A risky world

By Randell Tiongson on January 29th, 2011

Here’s a guest post from Melvin Esteban. Excellent writer!

———————————————-

A Risky World

Filipinos are generally conservative. Surprisingly though, you’ll still hear a lot of people losing so much money on the investment that they bought. In all the talks that I had, I’ve always been asked what investment do I best recommend that will give good return without taking risk. Well, bad news is, this investment don’t exist. Even your friendly and safe “Time Deposit” or “Savings Account” is not totally risk free.

Filipinos are generally conservative. Surprisingly though, you’ll still hear a lot of people losing so much money on the investment that they bought. In all the talks that I had, I’ve always been asked what investment do I best recommend that will give good return without taking risk. Well, bad news is, this investment don’t exist. Even your friendly and safe “Time Deposit” or “Savings Account” is not totally risk free.

No matter how you fix your investment and regardless on how much you diversify it, you can never remove risk. To better understand, there are two kids of risk. The risk associated with your investment (as an investment or a whole portfolio) has two components.One (unsystematic risk) can be diversified away, and the other (systematic risk) cannot.

Unsystematic Risk

Good news is, this can be diversified. This type of risk is very specific to the asset you bought (firm specific).

Say for example there was a massive recall of product produce by the company you invested because they found out it was tainted with poison or say the company unexpectedly in a deadlock with his labor union or even as simple as the a warehouse catching a fire.Financial risk will also be high if the company has high level of debt and Business risk will be elevated if investment is only concentrated to few industry or asset class.

You can eliminate this by simply just adding different investments and class of investments. This risk can be reduced because the other asset in your portfolio can offset the unsystematic risk associated with that asset. If poorly set up though, you may still end have a high unsystematic risk while a well set up will eliminate this risk.

Systematic Risk

This risk cannot be removed nor diversified away. This risk is market related compared to the first one that is firm specific. Market related may be the macro economic variables.

Examples of such macroeconomic forces are unexpected changes in the country’s growth rate like GDP and GNP, consumer price index, industrial production, interest rates, exchange rate, or even the money supply. In cases like this, your entire portfolio will be affected. Though an asset may be affected more than the other, overall, there is no way for any investment to escape from the impact.

The combination of the unsystematic risk and systematic is the risk total risk your portfolio. As mentioned earlier, unsystematic risk can be diversified and removed. So if properly done, what will be left is still the systematic risk.

So next time somebody tells you that the investment that they are offering is a sure thing! You may want to think twice.

HAPPY WEALTHY LIVING!

Melvin J. Esteban, RFP, CFC, FLMI, ACS is a contributor for Income-Tacts.com, the country’s premiere personal finance on-line community dedicated to the financial literacy of Filipinos. He is also the President of Motivating Minds, a consulting company. To write the author, send e-mail to [email protected]

Prepare the next generation

By Randell Tiongson on April 26th, 2010

The future belongs to the next generation indeed.. but will they be prepared to face the real world?

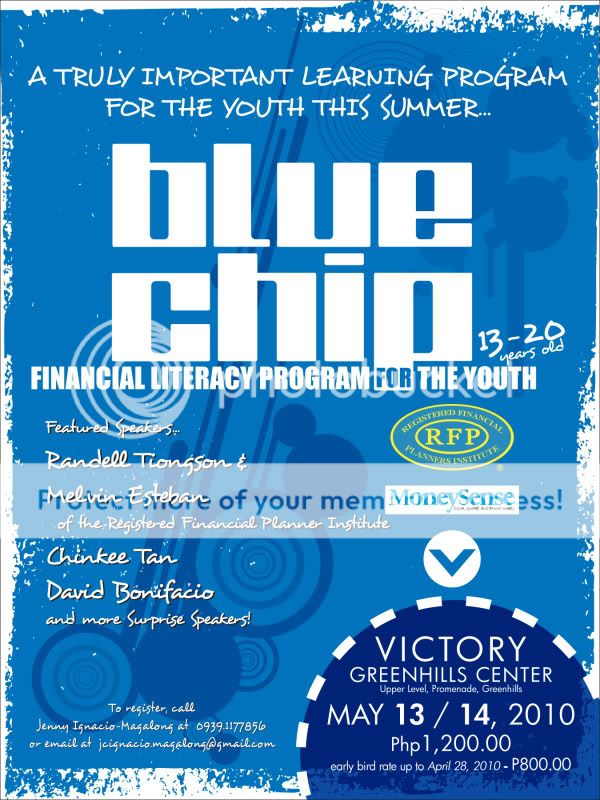

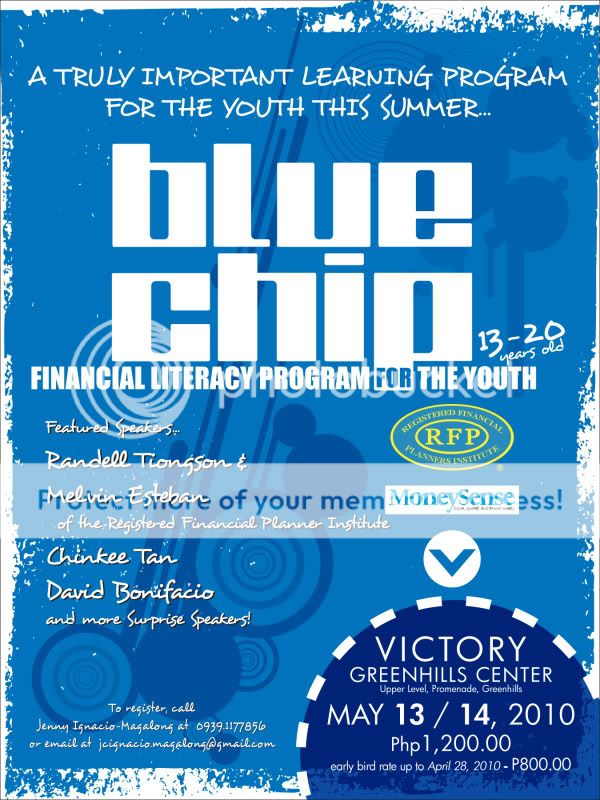

Victory Greenhills in cooperation with the Registered Financial Planner Institute (Philippines) gives you BLUE CHIP: Financial Literacy Program for the Youth! A 2-Day Summer Program on May 13 & 14 at the Victory Center, Upper Level, Promenade, Greenhills – 9am to 5:30 pm. This is a program for 13 to 20 years old.

Featured speakers are:

Melvin Esteban, FLMI, ACS, CFC, RFP and Randell Tiongson, RFP – leading instructors of the Registered Financial Planner Institute and the Certified Financial Consultant Programs.

Chinkee Tan, lifestyle trainer and best-selling author of the books “Till Debt Do Us Part” and “For Richer and For Poorer”

David Bonifacio, successful young businessman and advocate of Corporate Social Responsibility

Jennifer Ignacio – Magalong – Financial Services Trainer

Martin, Enrique and Anton Fausto – 3 teen-aged brothers who are actually investing and creating their own investment portfolios!

.. plus more!

What will they learn?

– Understanding Money and how cool it is to save and budget

– Basics of Financial Planning

– Time Value of Money

– Understanding Investments and Investment Instruments

– How to Invest for the future

– How to be responsible

…. And many more!

2 days of real world learning in a fun and hip way!!! This will definitely prepare the youth for the future!!

Fee is only P 1,200.00 but if you register and pay before April 28, 2010, you can avail the P 800.00 Early Bird Rate. This is real value and a fantastic investment for the Youth!

For inquiries, please send email to [email protected] or text to 0939-1177856

Starting Young

By Randell Tiongson on April 21st, 2010

Written by my good friend Melvin Esteban. Melvin will be featured at Blue Chip: Financial Literacy Program for the Youth!

——————–

Starting Young

By: Melvin J. Esteban, RFP®

Why does it seem so hard for us to save? My take is very basic: We are not really taught how at a young age. Kids should be properly taught the values of saving—constantly, from the elementary level all the way to college. In fact, I believe teaching it should be a requirement of every school.

A couple of weeks ago, I had the opportunity to give a talk to the students of St. La Salle in Bacolod. The topic they chose was financial planning. This means that they would not only be able to pass their subject but also learn something very important—financial planning. They even invited the lower batch to join the event.

If I were asked for advice by parents or teachers on the value of saving, I would tell them to make sure their objective should not only be to teach the child how to save but also to make sure the kid is motivated by it. It would be a struggle if you keep investing money but the kids resent you for it. I had the opportunity to open my first savings account when I was in Grade 1. It was the “Happy Savers Club” of Banco Filipino. It was a very good motivation for me because every time I made a deposit, I got to win a prize. At first, my mom accompanied me to the bank and explained the rewards of saving. After a while, I learned to go to the bank by myself.

Banks are the best starting point for children. Open a kiddy savings account for them. Almost all major banks have one. When you do this, however, make sure you bring along your son or daughter. Make this a fun learning experience for him or her. Make sure, too, that the bank is close to your house because eventually you will want him or her to do it on his/her own.

As the fund gets bigger, you can start to transfer the money in a time deposit. Use the opportunity to explain to him/her the concept of not touching the money for a time so it grows faster.

These lessons can go a long way in motivating your child to save. As you progress from this, you may want to look at other investments like mutual funds, which are offered by mutual-fund companies; or unit investment trust funds, which are offered by banks. The basic concept of this product is that your money is pooled together with other people’s money to make the fund bigger. This will allow the manager to diversify the investment, giving the fund a higher level of return with a lower risk. You may need to choose from a different array of funds like a bond fund or an equity fund. I personally prefer the bond fund, as this is safer and has a fairly good return in the long run.

Remember the advice of a wise man: “Your objective is not to make a lot of money but to make consistent money.” If you keep on looking for investment that makes a lot of money, surely, you can also lose a lot of money.

Last, you may want to look at stocks or equities. Although it’s normally perceived as a risky investment, in the long run you are most likely to be much better off with this kind. Limit your choices to the blue chips. I personally like SM Investments Corp., Ayala Corp. and Bank of the Philippine Islands. This money is intended for your child’s long-term needs, like college education; or you can give it as a graduation gift or seed money for his business in the future. Please do not play the market. Do not buy and sell the stock every month or every time your brokers tell you. It’s only the broker who will become rich because of all the commissions he’ll get. The secret is patience. For as long as you stick to the best company, you shouldn’t mind the volatility in the middle.

There are a lot more investment choices out there, but the trick is to have a good mix of this instruments.

Here are some suggestions:

1. Do not give your child too much allowance. I always tell parents that instead of giving money as baon, just prepare food for the child. When you’re in a grocery store, buy him what he wants so he will look forward to taking that to school. Not only that, you are sure that you are feeding him nutritious food and he won’t be used to the notion that money is given.

2. Assign a weekend task before giving him his pocket money or allowance. It may be as simple as feeding the dog or cleaning his room. The value here is to develop in the child the notion that money is earned.

3. When giving money, show him that you are putting it directly in a piggy bank and eventually putting it in the bank. Let him keep the passbook so he can see his money growing. Explain to him the concept of his money making more money, or the concept of returns. The earlier you impart this value, the better. I was introduced to this concept at the age of 10.

4. Finally, encourage the child to set a goal for saving. It may be a toy for Christmas or a bicycle. This way he will have something exciting to look forward to. This develops delayed gratification.

As a final note, you are doing a good thing here. More than the money, the child learns the value of saving. Sadly, sometimes, this will be a very big challenge for a lot of parents if they themselves don’t save. Make this a family thing, a fun activity. Last, stay committed! Happy wealthy living!

Filipinos are generally conservative. Surprisingly though, you’ll still hear a lot of people losing so much money on the investment that they bought. In all the talks that I had, I’ve always been asked what investment do I best recommend that will give good return without taking risk. Well, bad news is, this investment don’t exist. Even your friendly and safe “Time Deposit” or “Savings Account” is not totally risk free.

Filipinos are generally conservative. Surprisingly though, you’ll still hear a lot of people losing so much money on the investment that they bought. In all the talks that I had, I’ve always been asked what investment do I best recommend that will give good return without taking risk. Well, bad news is, this investment don’t exist. Even your friendly and safe “Time Deposit” or “Savings Account” is not totally risk free.