Inflation simplified

By Randell Tiongson on June 16th, 2014

A recent report has pegged the Philippine inflation at 4.5%, quite a high number which caused a lot of concern for many. My friend & respected economist Dr. Alvin Ang says that the inflation is mainly due to increasing food prices which can be partly blamed on Typhoon Yolanda. The government is unfazed with the high inflation number and are still confident that they can keep inflation within acceptable limits. There are talks that interest rates might go up as a means to control inflation.

Just what is inflation? Investopedia defines inflation as “the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum.”

Just what is inflation? Investopedia defines inflation as “the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum.”

Someone asked me what inflation is and how it can affect them? Let me answer in a more practical way — simply put, inflation is a measure being used to track the rising costs of general goods and services. Because of inflation, the purchasing power of our peso will actually deteriorate. Countering inflation is done through an increase in income– as long as the increase in income is equal or higher than inflation, things will be ok. The case for your savings is a different one. If your savings do not appreciate faster than inflation, the real value of your savings will go down in terms of what goods and services it can buy. The solution to this is investing your money where it can grow faster than inflation.

Now, where can you invest your money where it can grow faster than inflation? Typically, stocks or equity-laced funds (mutual funds, UITF & VUL) and real-estate are good investments that will can outperform inflation in the long run — emphasis on the long run… meaning, in the long-term…. as in after many, many years. When investing for long-term objectives like retirement, be mindful of inflation.

Attend RETIRE 2014, the comprehensive retirement planning workshop on July 23, 2014. Details HERE.

From Spenders to Investors

By Randell Tiongson on May 7th, 2014

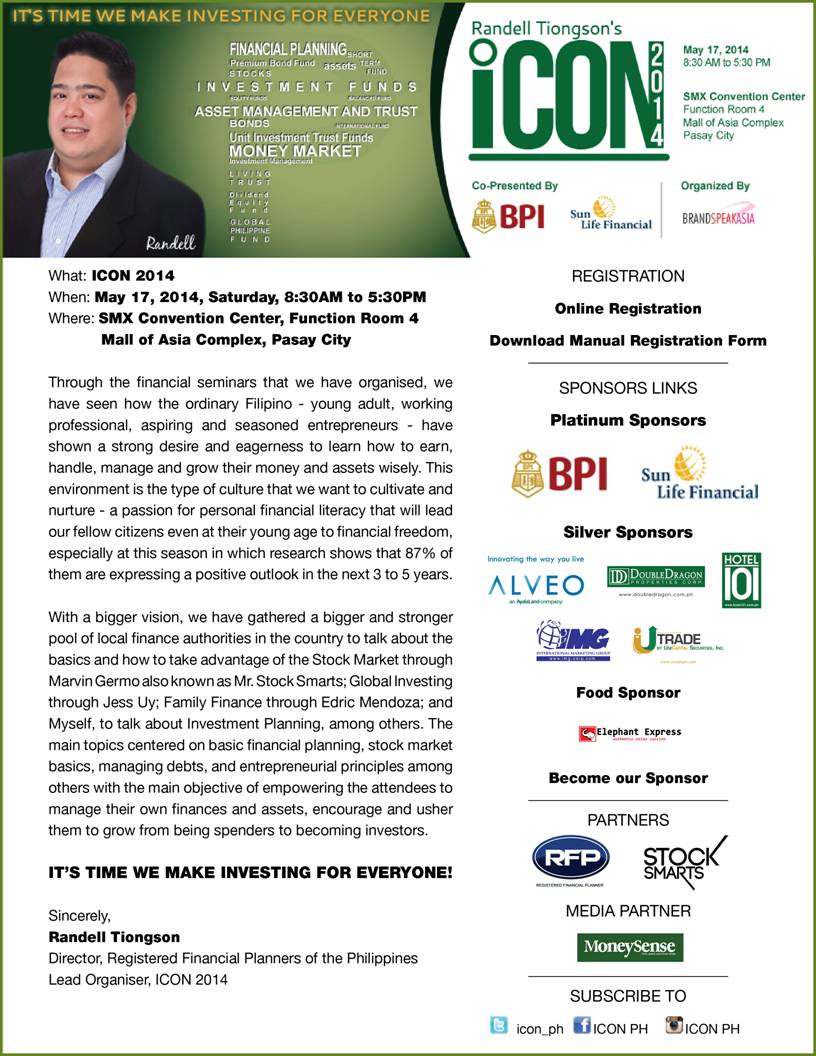

Do not miss the life-changing conference that will help transform Filipinos from Spenders to Savers and ultimately to INVESTORS!

iCon was a long dream of mine because I yearned for the time where more and more Filipinos will be interested in investing for their future. I longed for the day to see long lines of people queuing to enter a financially themed event, the way they do for a block-buster movie. In 2013, the first iCon proved that Filipinos are more receptive to learning finance and investments as 1,000 people flocked to the very first iCon. I was overwhelmed with the site of 1,000 people all eager to take better control of their financial future.

This year, despite the difficulty of mounting an even bigger event, we felt that the Filipinos need an iCon again so we put together even more speakers and an even longer conference time for those attending iCon2014. Our roster of speakers are impressive as they are indeed the subject matter experts of their own fields. However, it is not just the competence of the speakers that made them part of iCon2014 — it is their passion to help Filipino achieve their dreams!

For inquiries and registration, visit http://www.brandspeakasia.com/iconor send an e-mail to icon@brandspeakasia.com

2014 Outlook, part 5

By Randell Tiongson on January 13th, 2014

It is both an honor and privilege to be presenting the views of one of the most respected economist of the country and a very dear colleague, Dr. Alvin Ang. I always run to Dr. Ang for help in anything that deals with economics and he has always been there to help. Aside from being a well respected economist, Dr. Ang’s heart to help uplift the nation is something I have always admired.

The 2014 Outlook of Dr. Alvin P. Ang, Ph

The Philippine Economy in 2014: Bring in the Good out of the Bad

2013 will be one for the history books for what transpired in the Philippines. The economic performance that outpaced the rest of ASEAN probably grew 7% in 2013. Backed by the investment upgrades of the major ratings agency, the economic performance helped push equities to all time highs until the middle of the year. Nonetheless, these good reports were soon crowded by external pressures led by the quantitative easing plan by the US Fed and various internal man-made and natural disasters. All told, strong typhoons hit the north and central areas coupled with the strong earthquake. The Zamboanga incursion and the PDAF issue are big man-made disasters that also barreled through.

Did the bads cancel out the goods? It is very unlikely that the Philippines will reverse its current upward economic growth trend. The reason for this are as follows:

Firstly, the momentum for growth has pushed strong domestic capital formation. Private sector is building and expanding capacities for production. This is validated by the above 5% growth in durable equipment for the last 8 quarters. This is confirmed by robust growth in manufacturing which (contributes to about 20% of GDP) is also experiencing a similar above 5% growth in last 8 quarters. The rebound of the US (our largest trading partner) and the becoming expensive China open good opportunities to support export growth. similarly the growth in support services in the BPO, tourism and private construction sector will be modest but will continue to be robustly close to the higher single digit.

Second, the impact of the disasters will push public sector expenditures to even higher levels. Public construction, in particular, is now at 1/3 of private construction. In the past, it hardly reached 1/5. This will probably be higher in next 3 to 4 years as the reconstruction requirements of the affected regions will require strong government support. Furthermore, public services expansion in the form of education, health and basic social support to reconstruct human capital formation. This is already seen in the approved supplemental budget for reconstruction in 2014. Pressures to ensure proper usage of these funds will make the national budget much more efficient and put to direct use. Likewise, all forms of aid from international and local sources will continue to come in phases providing additional fund base.

Thirdly, budgetary reforms including the direct use of the approved budget will facilitate expenditures. Moreover, the investment upgrades will allow the country to access the international funds market easily for additional budgetary support. This is now starting with the launch of the 10 year Philippine Global Fund.

Finally, the OFW remittance will remain as the robust financial support for sustained personal consumption expenditures. On the monthly basis, the remittances has breach the USD2Bn in October 2013. For full year 2013, this has probably reached more than USD22Bn or a growth of above 5%. Remittances also is seen to increase to support private reconstruction efforts as anecdotally observed last November – December of 2013 and in previous disasters. This should help lead to a remittance growth of about 7% pushing it to USD 24 Bn this 2014. All told, these conditions are seen to help push 2014 GDP growth to a low of 7% and possibly to a higher 7.5% as all these go full steam.

The main concern apart from the challenges out of reforms is the physical impact of the disasters. These have brought damage to agriculture which is connected to food prices which in turn could lead to inflationary pressures. Coupled with the looming increase in electricity rates, households may experience upward price pressures.The quantitative easing also shows that there will be less dollars in the economy than before which depreciate the peso to about 45 to 1. This is good for OFWs and exporters but could also lead to higher prices particularly of imported inputs. Finally, a lot of funds out of the SDA are still in the system and not finding their ways to productive pursuits. These could challenge the relatively low inflation rate regime we have been experiencing and consequently the low interest environment. However, we do not see inflation beyond 5% unless significant supply constraints occur in food and electricity.

While GDP growth for 2014 will likely remain at around 7%, price pressures may cause equities to move tentative and upside potential for interest rates for this year. However, more than the price pressures is the opportunity to improve the disaster affected regions. These have continuously been high poverty and low productivity areas. If the reconstruction is done right – it will be good for long term growth. Overall, the growth story will be the same but the critical factor is its sustainability and inclusivity. A growth that is able to expand its base will certainly be better than a one time event. Investing in the Philippines is believing that its growth potential is becoming broader and larger segments are benefiting. At this perspective, its present value is still quite affordable.

Blessings for a great 2014 and beyond!

Alvin P. Ang has more than 20 years of professional experience in both public and private sectors. He started his Economist experience with the National Economic and Development Authority (NEDA) of the Philippines where he developed his skills in Development Planning, Policy Formulation and Analysis. He also worked in Investment Research and Economic Forecasting with his stints at the Philippine National Bank and All Asia Capital as Chief Corporate Planner and as Economist, respectively. Within those periods, he has been teaching part-time at the University of Santo Tomas in Manila. In 1999, he joined the academe as full-time Faculty member after completing his Master in Public Policy at the National University of Singapore as a Scholar of the Singapore Government. He went on to complete his Ph.D. in Applied Economics at Osaka University in 2006 as a Japanese Government Scholar. He has published in renowned journals such as the Review of Development Economics, Asia Pacific Social Science Review, among others. His research fields are in Labor and Development Economics and his research interests include Privatization and Development Finance. His researches on Remittances and Economic Growth in the Philippines have been widely circulated. He has also consulted for the World Bank, World Health Organization, the European Union, Asian Development Bank, International Labor Organization and the USAID on policy matters. He recently won the first prize (together with Jeremaiah Opiniano) in the Outstanding Research for Development in the 2011 Global Development Awards (besting 400 entries worldwide) held in Bogota, Colombia. He is a lifetime member of the Philippine Economics Society where he currently the President. He is an advocate of responsible personal finance and has lectured on this topic in many fora. Presently, he is a Full Professor of Economics at the University of Santo Tomas.

Alvin P. Ang has more than 20 years of professional experience in both public and private sectors. He started his Economist experience with the National Economic and Development Authority (NEDA) of the Philippines where he developed his skills in Development Planning, Policy Formulation and Analysis. He also worked in Investment Research and Economic Forecasting with his stints at the Philippine National Bank and All Asia Capital as Chief Corporate Planner and as Economist, respectively. Within those periods, he has been teaching part-time at the University of Santo Tomas in Manila. In 1999, he joined the academe as full-time Faculty member after completing his Master in Public Policy at the National University of Singapore as a Scholar of the Singapore Government. He went on to complete his Ph.D. in Applied Economics at Osaka University in 2006 as a Japanese Government Scholar. He has published in renowned journals such as the Review of Development Economics, Asia Pacific Social Science Review, among others. His research fields are in Labor and Development Economics and his research interests include Privatization and Development Finance. His researches on Remittances and Economic Growth in the Philippines have been widely circulated. He has also consulted for the World Bank, World Health Organization, the European Union, Asian Development Bank, International Labor Organization and the USAID on policy matters. He recently won the first prize (together with Jeremaiah Opiniano) in the Outstanding Research for Development in the 2011 Global Development Awards (besting 400 entries worldwide) held in Bogota, Colombia. He is a lifetime member of the Philippine Economics Society where he currently the President. He is an advocate of responsible personal finance and has lectured on this topic in many fora. Presently, he is a Full Professor of Economics at the University of Santo Tomas.

Just what is inflation? Investopedia defines inflation as “the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum.”

Just what is inflation? Investopedia defines inflation as “the rate at which the general level of prices for goods and services is rising, and, subsequently, purchasing power is falling. Central banks attempt to stop severe inflation, along with severe deflation, in an attempt to keep the excessive growth of prices to a minimum.”