2015 Outlook, part 8

By Randell Tiongson on January 21st, 2015There has been a rise in the interest of Filipinos with regard to stock market investing. Financial advisers often recommend stocks to be in one’s portfolio and for a good reason, it has given the investor good returns for sometime now. However, stocks are also one of the most volatile investments and many have ‘lost their shirt’ in the stock market, so to speak.

Are we seeing a continued bull run in the Philippine Stock Market for 2015? Marvin Germo, one of the country’s most popular stock market enthusiast shares his views on where the market is heading for 2015.

The 2015 Outlook of Marvin Germo

I love watching basketball. I love the part where the underdog, who has been trailing massively in the first 3 quarters start to turn things around and shift things toward their favor. I just love seeing that sight, to see people who have been battered and forgotten move forward and shift from losing to wining.

I believe that this is what is happening in the Philippines. I believe we are surging like never before. The economy may not be perfect and there are things that I think still need to be changed. But like the basketball team I know we are moving up instead of falling down. All the cards are stacking right towards our favor.

What has changed?

1. Our GDP is still strong, relatively higher than most of our peers in region and also as compared to its historic average. The economy was flying prior to Yolanda but it slowed down a bit in 2014 due to its effects of the typhoon. But I believe this year our economy would pick up further. Our GDP is still and will be consumption driven, this means that as more Filipinos spend our economy would grow as a whole.

2. Two years ago we moved from speculative to investment grade but not just that over the past few months we have proven that we can go higher than that as evidenced by more and more upgrades.

3. Inflation is still low, as oil prices continue to drop worldwide, I believe this would further slow down inflation in the country.

4. Interest rates are also low, this means more people are taking loans. More loans allow other sectors in the country to grow. In spite of more people taking loans our Non Performing Loans ratio is still relatively low, this means that people are paying their loans and not defaulting on them. As interest rates are low, this also means more liquidity in the market. It shows that more people would be taking more risks to get more gains. This is good for people involved in stocks and equity funds.

5. We are the top 23rd in the world in gold reserves and top 25th in US dollar reserves beating other 1st world countries.

6. Our unemployment rate is relatively lower, meaning more jobs are being created for our countrymen but aside from that we are seeing also more OFW remittances that help energize our consumption driven economy.

7. More money is also heading the government’s way as they are now able to collect taxes more effectively, which in theory can be used to further our economy.

8. Aside from this our debt to GDP ratio also has continued to drop.

I could go on and on about how things are doing well for our country. However as what I mentioned it is not a perfect economy and certain adjustments need to be made.

What needs Improvement?

1. I believe the government still needs to increase spending and infrastructure spending needs to be a priority. More infrastructures built would bolster business, tourism, and make growth inclusive to everyone.

2. We also need to see more foreign direct investments that will create real jobs and not just money flowing in and out of the stock market.

How does this fit our investments?

Given that interest rates are still low and there is so much money moving around. I believe equities would still take the helm this year. If you are an investor try to align your investments with anything that is related to stocks. Either via direct stock investing or via an equity fund.

Will the PSEI hit 8,000?

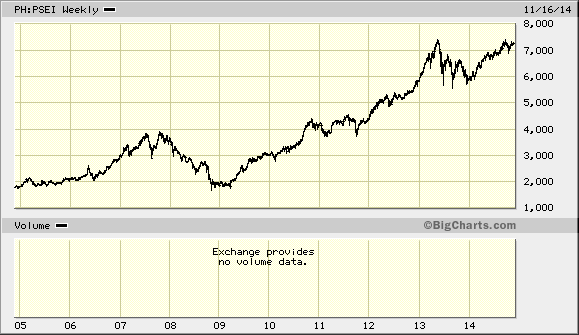

I believe no one has a crystal ball to determine where the market will go. Stocks over the short term still move with respect to sentiment and supply & demand. However, given the fact that the fundamentals of the Philippines remain to be amazing, I believe its not a question if the PSEI will hit 8,000 but rather a question of when.

Also as an investor, you should ask your self the question, should the market hit 8,000, would you be buying, holding, or selling? The technique to earning in the market is by having your own strategy and sticking to it.

If you who want to maximize the growth of our economy, I suggest to invest in stocks that are consumer related (Read: Stocks and our Consumption Driven Economy) or if you are entrepreneurial create businesses that will cater to consumption. At the end of the day as more Filipinos spend businesses aligned to consumption will produce more earnings. In stocks, stock prices follow earnings that move up.

Is our market relatively higher?

Yes it is. The PSEI is more expensive compared to other foreign markets in the region. This means that more investors may be more cautious to come in and may wait for the market to go a bit lower before they start investing.

As our market is relatively higher and for those who are a bit more conservative, you may still go for stocks. However, go for stocks that give higher dividends and are less volatile. This is so if the market would correct you still get your dividends and you don’t get hit much by the volatility.

Technicals

On a technical analysis level the market is still in a good uptrend from its reversal in 2009. The 200 day moving average support (as of this writing) is at 6,960. As long as we stay above the 200 day moving average I believe the market can still push up further, however if this breaks downward, you may consider taking profits.

While as of this writing, the peak of 7,400 has been broken twice this year. What I would like to see is that the PSEI stays above 7,400 and builds a support there. If 7,400 holds, over the short term we may see the market move towards 7,600 then eventually 7,800. After that the road to 8,000 doesn’t seem so far off.

Will the market move up on a straight line up? Not necessarily! As always markets drop, when majority of investors take profits. You may also want to consider that the PSEI has been more than 27% up since the start of 2014 and a lot of investors are also waiting for a proper time to take profits.

At the end of the day, it is you as an investor who will make the decision on what to do and how to trade your portfolio. If you are a trader stick to your technical analysis and your trading plan. If you are an investor buy reasonably priced stocks that are cheap, growing and stick your fundamental analysis.

If you are investing in equity funds, either via UITFs or Mutual Funds stick to your financial plan. Don’t just take out funds because of emotion and just because the market is super high or low. Stick to your fund knowing that your fund manager knows what they are doing and that’s the reason why you are invested with them in the first place. Only take money out when your plan or goal has been hit.

At the end of the day I believe 2015 will be a great year for you as an investor. The Philippine economy which used to be an underdog is reversing, moving forward and surging higher. It’s time to be invested and to take part of the progress. God has great plans for you to prosper and to succeed in life. It’s time for you to step into them!

Have a great 2015 ahead!

Marvin Germo is an engineer by education and a Registered Financial Planner. He is one of the country’s most prolific stock market enthusiast and an advocate of stock market education. He is the author of two best selling books (Stock Smarts) on the stock market, a columnist for Business Mirror and Rappler and speaks locally and globally.

Marvin Germo is an engineer by education and a Registered Financial Planner. He is one of the country’s most prolific stock market enthusiast and an advocate of stock market education. He is the author of two best selling books (Stock Smarts) on the stock market, a columnist for Business Mirror and Rappler and speaks locally and globally.