Master Class for Financial Advisors

By Randell Tiongson on July 1st, 2019Financial advisory and sales are one of the most attractive professions today. However, financial advisors are subjected to many challenges that prevent them from achieving success in their chosen field.

If you are a financial advisor and you would would want to improve your craft, join my Master Class and be on your way to achieve greater heights with your profession and business.

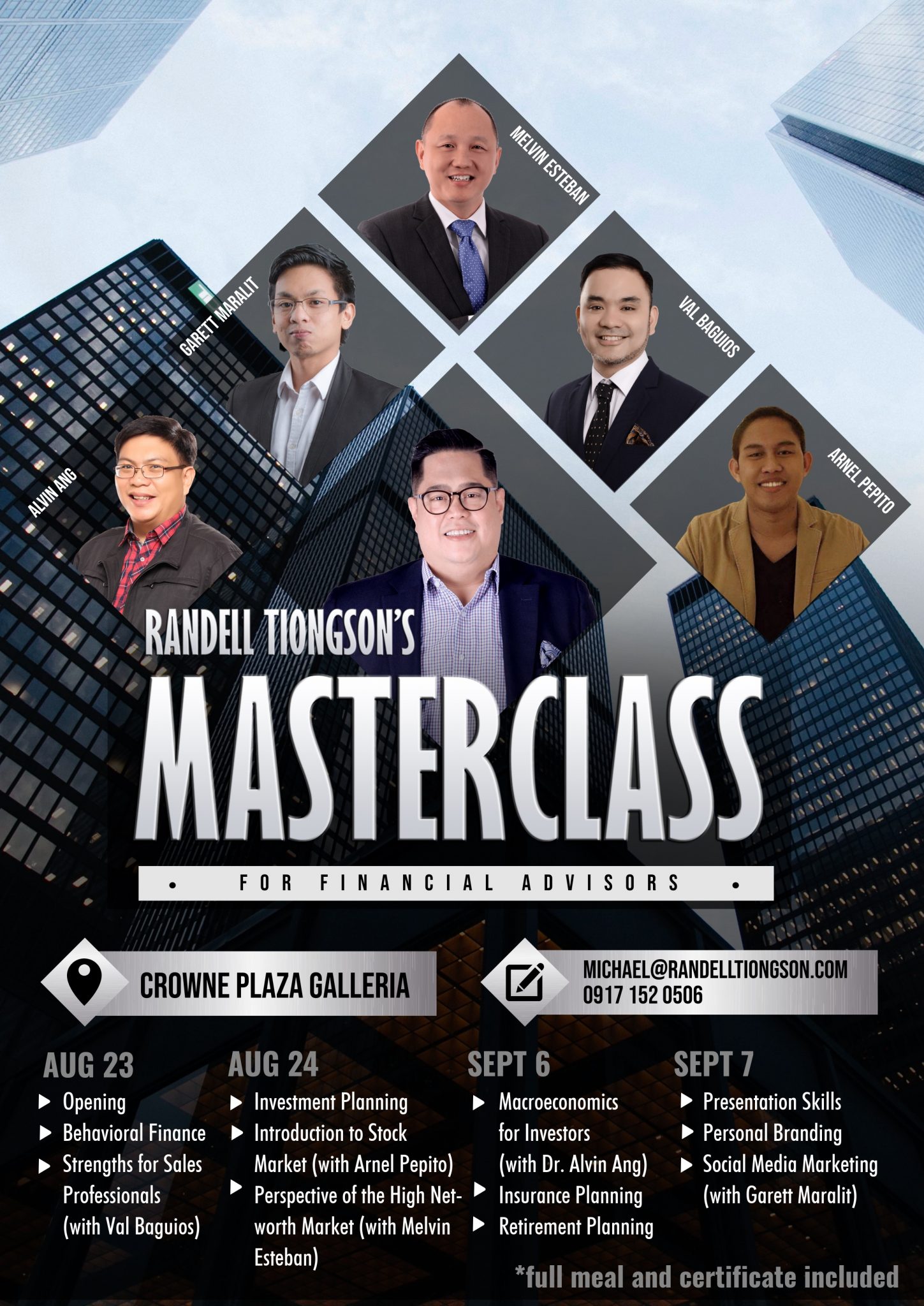

Randell Tiongson’s Master Class for Financial Advisors will feature experts who have proven track records:

Melvin Esteban is a well-respected wealth management practitioner who has over 2 decades of experience in the financial services industry. He has extensive corporate experience in insurance, wealth management and consultancy and also a regular lecturer at the Registered Financial Planner program. Melvin is a Fellow of the Life Management Institute (FLMI) with Distinction, an Associate with Financial Services Institute, a Registered Financial Planner with the Registered Financial Planning Institute, Ohio, and a Certified Financial Consultant by the Institute of Financial Consultants, Canada, with High Distinction.

Dr. Alvin Ang is a professor of economics at the Ateneo de Manila University. He is currently Director of Economic Research in the same university. He has a PhD in Applied Economics from Osaka University as a Japanese government scholar. He was a former economics professor at the University of Santo Tomas and was the former head of the Research Institute of UST. Not only is he a favorite professor my many, he is also a favorite speaker on economic matters in different government and corporate settings as well as a regular guest on tv and radio on the same topic. He is a regular columnist for the Business Mirror. He ss fondly called the “everyday economist” because he has makes complex topics easy to understand my many.

Val Baguios is a an IT practitioner but pivoted to become a strengths and executive coach. He is an International Coach Federation (ICF) certified coach and a Gallup-certified Strengths coach. Val has been featured in many institutions and programs where he makes people understand the value of coaching and empowering individuals to strategic, purposive and strengths-based endeavors through one on one coaching and people development.

Arnel Pepito is a full-time trader and portfolio manager participating in the Philippine Stock Exchange. Arnel is a stock market enthusiast and an investing/trading advocate. He has vast interests from trading currency, commodities, futures to global equities. He is also blogger and a no-nonsense investments advocate who is very passionate in sharing the opportunities in the stock market and other investment vehicles. He is the founder of Investambayan, a very active social group that provides stock market education. He is followed by over 10,000 people due to his passion to share his knowledge.

Garett Maralit is an engineer turned financial practitioner. He is the co-founder of The Bright Millenial, a Facebook group that currently has over 220,000 followers. Garett has been one of the most prolific and successful individuals to use and maximize the benefits of social media to benefit the financial advisory industry. With the barrage of pages and groups in the social media, Garett Maralit was able to distinguish his brand and continues to stand out in social media, particularly Facebook. His experience and exposure in the social media has propelled Garett to be one of the top advisors of his branch and now leading a robust group of young financial advisors.

Randell Tiongson is one of the Philippines’ most respected and followed personal finance coach. He is the cofounder of the Registered Financial Planner, a best-selling author, media practitioner and international speaker and a columnist. He has been influential in the development and growth of the financial planning industry and is a leading thought leader and influencer in personal finance. Randell has over 3 decades experience in the financial services industry and has experience in sales, marketing, training, consultancy and more. He is the person behind the most attended finance conferences such as iCON, Money Talks, Build Your Future. He has also sold over 100,000 finance books to date and has given over 1,000 talks and seminars over the years.

Randell Tiongson’s Master Class for Financial Advisors will run on August 23 & 24, 2019 and September 6 & 7, 2019 at the Crown Plaza, Robinsons Galleria from 9am to 5pm.

What can you experience in the Master Class for Financial Advisers?

August 23, 2019

The need for a better advisor

Behavioral Finance

Level Up Sales

Strengths for Sales Professionals (with Val Baguios)

August 24, 2019

Investment Planning

Introduction to Stock Market (with Arnel Pepito)

Perspective of the High Net-worth Market (with Melvin Esteban)

September 6, 2019

Macroeconomics for Investors (with Dr. Alvin Ang)

Insurance Planning

Retirement Planning

September 7, 2019

Presentation Skills

Personal Branding

Social Media Marketing (with Garett Maralit)

The learning investment is only P19,800.00 and it covers full meals, Gallup Strengths Finder test and a certificate.

*Special Group rate: P15,800 per participant, minimum of 5.

Here’s how you can participate:

- Deposit the amount to BDO 006440069496 or BPI 0249111309 under John Randell Tiongson.

- Email a photo or screenshot of the deposit slip or transfer advise to michael@randelltiongson.com and indicate the following:

- Full name and nickname

- Company represented

- Years in practice

This Master Class has only limited slots available and we expect it to be filled up soon.

See you at the Master Class for Financial Advisors!