlook of John Mangun

Philippines 2015: a turning point

“A turning point” in literature is defined as the point of highest tension or drama when the solution or climax to the story begins to unfold. That is what the world and the Philippines faces in 2015.

Two events occurred in the financial markets as we closed 2014. The spot price of Brent crude oil hit its lowest price since May 2009. The US Dollar Index, measuring the exchange rate for the US dollar against a basket of currencies, reached its highest level at 90.64 since December 2008.

While we are all looking at the price of crude oil as it affects local gasoline prices, the bigger picture is the general price of most commodities. Virtually every index that measures a broad basket of global commodity prices is trading at or near its 2009 level.

To have this situation can only mean one thing. The global economy is in such bad condition that demand is falling rapidly. If it were only crude oil prices that were falling, then we might be able to make the argument that this is being caused by increased supply. But it is across the board for other critical commodities.

The turning point for the globe is twofold. The first is the uncovering of how bad the global economy really is as the commodity prices fall. The second turning point is how much of the ‘emerging economies’ like Brazil and that class of countries has been dependent on dollars flowing out of the US into their economies.

The same thing happened in the 1997 Asian crisis but the major emerging countries did not account for 50 percent of the global economy like they do now.

The ‘gloom-and-doomers’ have been saying that the Philippine economy is in a bubble and all the growth of the last five years is because of foreign money supporting the economy. I do not believe that. Foreign money as investment coming into this country has been dismal. Remittances from outsourcing companies and from overseas Filipinos are significant. But with domestic sources accounting for 90 percent of all new investment, we are not dependent on the foreigners and their money.

But in the next 12 months we are going to resolve the question if whether or not the Philippines is in a bubble or has finally achieved a self-sustaining growth economy that can handle global economic shocks. I believe we have.

If the Philippine peso can maintain is relative strength and narrow sideways movement in the face of the appreciating dollar, we have finally come to economic maturity. If the interest rate that top corporations must pay on the debt does not widen in relation to the US corporate borrowing rate, we are in great shape.

For stock market watchers, caution is still the strategy. Either we will see a move on the Philippine Stock Exchange Index (PSEi) above 8,500. Alternatively we will see 2015 take the PSEi to below 5,500.

This year will bring new meaning to “It’s more fun in the Philippines”. I’m looking forward to it.

Interest in the stock market first hit John Mangun when he was in his early teens, following the stock price action of  major companies in the daily newspaper long before the computer.

major companies in the daily newspaper long before the computer.

In 1976, Mr. Mangun earned his license as a stock broker on the New York Stock Exchange as well as being licensed and registered for the Options and Commodity markets.

After working for two major Wall Street firms, Mr. Mangun went to England as head of foreign exchange trading for a British asset management company.

Upon his return to the United States, he formed his own investment advisory company administering to the investment needs of corporations and high-net worth individuals.

Mr. Mangun has actively analyzed and traded the Philippine Stock Exchange since 1989, making his first stock purchase (and losing trade) buying shares of San Miguel Corporation on Friday, November 24th, one week before the 1989 coup attempt.

He has been a regular newspaper columnist, writing about the Philippine economy, business, and stock market since 1996. His website is MangunOnMarkets.com

2015 Outlook, part 5

By Randell Tiongson on January 14th, 2015

In this 5th installment of the Outlook series, a discussion on the government’s role in the economy is discussed. While there has been admirable growth in the Philippine economy, one can wonder if the growth is because of or despite of the government. We are presenting the views of one of the country’s most distinguished and revered investment expert, Mr. Gus Cosio. With his many decades of experience in the finance industry both here and abroad, Gus Cosio has become an icon in the investing industry. He is currently the CEO of First Metro.

The 2015 Outlook of Gus Cosio

Our economy could have done much better in 2014 had the government put significant effort in improving the country’s infrastructure. The country’s private sector has been doing most of the heavy lifting in terms of contributing to growth. Businesses are hiring more people such that annual employment increase looks to be sustainable so far at the one million level, this in spite of little help from government both national and local. Red tape continues to stifle businesses who would like to expand rapidly while lack of long-term government planning imposes more difficult challenges for enterprises to streamline operating costs.

A glaring example of the combined ineptitude of government units was the fiasco at the Port of Manila which wreaked havoc not only to traffic in the metropolis but also dragged down the operations of importers and exporters alike through a major disruption of the national supply chain. Of course, the MRT/LRT situation is another example of government inaction which creates frustration to both users and non-users of the system. In spite of it all, the government made some points in its favor. I particularly like the Conditional Cash Transfer program which to my mind gives tremendous hope to the poorest of the poor. I also observed good quality highways having been built in Mindanao and other rural areas. The DepEd had also embarked on a massive classroom building program which delivered good quality school facilities to many places in the country. I hope the responsible agencies continue to be productive in their programs.

Nevertheless, the Filipino has proven himself in terms of resilience, and Philippine business likewise, in the face of all these hurdles. This gives me confidence that the national economy can do better in 2015. There may be a slowdown in the real estate market due to the new regulations imposed by the BSP which lowers the loan to value of mortgages. So while a housing backlog continues in the country, with financing becoming more difficult in 2015 compared to 2014, property companies will need to be more creative in their marketing and affordability schemes. Banks will also feel the brunt since they would have to limit exposures to property resulting to slower loan production in this sector.

The bright spot is industry and manufacturing. News of new manufacturing facilities being set up in the country has been plentiful. In fact, most of the industrial estates that were set up in the late 1990’s are only seeing their capacities running full last year. This means that new industrial estates need to be developed in the coming years. Consumer spending will likely be robust. Growth in this sector had been sustained in 2014 and given that 2015 is a year prior to national elections, we can expect consumer spending to even be greater. I will not be surprised if I see our malls bursting with shoppers and restaurants filled to the brim. The lower petroleum prices should leave more cash in the pockets of consumer as the pay less in running their cars and motorcycles.

I remain positive in my outlook for the Filipino consumer and investor in general. The looming power shortage in the dry season this year is bringing attention to the longer term power supply situation in the country. This is good because the need for additional generating capacity is being recognized. Investment opportunities in the sector has also become available to the individual investor as a number of power producers are listed in the stock exchange. Since employment is growing among the middle class, surely the various listed consumer companies should present good investment opportunities as well. I am sure a lot of positive economic and business news will crop up in the country this year. Given the credit rating upgrade last December, more investors – both financial and direct investors – will be giving the country a second look. With more people getting involved in our country, economic activity can only grow. I only hope that the government does not become a dampener.

Augusto M. Cosio, “Gus” as he is more popularly known, is a known advocate for the development of the Philippine capital markets. Having gained a wealth of experience in the global capital markets after working in Hong Kong and Singapore for global investment banks such as Deutsche Bank and BNP-Paribas, he is a passionate crusader for investment literacy among Filipinos. He is a regular resource speaker for the Philippine Stock Exchange Certified Securities Specialist Program and for capital market topics at the University of Asia and the Pacific. In the First Metro Group, Gus had spearheaded The Capital Market Seminar Series conducted regularly by First Metro Securities Brokers and First Metro Asset Management Inc. (FAMI) in their offices Makati, Binondo, Cebu and Davao.

Augusto M. Cosio, “Gus” as he is more popularly known, is a known advocate for the development of the Philippine capital markets. Having gained a wealth of experience in the global capital markets after working in Hong Kong and Singapore for global investment banks such as Deutsche Bank and BNP-Paribas, he is a passionate crusader for investment literacy among Filipinos. He is a regular resource speaker for the Philippine Stock Exchange Certified Securities Specialist Program and for capital market topics at the University of Asia and the Pacific. In the First Metro Group, Gus had spearheaded The Capital Market Seminar Series conducted regularly by First Metro Securities Brokers and First Metro Asset Management Inc. (FAMI) in their offices Makati, Binondo, Cebu and Davao.

He is the president of FAMI – the First Metro Asset Management Inc. – a multi awarded fund Management Company with 14 billion pesos of Assets under Management (AUM).

Investing in good and bad times

By Randell Tiongson on November 20th, 2014

To a great degree, investments are generally affected by economic cycles. You always hear people encouraging you to make investments because the economy is good. You also hear businessmen complain a lot when the economy is bad. The economy goes through changes from time to time which we normally refer to as economic cycles.

Economic cycles are fluctuations in the economy between periods of expansion or growth and contraction or recession. Factors that determine cycles are usually Gross Domestic Product (GDP), interest rates, employment numbers, consumer spending and the like. Investopedia further explains: “An economy is deemed to be in the expansion stage of the economic cycle when gross domestic product (GDP) is rapidly increasing. During times of expansion, investors seek to purchase companies in technology, capital goods and basic energy. During times of contraction, investors will look to purchase companies such as utilities, financials and healthcare.”

People are more likely to invest their money during when the economy is in its growth cycle and they are likely to stay away from investing when the economy contracts. What should be the right investment approach during the economic cycles? Should you stop investing when the economy is down and invest when it’s growing?

Economist and finance advocate Dr. Alvin Ang’s position is as follows:

“My take on business cycles is that they are closely related to productivity growth. Sustained growth of productivity usually predicts expansion. The investment strategy during this phase should be aggressive commensurate to the growth of productivity. It’s a time for accumulation as household capacities are expanding as well. During slowdown of productivity growth, leading to Decline, investment strategy should mimic the rate of productivity slowdown. During recession productivity falls sharply. Investment becomes least priority but the strategy is to continue with an established base amount at least 10% of the rate invested at aggressive phase. This should go up commensurate to the rate of recovery.”

Seasoned stock market investors, especially the more aggressive ones like Marvin Germo may take a contrarian approach when it comes to investing in economic cycles. Stock prices usually would go down prior to any economic decline so they will start to stay away from the market even if the economy is still not yet at a decline. The stock market will usually be at it’s lowest during a recession which is a signal to investors to start accumulating good quality stocks at a bargain. I once heard a stock market expert say to ‘start selling stocks at the sound of bells and start buying at the sound of alarms’; in other words, buy when people are afraid to buy and sell when people have been buying like crazy. This approach is typical of many who have a trading strategy. Recessions to them are opportunities to make a killing in the market. Interestingly enough, many of SM’s major investments were also done during bad economic times (SM North EDSA, Mega Mall, etc.) since cost of land, labor, etc. are much cheaper. In 2013, the economy was doing really well, and yet there was a big correction in our local markets. In the short term, prices may not always be a true representation of real value. The chart below shows the performance of the PSEi in 2013:

Other investments such as fixed income are also economy sensitive but not as anticipatory like stocks. When the economy is in a decline, prices of bonds normally go down and with that, yields of bonds will go up as a result. Although not as volatile as stocks, capital losses can also be experienced if you have a short-term orientation.

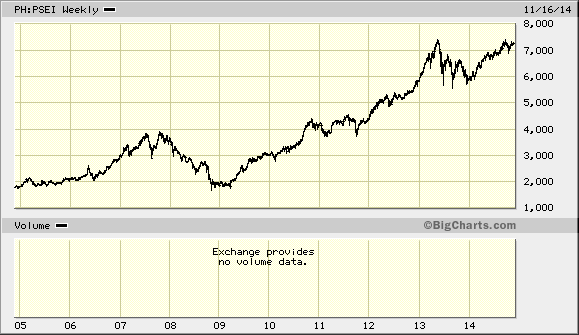

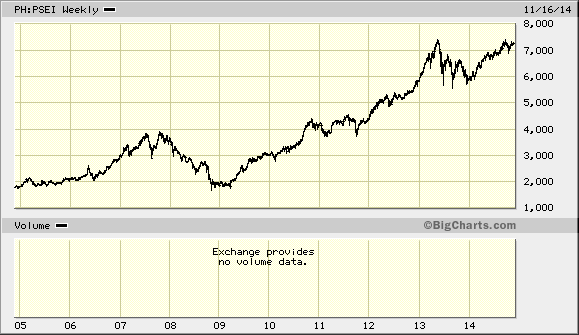

If you are a long-term investor and you are investing according to long-term objectives such as retirement, education funding, etc., cycles should not have an adverse effect on you. In a longer period, say 10 years and while markets will go up and down, and even experience crashes such as the 2008 crash, it is expected that markets will recover and will still go up despite volatility. For long-term investors, the issue is not so much on volatility but really on time. I often remind people that stock market investing is not just about timing, it is also about time. The general rule in investing is this: the longer, the better. The chart below shows the PSEi in a 10-year period. You can see that the market, though very volatile is on an upward trajectory in the long term:

Fixed income investments (Bonds) will not have any capital loss and yields will be realized if it is held up to its maturity. Just like stocks, bonds will do well in a long period, with less volatility.

When investing, it is very important to determine your investment objectives and time frame first. It is generally a good idea to hold on to your investments up until the time you need it and if your horizon is rather long, say 10 years, you should not be too nervous every time you hear negative news about the economy. A properly diversified investment strategy should allow you to hit your objectives even with the different economic cycles if you in the long run. Opportunities are also there for the taking when economy goes down, as long you are patient enough to wait when the economy rebounds and you have the appetite to take risks.

But alas, always remember that money and investments are just tools and they are not the end goal. In God’s economy, there are no recessions.

“But lay up for yourselves treasures in heaven, where neither moth nor rust destroys and where thieves do not break in and steal.” – Matthew 6:20, ESV

Learn more investment strategies at the Money Manifesto Conference. To register, CLICK HERE.

Is the Philippines now entering a turning point? Is the Philippine economy in a bubble or have we achieve a self-sustaining economic growth? Presenting the views of Business Mirror columnists, investment advocate and seasoned stock market expert John Mangun!

Is the Philippines now entering a turning point? Is the Philippine economy in a bubble or have we achieve a self-sustaining economic growth? Presenting the views of Business Mirror columnists, investment advocate and seasoned stock market expert John Mangun! major companies in the daily newspaper long before the computer.

major companies in the daily newspaper long before the computer.