Thoughts on “The Last SONA”

By Randell Tiongson on July 30th, 2015

A lot of controversy surrounds President Benigno Aquino III’s last SONA, but whatever you think of the man, the economic improvements under his tenure are undeniable. In the span of six years, we’ve gone from “Sick Man of Asia” to “Asia’s Rising Tiger,” “Asia’s Rising Star,” and “Asia’s Bright Spot.”

A lot of controversy surrounds President Benigno Aquino III’s last SONA, but whatever you think of the man, the economic improvements under his tenure are undeniable. In the span of six years, we’ve gone from “Sick Man of Asia” to “Asia’s Rising Tiger,” “Asia’s Rising Star,” and “Asia’s Bright Spot.”

For the very first time, the Philippines has been rated as “investment grade” by the leading credit agencies in the world (S&P, Fitch, and Moody’s). This is no small feat, and the President deserves applause for his role in this achievement.

Domestic investments are also on the rise. In the President’s words, “ngayon, ang Pilipino, tumataya sa kapwa Pilipino.” From 2003 to 2007, only P1.24 trillion was invested domestically. From 3rd quarter 2010 to 2014, that number rocketed to P2.09 trillion, showing that Filipinos believe in the local economy and are staking their bets on it. I myself have seen this improvement in the increasing number of people asking me how they can invest.

The President touted the increase in net foreign direct investments (FDI), up to USD 6.04 billion in 2014, the highest ever. But I think this is an area that could still use some improvement. As recently as last year, reports showed that the Philippines has the lowest FDI to GDP ratio among Asean countries, as only 1.12% of our GDP came from FDI. Steps must be taken to increase FDI inflows and keep them; this involves loosening regulations that limit foreign investments.

After the President’s fourth SONA, I expressed that there needs to be more and better jobs for growth to be truly inclusive. In this year’s SONA, he pointed to the decreasing number of OFWs, a drop in the unemployment rate to 6.8% last year, and only 15 total workforce strikes in the last five years as a sign of an improving labor climate in the country. Programs like TESDA have helped more Filipinos find jobs, which can only be good for the economy.

Overall, to me, these numbers are good, but the most important achievement of President Aquino is there was a big improvement in the battle on corruption. The World Economic Forum has stated the anti-corruption drive propels the Philippines 33 places up its rankings. The stark improvement of international perception on diminishing corruption is one of the President’s biggest contribution. This not only makes foreigners more likely to invest, but locals as well. This foundation initiated by the President sets the stage for more economic improvements in the future.

Of course, there is still room for improvement, and I know that some of the reforms will take a long time before we can see any positive effects. But I believe that the fundamentals of our economy are good, no matter who takes over. And if we stay on the right track, we can prosper as a nation.

Let us continue to pray for our beloved nation. “Blessed is the nation whose God is the LORD, the people he chose for his inheritance.” – Psalm 33:12, NIV

Euro nations borrow from Philippines’ IMF fund

By Randell Tiongson on April 6th, 2015

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!

A recent post at the Manila Bulletin, it said that “the central bank reported that nine countries in Europe had withdrawn $439.50 million from its credit facilities with the International Monetary Fund (IMF).”

As a young elementary student in the 70’s and a high school and college student of the 80’s, I remember having to hear a lot about the International Monetary Fund and how the Philippines was so dependent on it for funding. The IMF was always mentioned as one of the main culprits why the Philippines was poor and how it was enabling the Marcos regime to enslave the nation. Wow, how things have changed from those times!

As a creditor member of the International Monetary Fund, drawing of funds from the fund is the Philippine’s participation to global financial stability. Can you imagine the Philippines contributing to provide ‘global financial stability’? There are 2 funds: IMF’s Financial Transaction Plan (FTP) and New Arrangements to Borrow (NAB). EU member nations Portugal, Ireland, and Greece were the biggest recipients from IMF’s FTP while other nations like Greece, Portugal, Tunisia, Cyprus and Ukraine was also accessed. The Philippines earns from said drawdowns by way of interest payments.

The country continues to register very strong Gross International Reserves (GIR’s) at $ 81.336 as of February 2015.

Another big change from before is our nation is not as indebted as it was before! In fact, the Philippines latest Debt to GDP ratio has improved to 37.3% as compared to 39.7% a year ago. The growth in the Philippine economy has made our debt management easier and we are outperforming many other nations. Our debt to GDP ratio is better than our ASEAN counterparts. The US’s debt to GDP ratio stands at 102.47%, Japan at 227.2%, France at 92.2%, Italy at 132.10%, Singapore at 105.5% and Thailand at 45.7%.

Admittedly, there are much more that needs to be done to ensure sustainable economic gains for the Philippines, one of which is the issue of inclusive growth. However, one cannot argue that the economic condition of the Philippines today is in a much better place than where it was decades ago. Let us continue to work hard at improving our nation, and having the faith to see real and sustainable progress in this generation… our gift for the next generation.

Ph economy to zoom past peers

By Randell Tiongson on April 2nd, 2015

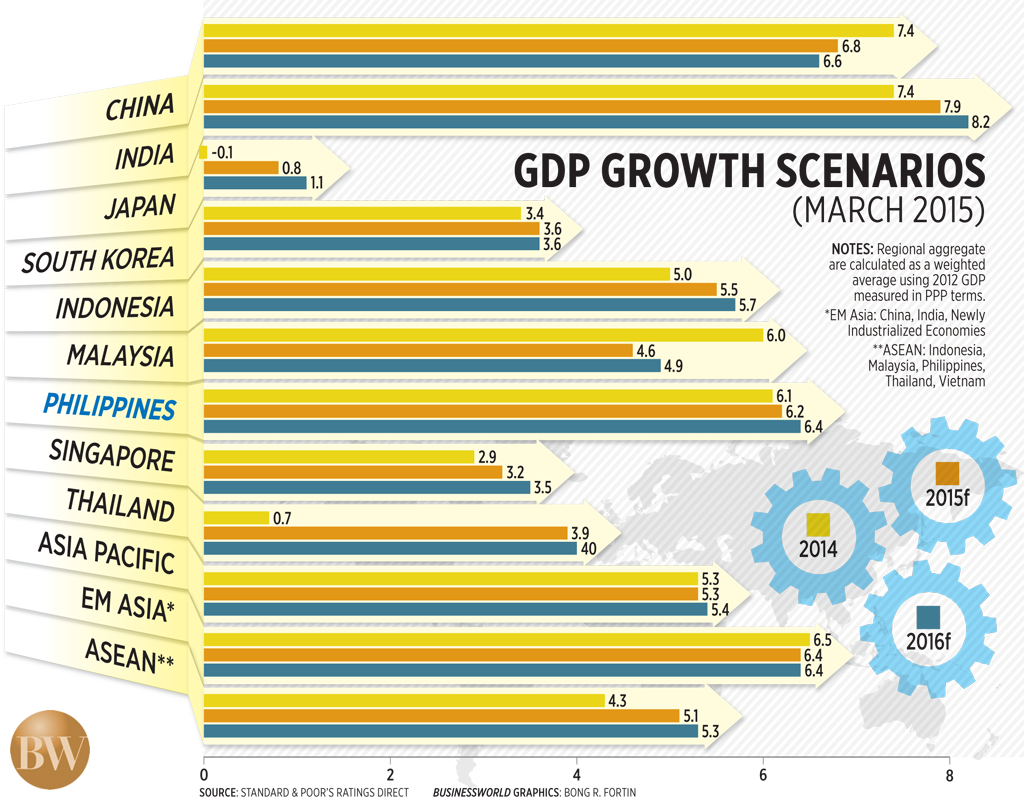

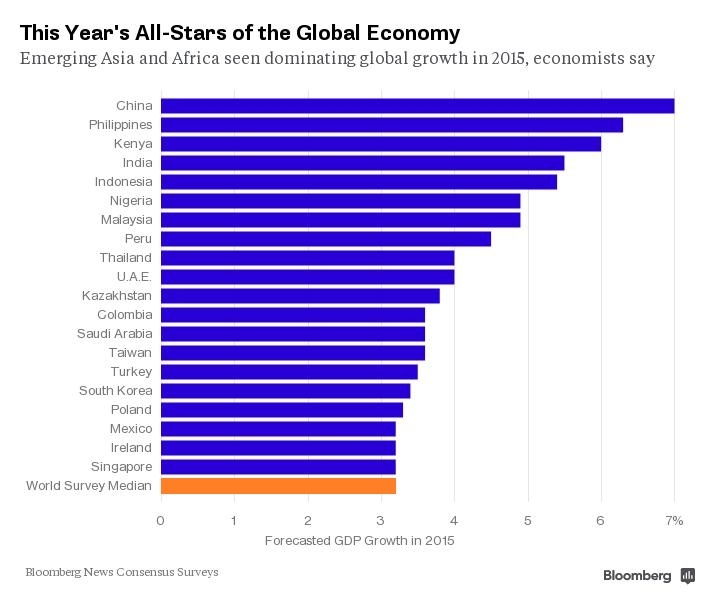

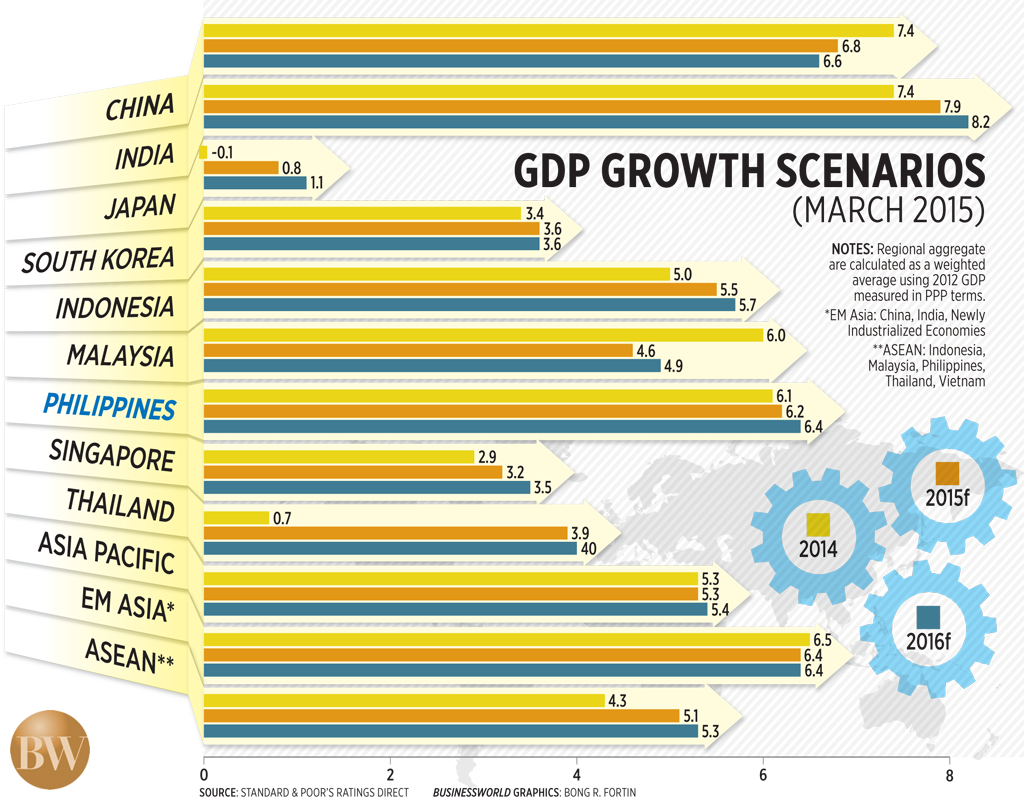

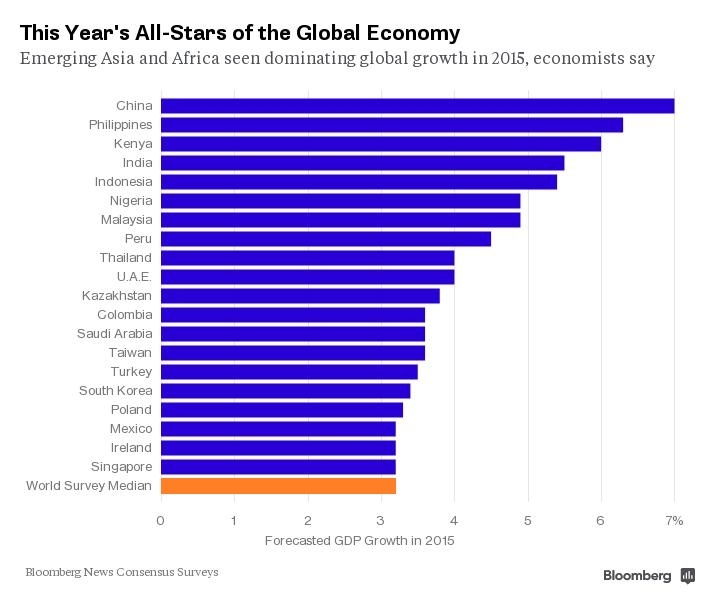

We have been reading a lot of positive news about the Philippine economy. Despite the cynicism of many, our economy continues to grow and has been attracting a lot of deserved attention. For 2015, we are poised to continue to grow and not only are we expected to perform well, we are expected to outperform our peers.

In a recent article by the Business World, it stated the we are to outpace our peers. Click HERE to read the article.

Bloomberg, a leading finance media also reported that the Philippines is expected to place 2nd in terms of economic growth, just below the economic behemoth China. To read Bloomberg’s article, click HERE

Despite the bullishness, the Philippine economy is not without any threats:

- Poverty and high un/underemployment

- Rising inflation

- Power deficits

- Natural disasters

- Logistic problems – port congestion, truck bans, etc.

- ASEAN – more competition from foreign companies (for market share and skilled labor and professionals)

- Political uncertainties (going into 2016 elections); continuation of economic and governance reforms

However, the economic threats are shadowed by opportunities:

- Transiting to higher levels of economic growth

- Sectoral and regional growth drivers)

- Increasing GDP per capita

- Peace dividends – expanded markets in Mindanao

- ASEAN integration – larger market for expansion and FDI attraction

- ASEAN – lower import prices for inputs

- Demographic Sweet Spot (majority of population now in the working/productive age)

I grew up always hearing that there is little hope for the Philippine economy, that we are buried in debt and that we are the ‘sick man of Asia’. Today’s ‘millennial’ generation are hearing another story and I pray that they will pass on the nation to their next generation in an even better shape.

Let us continue to honor the Lord for what He has been doing to our nation…

“Blessed is the nation whose God is the LORD, the people he chose for his inheritance.” — Psalm 33:12, NIV

A lot of controversy surrounds President Benigno Aquino III’s last SONA, but whatever you think of the man, the economic improvements under his tenure are undeniable. In the span of six years, we’ve gone from “Sick Man of Asia” to “Asia’s Rising Tiger,” “Asia’s Rising Star,” and “Asia’s Bright Spot.”

A lot of controversy surrounds President Benigno Aquino III’s last SONA, but whatever you think of the man, the economic improvements under his tenure are undeniable. In the span of six years, we’ve gone from “Sick Man of Asia” to “Asia’s Rising Tiger,” “Asia’s Rising Star,” and “Asia’s Bright Spot.”