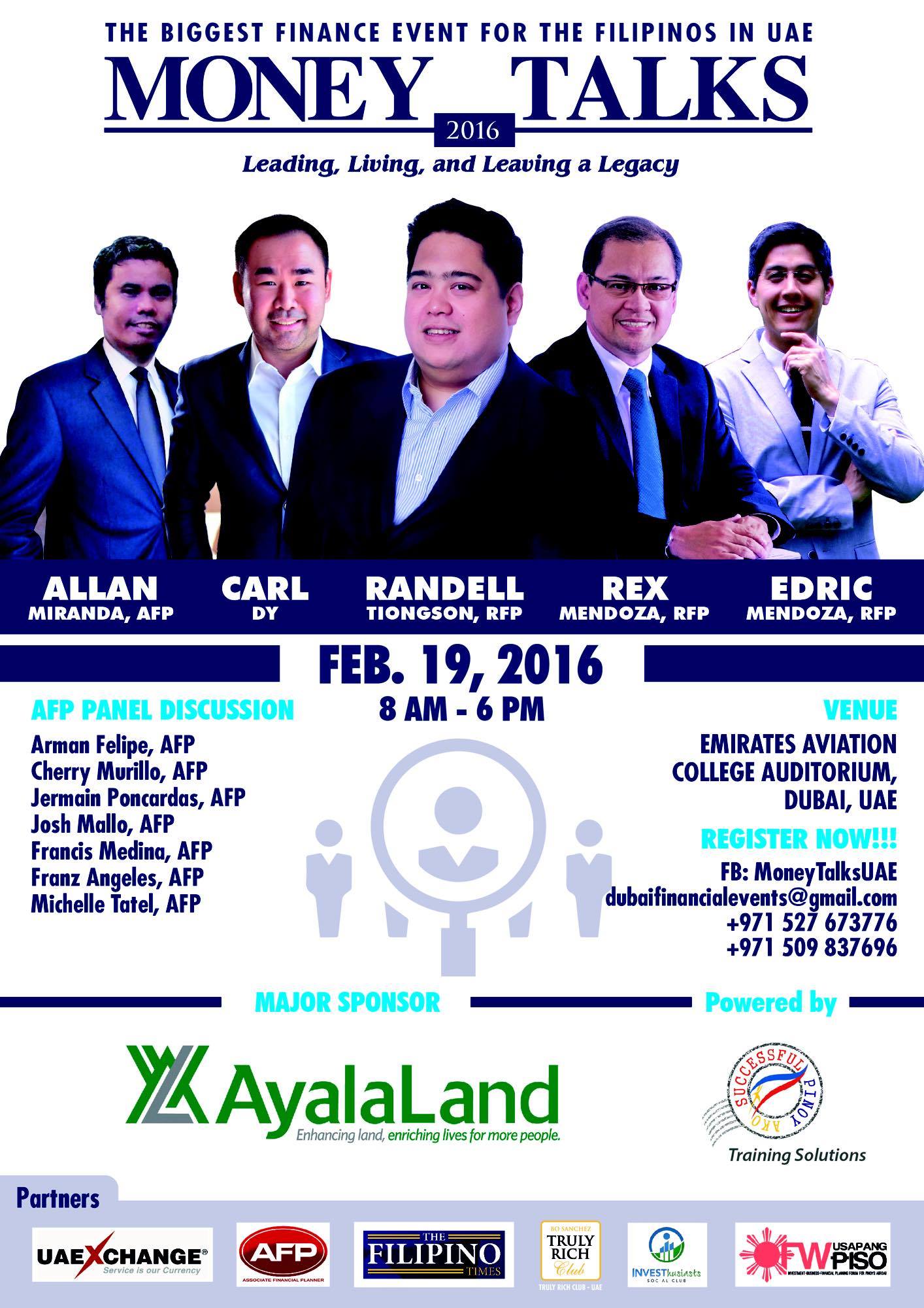

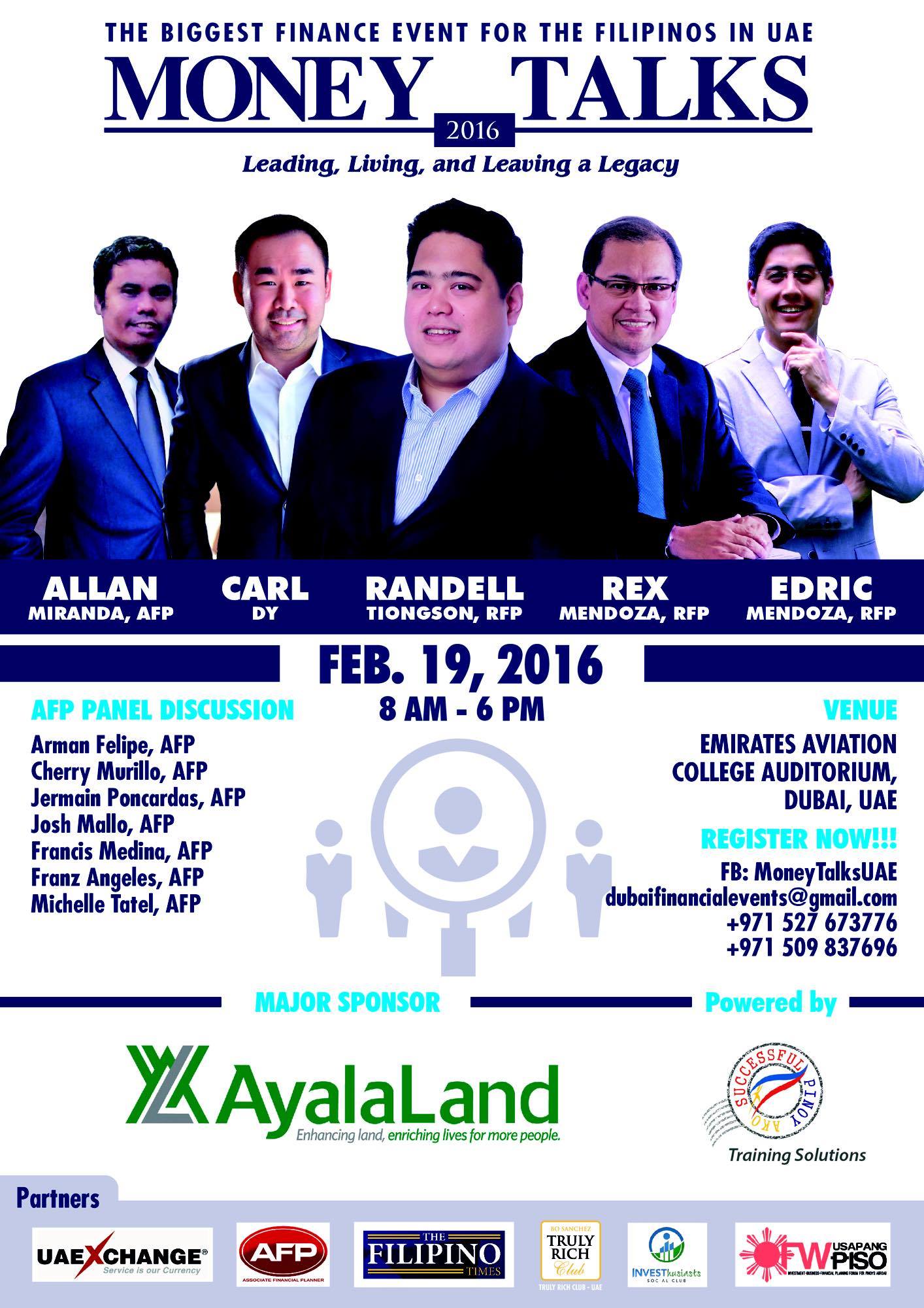

Money Talks UAE 2016

By Randell Tiongson on January 21st, 2016

On February 19, 2015, the Filipinos based in the United Arab Emirates will once again experience the biggest finance and investment conference for the FIlipinos in the UAE: Money Talks UAE 2016!!!

Money Talks UAE 2015 was our first attempt to provide our ‘kababayans’ in the UAE with a quality conference that is comprehensive and yet practical; informative and still inspiring… the goal is for the participants to be enabled and be empowered.

As the lead organizer of this conference, I am both proud and honored to share the stage with the individuals that are not only experts in their own fields, they are individuals who share my passion for financial education.

Joining me for this year’s Money Talks UAE are:

Rex Mendoza, RFP — Currently the CEO of Rampver Financials, one of the Philippines’ largest and most dynamic distributors of mutual funds and other financial services. Rex Mendoza was formerly the CEO of Philamlife, a subsidiary of AIA and one of the largest financial services company in the Philippines and globally. He was also the former head of sales of Ayalaland and formerly the President of Ayalaland International Sales Inc. He sits in the board of many organizations such as Alveo, Globe, among others. He is one of the esteemed mentors of Truly Rich Club.

Edric Mendoza, RFP – He is the lead anchor of ANC’s On The Money, a daily finance show that has been a trailblazer in finance media in the Philippines. Edric is one of the fastest rising finance personalities in the country and he has the knack of making people understand difficult concepts of finance. Close to Edric’s heart is family finance and raising the next generation to be money wise and with the proper values.

Carl Dy – Carl is one of the country’s most sought after speaker and resource person with regard to real estate investing. Carl has many years of experience with the real estate industry and currently the CEO of Spectrum Investments. Carl has been going all over the Philippines and many other countries to enlighten Filipinos on the proper way to grow wealth using property investing. He is the author of a booklet that has helped many people earn from their property investing through renting.

Allan Miranda, AFP – An OFW who is a living testimony on how to financial education can totally empower and enable someone while working abroad. Allan is currently working as an engineer in Dubai and yet he has made headways as an entrepreneur both in the Philippines and in the UAE. He is also very active in the education of many Pinoys in the gulf and one of the reasons why many OFWs are now experiencing financial freedom.

Aside from the distinguished line up of experts, it is with great pride and honor to feature our panel of Associate Financial Planners who have been making waves as exemplary OFW finance advocates. The panel will showcase how the AFPs are enjoying their journey towards financial enablement and at the same time doing their part in educating and encouraging other OFWs to do the same. They are: Arman Felipe, Cherry Murillo, Cherry Poncardas, Josh Mallo, Francis Medina, Franza Angeles and Michelle Tatel.

The event will be held at the Emirates Aviation College Auditorium in Dubai and will run from 9am to 5pm.

To register for the conference, click HERE or send an email to [email protected] or call +971 527 673776

Associate Financial Planner Program in La Union

By Randell Tiongson on November 6th, 2015

If you are from La Union and you are serious about financial planning, it is time for you to be certified! Join the first ever AFP certification program in La Union.

Joining me for this program is the country’s in-demand Stock Market advocate, Marvin Germo.

The 2-day comprehensive program will discuss the following:

- Personal Finance

- Behavioral Finance

- Insurance Planning

- Time Value of Money

- Investment Planning

- Stock Market Basics

Participants of the program will be awarded the AFP designation upon passing the required examination after the program. The AFP designation is being issued by the Registered Financial Planner Institute, the country’s largest and most distinguished financial planner designation institution.

If you are interested to enroll in the program, please get in touch with Jessamine at 0949-4661818. Limited slots only.

The story of a finance advocate in Qatar

By Randell Tiongson on September 1st, 2014

In 2013, a group of dedicated finance advocates took an extensive financial planning program and a comprehensive examination that allowed them to be certified as Associate Financial Planners. Here’s a post by one of the distinctive graduates of the program. She is not only a dedicated advisor, she is also a dedicated advocate who has helped a lot of OFWs in Qatar become financial enabled. I am proud to share the story of my good friend Ellen Labastida!

—————-

AFP Graduate Personal Story

“It’s not what you earn, it’s what you keep”

I have come to grasp the reality of old adage “It’s not what you earn, it’s what you keep” six years ago, during the 2008 global financial crisis that hit the big financial institutions, banks, governments, stock markets around the world and of course our family.

At the start of 2006, a 300 sqm. lot compound with two modest houses in it was offered to us for half a million, so we grab the opportunity. A year later, we bought another lot offered to us. Back then, I and my husband were in Dubai, working hard for the money and spending hard too. We acquired those properties through a bank loan in Dubai that my husband has taken for a repayment scheme of five years. He had several credit cards too because it is easy to receive one (I don’t have any as he has too many for our use). For credit cards in Dubai, the bank agents will chase you and apply for you without difficulty, all you need to do is say yes to the agent, comply few documents and voilà: you suddenly need a bigger card organizer for your wallet.

My husband has a good paying job as an engineer and he moved from one company to the other as opportunities to get higher salary were ample. Then financial crisis of 2008 came, the time when our spending hit high. The real estate and construction industry took the beating; there were massive suspension of projects and layoffs. It was October, a month after we took the car loan, my husband and 90% of his entire colleague engineers in the same department all got termination letters in one day. They were ordered immediately to hand over IDs, laptops, security pass, company phones and sign the redundancy letters and asked to leave. The end of service benefit was fair enough to sustain the family expenses for three months, this without considering the loans and credit cards of course!

The certainty of loss began to sink and I started to feel dreaded fear. Unemployment in the construction industry was so high that my husband’s competitors for some of the job interviews were used to be his seniors in the work place. I used to contribute 40% from our combined income and was confronted with the problem where would we get the remaining 60% in order to pay our debt obligations, remittance back home and our expenses. The agony has taken its toll on our relationship, so stressful that it took me countless sleepless nights crying. Yet I have to be strong for my husband as he was counting on me to understand the full scope of our situation. If it was difficult for me, it was more difficult for him as a man and as the main bread winner. No job opportunity, emergency fund exhausted, two huge loans, several credit cards and a family to feed.

He found a job that would separate us physically. He was assigned in Doha, Qatar as mainly no projects running in Dubai. We have to deal with the physical separation and for the next two years, my budget list every month was consisting mainly of paying off the debts. Every payroll means going to banks to deposit our hard earned money ironically into our savings account but only to be taken away immediately. We have agreed to drastically cut our individual food trips to the restaurants, box office cinemas, gadgets, jewelries and no more sale purchases except for food and basic groceries. These were two agonizing years of pure payments.

Being alone, I started reading financial e-books. I was inspired by financial author Dave Ramsey’s advice on getting out of debt – snowballing. We took the strategy and knocked off smaller balances first and every time I removed a bank name from my excel list, I always feel a bit closer to freedom!

After two years of paying debts off, my husband could now afford to travel few times in a year to visit me in Dubai, the same period we attended financial literacy seminar through our friend. The trainings indeed made a profound impact on our lives and finances. We learned the 70-10-20 prosperity formula in managing our income and how to establish the solid financial foundation. We learned the X curve concept of responsibilities as against savings, the rule of 72(compounding interest) and investing. We have faithfully structured our finances and built solid emergency fund at last. For the next four years, we were able to increase and diversify our savings and investments. We have our plans written on paper and keep ourselves in the associate of really positive, inspiring and investment savvy people. Finally, I was able to join him in Doha with our kids!

We embrace the advocacy and share our experience with OFWs through the Overseas Filipino Investors and Entrepreneurs Movement- an OFW association accredited by the Philippine Embassy in Doha, Qatar.

To solidify our cause, we studied and acquired financial planning accreditation through RFP’s Associate Financial Planner Program brought for the first time outside the Philippines. We were amongst the historical international first batch. The AFP course made me understand more that we cannot change our financial challenges in the past but because of it, we were able to determine that behavioral change is the key solution to many of OFWs financial problems.

We learned that there are also three basic things we should consider essential for financial planning – 1. Money 2. Self-discipline 3. Right information. It would be pointless if you will not balance these three. You may have the money, but lacking self-discipline will lead you nowhere but struggling. You may have both the money and self-discipline but no right information may lead you to either scammers or become a flat liner fiscally.

We learned the hard lessons and we believe God always have his miracle hand in our life as He taught us to become in control with our finances. We were humbled and God was only our anchor during those difficult times. Whenever we need something, it is beyond my understanding how we were able to sustain it, only I know He answered our prayers. In those two years, He taught us the value of patience; discipline and become responsible stewards of His blessings. To this day, we speak of our past and share it so others may learn.

While a lot of people six years ago were pointing their blaming finger to the Lehman Brothers for the situation, we held ourselves accountable. You may wish Lehman Brothers have sisters perhaps to suggest a different history but that part of world history has put me and my husband into the right perspective. Our ultimate message for OFWs in debt – no matter how unsure you will be in keeping your head above water, there’s always a way out and running away from debt is not one of them. Start with a behavioral strategy, stick with it and develop the habit.

Indeed it is not about how much you earn, it is how much you keep and where you keep it.

————–

Be part of the next AFP-certified Filipinos in the Middle East:

Two-day certification course

Doha, Qatar: Oct. 3-4, 2014. for inquiries: [email protected]

Dubai, UAE: Oct. 10-11, 2014. for inquiries: [email protected]

————–

Ellen B. Labastida

Certified Associate Financial Planner – RFP Institute

Certified Financial Educator – Heartland institute of Financial Education, Colorado, USA

OFIE-M advocate, trainer

Pinoywise International trainer