Investment guide for different life stages

By Randell Tiongson on July 26th, 2019Once you get a job and start earning money, that’s the time you should begin sorting your finances and thinking about where you can invest your money to grow. Whatever stage of life you are in right now, there’s a type of investment vehicle perfect for your current financial situation and goals.

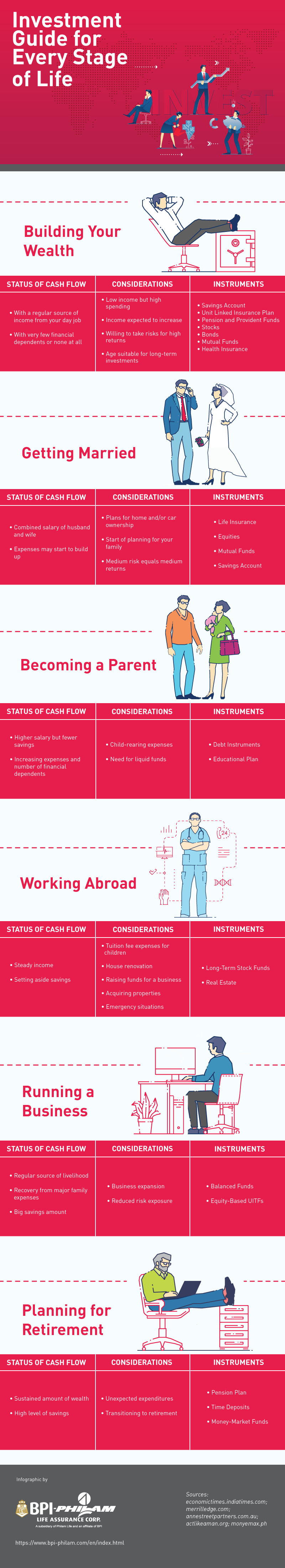

As you move from one life stage to the next, your goals, financial status, expenses, and priorities change. For instance, as a young employee, you’re goal is likely to start building your wealth. When the time comes that you get married, your goals begin to shift and expand—your expenses start to grow, you begin planning for home ownership, and open a joint savings account with your better half.

For many people, evaluating and creating an effective investment strategy can be a bit overwhelming. It’s a lot to take in, but what’s a little strain for a secured future? Whether you’re looking at family insurance or a unit-linked insurance plan, there are various instruments you can choose from to get started with investing.

To help you find the suitable investment option based on your financial goals and state right now, here’s a visual guide I got from BPI-Philam that breaks down each life stage’s cash flow, considerations, and investment instruments you can ponder on. Hope this helps you build your investments wisely!