Is diversification difficult?

By Randell Tiongson on February 7th, 2019

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.

What does Investopedia (a favorite online site for investment stuff) say about diversification?

“A risk-management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

“Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated.”

Diversification is often misunderstood and its execution has always been a mystery to many. To many of us, diversification is just putting your money in different banks or buying different pieces of property in different areas. However, diversification is much more than that and here are some ways to diversify:

1) By asset class — Cash or near cash (savings or checking accounts, time deposits, treasury bills or money market accounts); fixed income (government securities, corporate bonds); equities (stocks); real estate (properties); collectibles (paintings, jewelry, etc.); enterprise (business)

2) By time frame — short term (about a year); medium term (up to about five to seven years); long term (over seven years)

3) By risk — conservative, moderate, high or speculative

4) By liquidity — highly liquid vs. non-liquid

Above are just a few ways to consider classifying your assets/investments regarding diversification. Here are some diversification tips: vary your asset classes; combine short-, medium- and long-term investments; combine highly liquid and non-liquid assets.

By practicing diversification, you are also practicing sound risk management. A properly constructed diversification strategy will minimize the risks of your investments and, at the same time, give you better yields as compared with taking an ultra-conservative position. With a good diversified portfolio, the risk of totally wiping out your wealth is highly unlikely, but at the same time, allow you to experience better growth which will be more than inflation.

But diversification also has its downside. Sometimes, a portfolio that is too diversified can also prevent you from earning properly, as the volatility of many of the players in your portfolio can cancel each other. However, having a very risk-averse position can be just as dangerous as taking a risky option, as inflation can erode the value of your wealth. The more prudent option then would be to learn diversification.

Do not be too afraid to try out diversification, it is not rocket science. Come up with a diversified program that is consistent with your investment objective, risk tolerance and time frame and you are on the road to achieving financial peace.

I really like the way the Bible talks about diversification. Yes, the Bible is a good source of investment wisdom and here’s proof: “But divide your investments among many places, for you do not know what risks might lie ahead.”—Ecclesiastes 11:2 (New Living Translation). Since the Bible advocates diversification, I am assured that it’s a great idea.

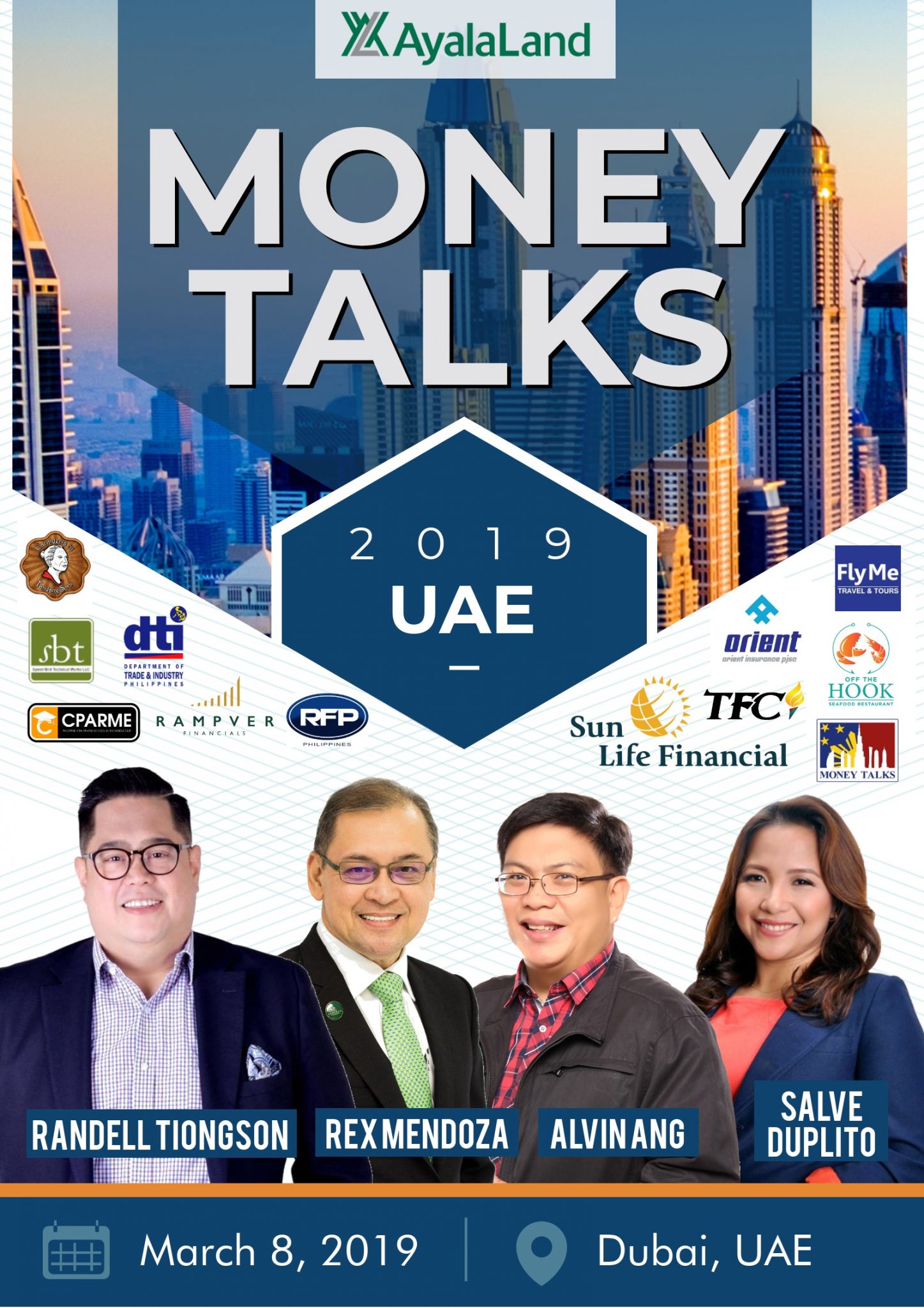

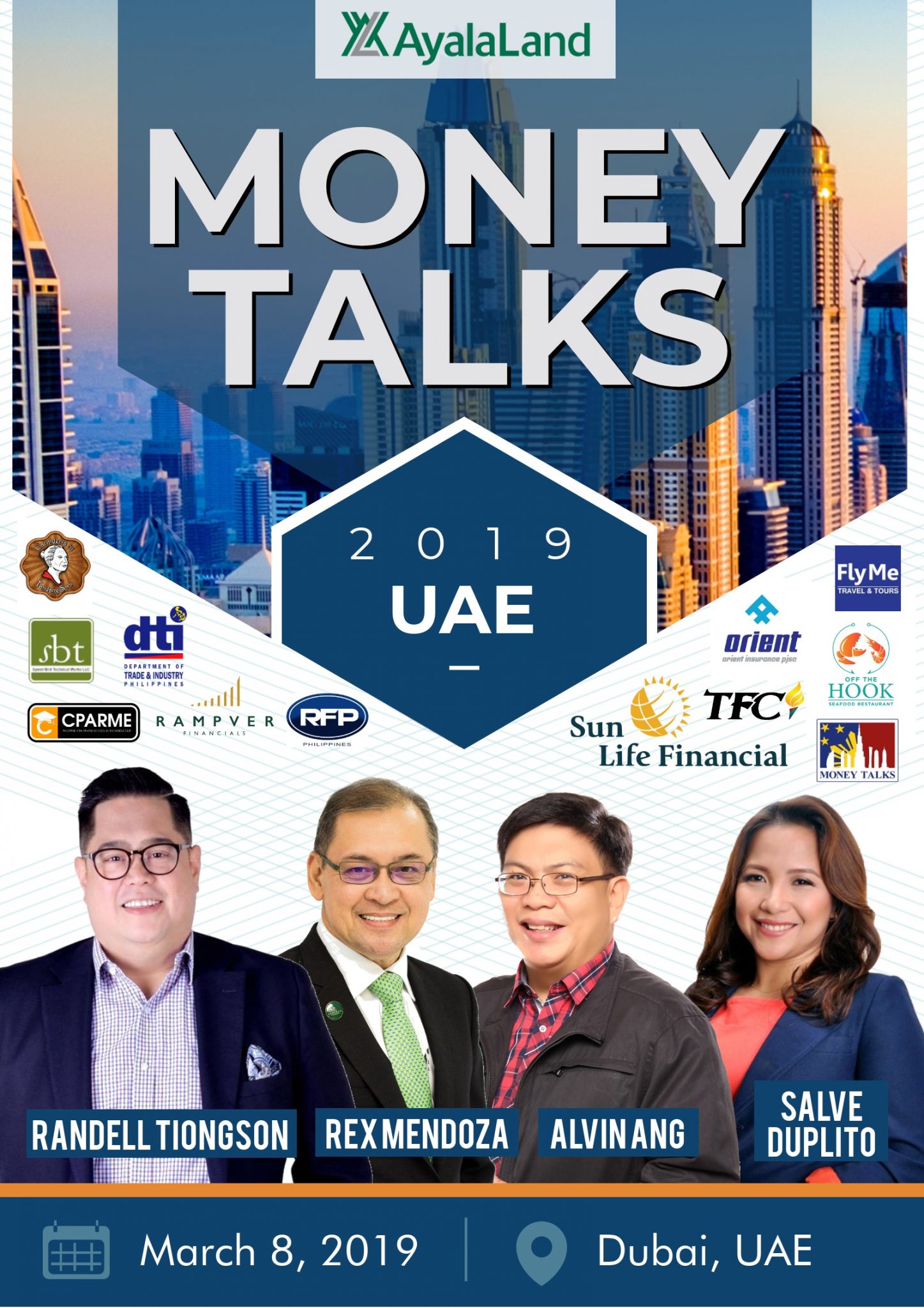

Catch me at my seminars for our Overseas Filipinos in the UAE and Japan this March and April 2019.

Registered Financial Planner Program UAE – www.bit.ly/RFPUAE2019

Money Talks UAE 2019 – www.bit.ly/MTUAE2019

Investing Insights Japan 2019 – www.bit.ly/investinginsightsjapan2019

When diversification does not work

By Randell Tiongson on September 7th, 2010

Readers of my work and those who attend my programs know that I am an advocate of diversification when it comes to investments. It is my view that diversification, when properly undertaken, is a great risk management technique and a truly prudent action. Many so called experts have argued that diversification limits real growth but many of its advocates would argue otherwise, this writer included.

However, there is one important area in our life when diversification is not only counter-productive, it is destructive – our faith.

A few weeks ago, I visited the beautiful home of a client. It was a nice place, well adorned and very functional – one that you would typically see in architecture magazines. However, there were adornments that caught my attention. In one corner, I saw a small altar with a crucifix displayed. On another part of the house stored some figures like Sto. Nino, Mother Mary and a saint or two. On another part of the house was bald and fat Buddha and a skinny bronze Buddha while on its opposite was some Chinese god of some sort and probably one that resembles Confucius. There were also some crystals that probably subscribes to some eastern pantheism or new age belief.

I have seen many houses like these and know of friends who live in those houses. I once asked a friend about the many idols in their home, and he was very coy in his answer… “para sigurado” (just to be sure)! Nice answer.

I respect the belief of others even if I do not agree with it. However, I also wonder about our commitment to our faith if we ‘diversify’ our beliefs. Some people I know genuinely believes in God and its trinity, yet they also subscribe to some other practices or beliefs because “wala naman mawawala” (we don’t loose anything). My view is simple, if I really belief in my God then I also believe in his glory and power, omniscient, omnipotent and all that. My logic will dictate that I should put my faith on Him and only Him; doing otherwise will be a contradiction of my own belief. If I contradict my own belief, that is also saying that I contradict my own self. Bible says it simply “You shall have no other gods before me.” (Exodus 20:3).

If I am to put my faith in my God, I will do so completely. If not, why believe in a god who you think is inadequate for you in the first place? My simplistic logic is this: if I believe that there is a super entity that created me and everything around me, I must believe in its power and glory completely. If I believe in such an entity, I must put my faith in Him and I must try to know Him as much as I can so that I may know what He expects of me. If He is an all powerful entity as I believe Him to be, then logic also tells me that I should not challenge his righteousness.

If you believe in God, get to know Him better. Best way to know Him is by praying to Him and reading His word, the Bible. As you get to know Him better, you will understand his infinitude nature with His unbelievable love for you.

Diversify your money but stick to one God. There is only one God.

Is diversification rocket science?

By Randell Tiongson on February 10th, 2010

Appeared at the Business Mirror, 02.08.2010

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.

What does Investopedia (a favorite online site for investment stuff) say about diversification?

“A risk-management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

“Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated.”

Diversification is often misunderstood and its execution has always been a mystery to many. To many of us, diversification is just putting your money in different banks or buying different pieces of property in different areas. However, diversification is much more than that and here are some ways to diversify:

1) By asset class—Cash or near cash (savings or checking accounts, time deposits, treasury bills or money market accounts); fixed income (government securities, corporate bonds); equities (stocks); real estate; collectibles (paintings, jewelry, etc.); enterprise (business)

2) By time frame—short term (about a year); medium term (up to about five to seven years); long term (over seven years)

3) By risk—conservative, moderate, high or speculative

4) By liquidity—highly liquid vs. nonliquid

Above are just a few ways to consider classifying your assets/investments regarding diversification. Here are some diversification tips: vary your asset classes; combine short-, medium- and long-term investments; combine highly liquid and nonliquid assets.

By practicing diversification, you are also practicing sound risk management. A properly constructed diversification strategy will minimize the risks of your investments and, at the same time, give you better yields as compared with taking an ultra-conservative position. With a good diversified portfolio, the risk of totally wiping out your wealth is highly unlikely, but at the same time, allow you to experience better growth which will be more than inflation.

But diversification also has its downside. Sometimes, a portfolio that is too diversified can also prevent you from earning properly, as the volatility of many of the players in your portfolio can cancel each other. However, having a very risk-averse position can be just as dangerous as taking a risky option, as inflation can erode the value of your wealth. The more prudent option then would be to learn diversification.

Do not be too afraid to try out diversification, it is not rocket science. Come up with a diversified program that is consistent with your investment objective, risk tolerance and time frame and you are on the road to achieving financial peace.

I really like the way the Bible talks about diversification. Yes, the Bible is a good source of investment wisdom and here’s proof: “But divide your investments among many places, for you do not know what risks might lie ahead.”—Ecclesiastes 11:2 (New Living Translation)

Since the Bible advocates diversification, I am assured that it’s a great idea.

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.