Achieving your financial goals

By Randell Tiongson on December 29th, 2014

QUESTION: I already have my financial goals but I am having a hard time achieving them, or even starting on them. What should I do?—name withheld upon request

QUESTION: I already have my financial goals but I am having a hard time achieving them, or even starting on them. What should I do?—name withheld upon request

Answer: There are many reasons why you are having difficulty. But I think the biggest reason is not having the right behavior. Personal finance guru Dave Ramsey says finance is 80 percent behavior and only 20 percent skill, and I agree with that 100 percent.

Your quest to achieve your financial goal is a big step in the right direction, and that should be backed up with consistent behavior.

The most important behavior that you need to watch out for is that in money management, and this is where a lot of people fail because it is a daily task. People do not get into a financial mess overnight, they do so with wrong behavior done on a daily basis. Spending and saving money are behavior concerns and not skills. Let’s break it down for better illustration: To achieve your financial goals, you need to invest properly. To invest properly, you need to save properly. To save properly, you need to spend properly. To spend properly, you need to earn properly. While investing is a skill, earning, spending and saving are all about behavior.

Here are some simple and practical tips:

1) Create a practical budget and stick to it. Have a spending plan. As your receive your income, you should already know where it will go. When preparing a budget, it is best for you to identify those that are needs and those that are wants so that when there is a need to make adjustments, adjust from your wants, not the needs.

2) Make savings automatic. The phrase ‘pay yourself first’ is one of the most helpful personal finance tips ever. Your budget will let you know how much you can set aside on a regular basis and when you know the amount, set it aside regularly. A 20- to 30-percent savings rate is an ideal target. You can also enroll your bank account into an auto-debit arrangement.

3) Invest small amounts regularly. Most people make the mistake of waiting for their savings to grow substantially before investing it. However, many will never get into investing because they keep on waiting for their savings to grow, but it never does because there is always the temptation to use the money every time we see it grow into something sizeable.

A number of people are not aware that they can invest small amounts. When done regularly and consistently, these amounts can grow into hefty sums someday. Some banks and mutual funds accept investments as low as P1,000 a month that can be invested in long-term instruments. Just make sure that you have emergency funds set aside before you invest. Once you invest, forget about it so that you will not be tempted to pull it out before you hit your objectives.

4) Study. It is always a good idea to learn about finance and investments. So go buy a personal finance book, attend a finance seminar, read blogs and posts. Learning helps you get motivated and to be on track with your goals. It’s not rocket science but you will need to do some studying. It can be a big help in the future. By studying, you will also surround yourself with financially-able individuals who can hold you accountable to your goals.

Don’t worry, there is still time for you to achieve your goals. But make sure that you begin with the change in behavior.

“Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty.”— Proverbs 21:5, NLT

Happy New Year to all!

Before investing your money

By Randell Tiongson on November 12th, 2014

A lot of people have always asked me about investing – where to put their money, how much to invest, do they buy stocks or mutual funds, etc. They are all great questions and those are important issues to address. However, before even thinking about putting your money somewhere, there are a few things that you need to take care of first:

1) Money Management – proper management of your finances is the foundation of your quest for wealth. If you are like most of us, your money doesn’t come in just one shot – they come in and go regularly and your investments will do well when you can add to those investments pretty regularly. You can only keep on adding to your investments if you know how to save properly… and you can only save properly if you know how to spend properly. Create and stick to your budget, as that will be your most important weapon in building your wealth.

2) Emergency fund – I cannot emphasize enough the importance of building a buffer fund before investing. Investments are volatile, well at least the good ones are and there is always a danger that when you liquidate your investment, it may have not earned yet or worse, its lower than its original amount. The buffer fund will allow you to keep your investment funds untouched since you have another fund to dip your hands into when emergency strikes. 3 to 6 months worth of expenses is a good emergency buffer fund.

3) Investment objectives & time frame – what are you investing for? Many people invest without really know why they are investing in the first place. Knowing your objectives and time frames will allow you to match the right investment instruments that will be best for you.

4) Risk tolerance – it is good to determine your risk appetite before jumping into any investment. A lot of people invest money into risky instruments and yet they are not prepared to handle investment risks which causes a lot of frustration that leads to a lot of stress. Never invest without knowing the risks.

5) Time – think long-term. There are no short-cuts to wealth and you need to be patient in building your wealth over time. Do not take short cuts and do not be in a hurry as those actions can cause you to make a lot of financial mistakes.

Good planning and hard work lead to prosperity, but hasty shortcuts lead to poverty. – Proverbs 21:5, NLT

—————

Get finance & investing tips from the Money Manifesto Conference this Nov. 29, 2014 at the SMX Aura! For inquiries, visit HERE

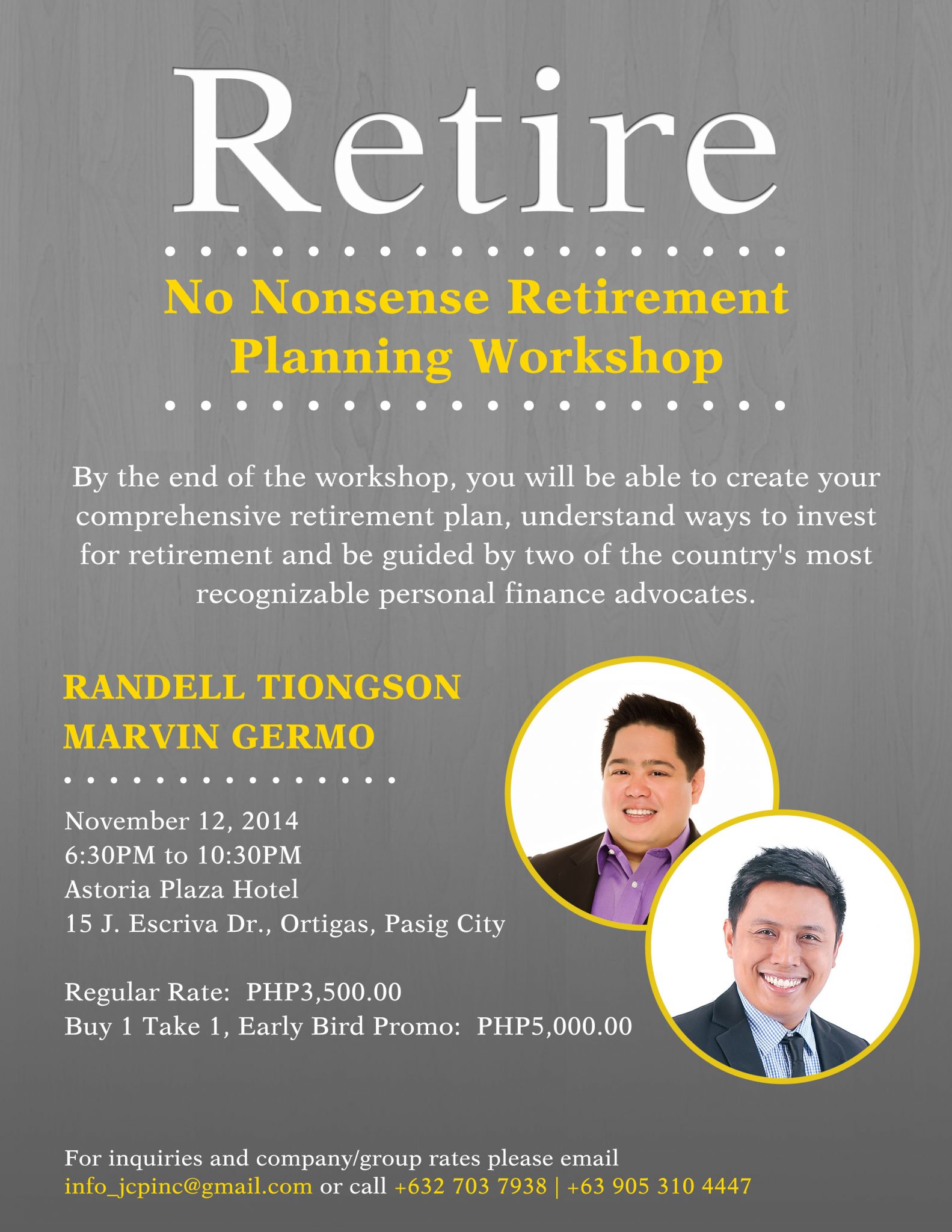

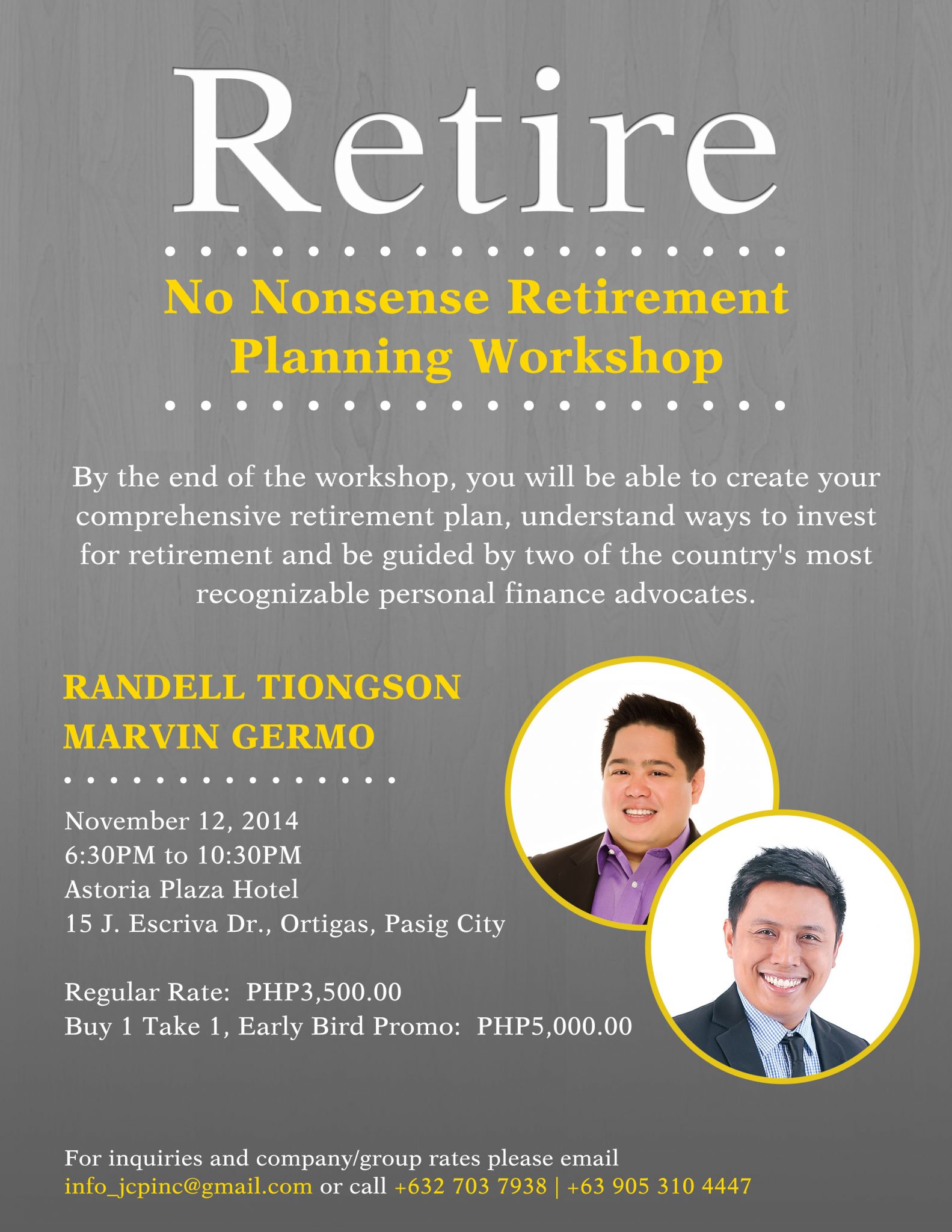

Retire 2014 Reload

By Randell Tiongson on October 28th, 2014

Studies shows that only 1 to 2 out of 10 Filipinos prepare for retirement. Studies also reveals that the few who prepare for retirement, most of them will only exhaust their retirement funds halfway through retirement.

Filipinos are experiencing longer life expectancy but unfortunately, huge costs are needed to live a life of comfort during those years.

Consider this: If you can generate 75% of your pre-retirement income during your retirement years, you will live a life of comfort; if you can only generate 30-50%, you will live a life of struggle. For a 20 year retirement, you need at least 20 years of preparation — if you plan to retire at 60, then you should start preparing at 40.

Attend RETIRE: No Nonsense Retirement Planning Workshop and learn how to properly prepare for your retirement. At the end of the full day workshop, you will be able to prepare a comprehensive retirement plan that is suited for you and a plan that really works. Find out how you can truly live a life of comfort & learn about the proper investments that is best suited for your needs objectively from two of the most recognizable finance advocates of the country.

For inquiries and registration, email info.jcpinc@gmail.com

QUESTION: I already have my financial goals but I am having a hard time achieving them, or even starting on them. What should I do?—name withheld upon request

QUESTION: I already have my financial goals but I am having a hard time achieving them, or even starting on them. What should I do?—name withheld upon request