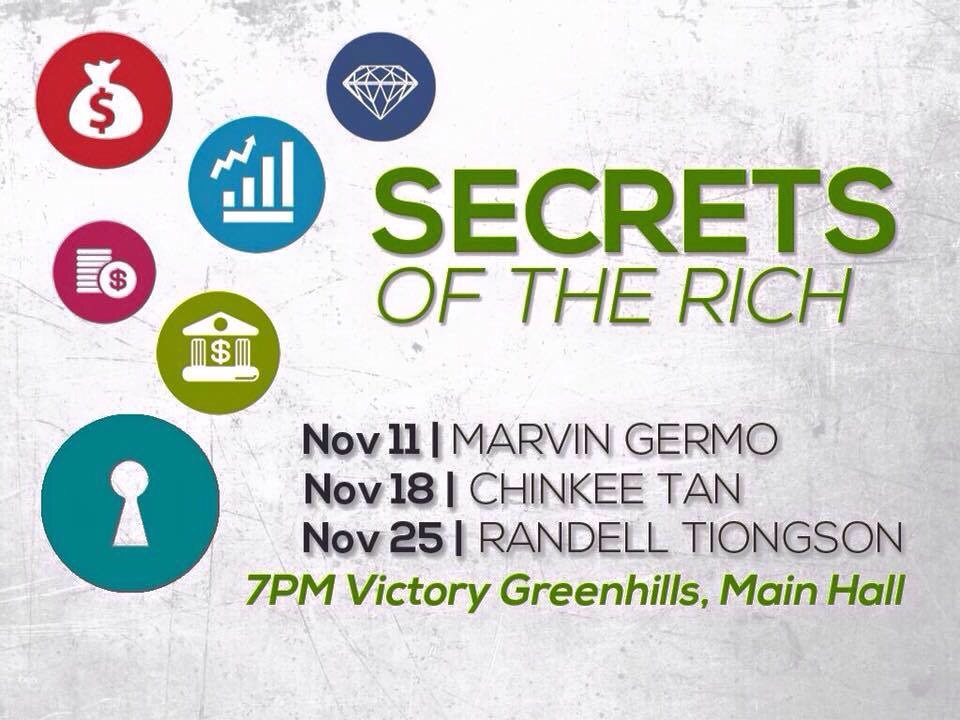

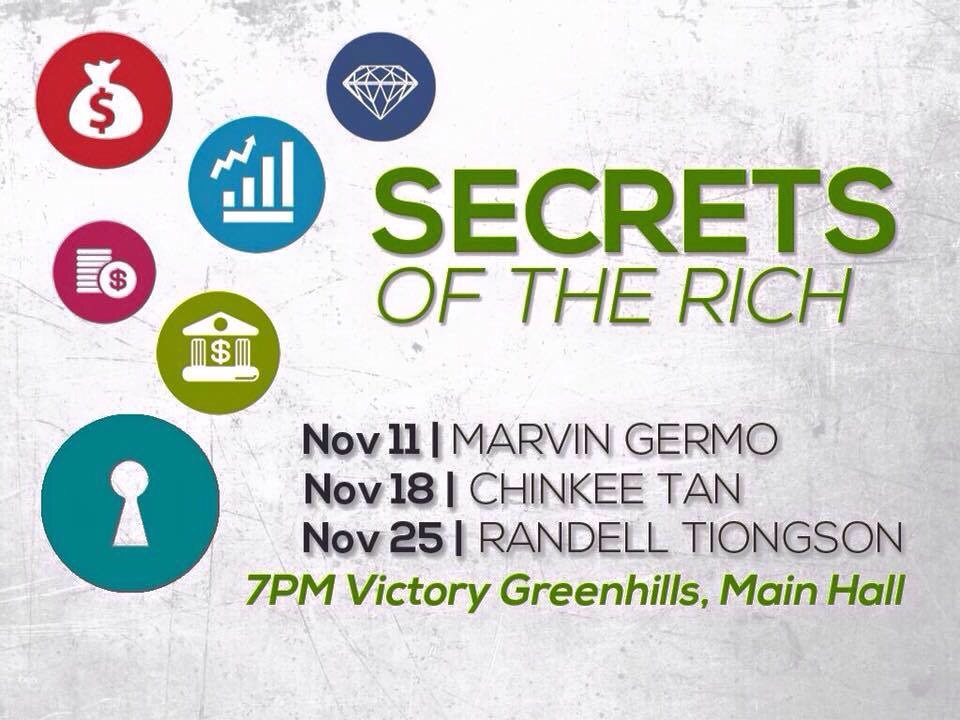

Free Event: Secrets of the Rich

By Randell Tiongson on November 20th, 2015

I would like to invite you to join me as I cap the final installment of “Secrets of the Rich” series this November 25, 2015 (Wednesday) at 7:00 pm. I will be discussing sound financial principles on building wealth and will also give you practical tips on where and how you can grow your money.

This event is for FREE and it is open to all, however I suggest that you come early so that you can get good seats. The event will take place at Victory Green Hills main hall at the 4th Level of V Mall, Green Hills, San Juan City.

Thank you Victory Green Hills for organizing this life-changing events.

See you there!

Where should I invest? Mutual funds, UITF, VUL or stocks?

By Randell Tiongson on September 1st, 2015

Question: HI, I’ve recently decided to start investing, but I don’t know which product I should choose. Should I invest in variable universal life insurance, a mutual fund, UITF or buy stocks? —Asked by Josiah via Facebook

Answer: First of all, congratulations on taking this important step in your journey to financial peace! But the question of which product is right for you depends on where you are in life and what your goals are. While I can’t make any specific recommendation because I don’t know more about your financial situation, I can give you a broad overview of each product you mentioned to help you make the right decision.

I’m an advocate of life insurance, which is something Filipinos sorely lack. Variable life insurance (or VUL) is a product you can consider if you need both insurance and investment. VUL will give you insurance benefits but it will also have a fund that is being invested according to your objectives, risk profile and other preferences. If there are already people depending on your income, you should get a life insurance policy. But if your sole objective is purely investing, then this may not be the right instrument for you at this time, because in the first couple of years of your policy, most of your money will actually go toward premium payments.

If what you want is to put all your money in investments, and your risk tolerance is moderate to high, UITFs and mutual funds can work for you. A big advantage of these is that they are professionally managed by experienced investment managers, who are trained to invest properly. Even if you yourself are not well-versed in investing, you can rest assured that you’re in good hands.

The main difference between these two is that UITFs are offered by banks, while mutual funds are their own companies. By buying into a UITF, you own units of this fund. By buying into a mutual fund, you own shares and become a shareholder in the mutual fund company. All your earnings are net of tax and fees as represented by the NAVpu (net asset value per unit) for UITFs and NAVps (net asset value per share) for mutual funds.

When it comes to these pooled funds, you can choose from a variety of investments for every risk appetite. You can also choose among actively managed funds, where a fund manager tries to beat the index, or passively managed funds, which simply try to match the performance of an index.

In more economically advanced countries, passively managed funds match or outdo the performance of actively managed funds because those markets are already efficient. However, in younger markets like in the Philippines, active fund managers can still perform better than the index because the market is not efficient yet and there are still advantages they can leverage.

However, investing in mutual funds and UITFs comes with some disadvantages. The management costs can be significant, going to up to 2 percent. For UITFs, sometimes the bank branch staff aren’t trained to handle inquiries, and some of them might even discourage you.

Mutual funds and UITFs will work for you if you don’t need the money right away and can stand risk, but don’t have the time to learn all about stocks. They’re also a good vehicle for retirement funds because the long-term nature of your need will allow you to weather the fluctuations of the market. I’m encouraged by the good performance of many funds over the last few years, but keep in mind that past performance is never an indication of future performance.

Now we come to the elephant in the room: stock investing.

Individual stocks come with a lot of advantages: you have direct control over what you buy, unlike in a pooled fund that is automatically diversified. You get residual income if you buy a stock which pays out good dividends. Your returns are maximized because you’re not paying management fees, and if your individual stock outdoes the market, you make money even if the market as a whole is going down. And if you choose the right balance of stocks, your portfolio’s growth can outperform the index.

But! Before you start counting your chickens, know that stock investing is not easy to get into. You’re going to have to spend a lot of time learning about how it works. You’ll also have to learn fundamental and technical analysis, spending time reading financial reports from the companies you want to invest in and learning market trends to make the best investment choices. And to be properly diversified, you’ll need to start with a big capital; otherwise, you’ll be limited in the kind of stocks you can add to your portfolio.

Bottom line: if you want the protection of life insurance, go for a VUL. If you want to participate in the growth of the Philippine economy but don’t have the know-how to go into stocks, choose a mutual fund or a UITF.

If you have the time to learn, money to invest, and aggressiveness to match, stocks may be for you.

There are a lot of options for you if you want to start moving your money out of a savings account and into a product that can work harder for you. If you are a new investor, I recommend you invest in a pooled fund first as you learn how the stock market works and develop your competency in investing. Once you’re confident that you’ve learned enough, then you can invest in the stock market.

Whatever undertaking you choose, it must have a good foundation—this is true for investments as well. Develop your base of good money management, savvy saving, and common sense, and this solid foundation will bring you real prosperity.

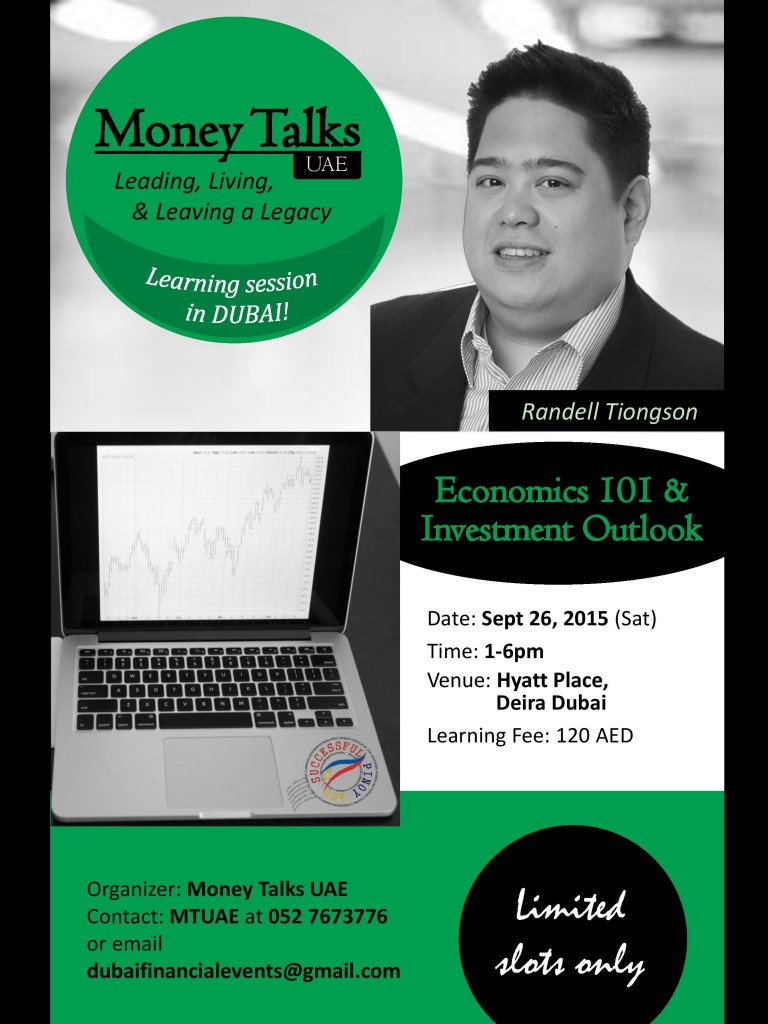

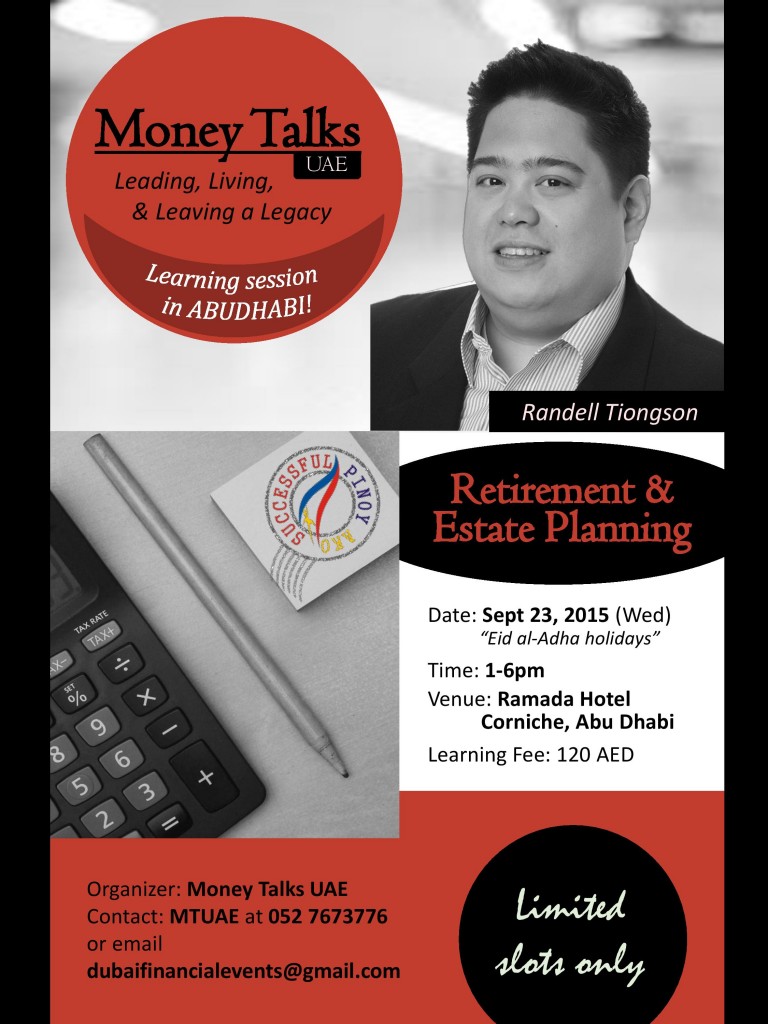

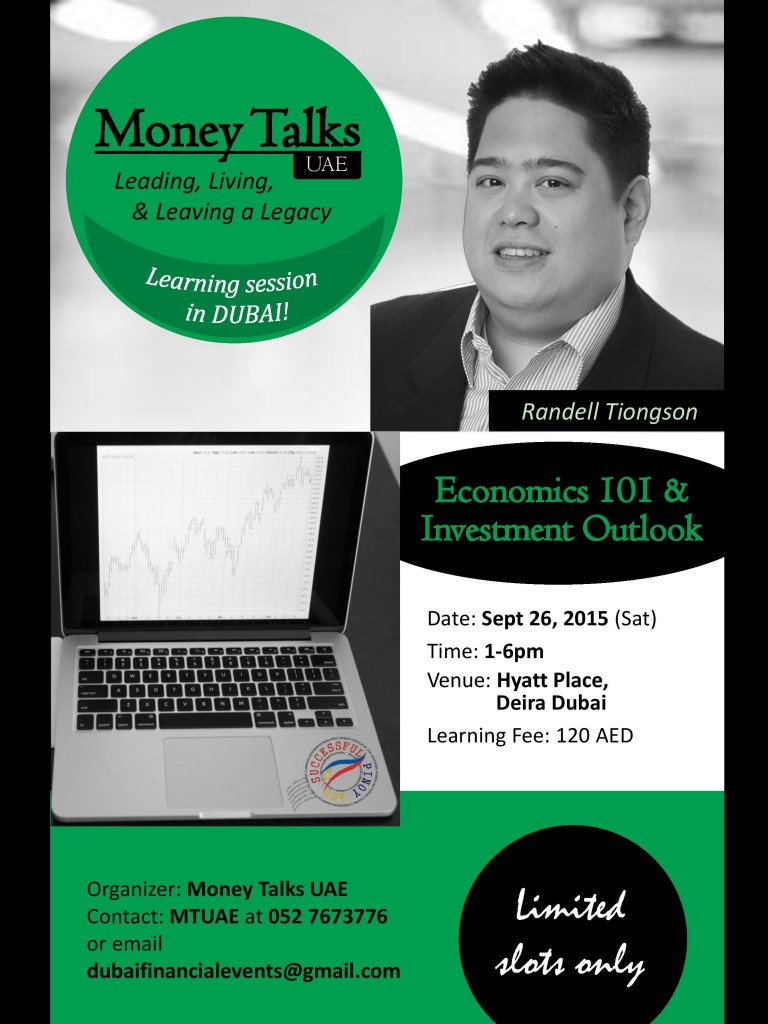

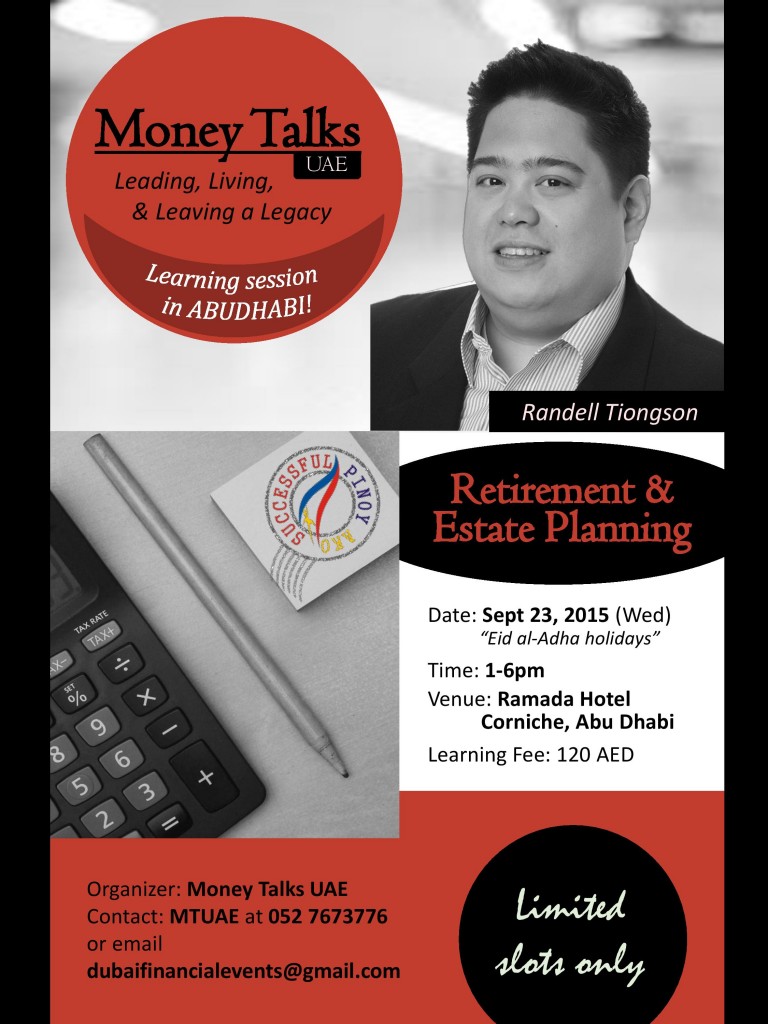

Special finance events for Dubai & Abu Dhabi OFWs!

By Randell Tiongson on August 18th, 2015

I will be back in the UAE for a series of training for the OFWs this September! It’s time to level up learning and be on your way to financial peace!

1) Economics 101 & Investment Outlook (Dubai) — this program will discuss the rudiments of economics especially matters that will have an effect to investors. How does interest affect investments? How does inflation play a factor in growing your wealth? How does monetary policies used to spur the economy?The program will touch up on basic macroeconomic learning as well as a thorough look on the Philippine economy as a bonus feature of the event. It is high time that we all understand economics and how it affects our everyday lives!

To register, click HERE or email dubaifinancialevents@gmail.com

2) Retirement & Estate Planning (Abu Dhabi)

Studies shows that only 1 to 2 out of 10 Filipinos prepare for retirement. Studies also reveals that the few who prepare for retirement, most of them will only exhaust their retirement funds halfway through retirement. Filipinos are experiencing longer life expectancy but unfortunately, huge costs are needed to live a life of comfort during those years.

Consider this: If you can generate 75% of your pre-retirement income during your retirement years, you will live a life of comfort; if you can only generate 30-50%, you will live a life of struggle. For a 20 year retirement, you need at least 20 years of preparation — if you plan to retire at 60, then you should start preparing at 40.

As and added feature, I will also discuss basics of estate planning under the Philippine setting. Many Filipinos are unaware of why estate planning is important to them.

To register, click HERE or email dubaifinancialevents@gmail.com

HURRY! We are only limiting this offerings through limited slots only.