5 Tips for 2017

By Randell Tiongson on January 1st, 2017

Firstly, allow me to greet everyone a Happy New Year! My prayer is that 2017 will be a great year for you and me.

People always think of having New Year’s resolutions at this time – some will come up with new ones while many will revisit old ones. Personally, I think New Year’s resolutions are great because it allows us to focus and look forward. The challenge is the discipline it involves until those resolutions come to fruition.

Allow me to share my 5 tips for 2017. Since I am a personal finance advocate, you will see that most of my tips will be related to money so here goes:

1) Review you cash flow and create your budget. I know you have heard this time and time again and I have also said this time and time again. But, when it comes to helping you achieve your goals, your budget and cash flow is your most important and a very critical. Learn how to allocate your funds properly but be practical as well. Some people will come up with a budget plan that is ‘too good to be true’ which will only look good on paper but very difficult to execute. You know yourself the most, so create a budget that you can follow. As you create your budget, make sure that having savings is your ultimate goal.

2) Start or increase your equity investing. Due to the massive correction of the stock market in 2016, it is an opportune time to accumulate good quality stocks or equity laced mutual funds, unit investment trust funds (UITF) or variable universal life insurance (VUL). There are good bargains among some quality stocks which you may want to invest in, or you may opt to invest via pooled equity funds (mutual funds, UITF, VUL). If you are not sure if buying stocks or buying funds is for you, read here.

3) Start that business that has been brewing in your mind for a long time. The Philippine economy will continue to grow in 2017 and that will continue to bring entrepreneurial opportunities. You don’t need to quit your job to start a small business, what is important is that you start. Make sure that you do enough study before you actually start your business. If you are wondering if you should be an employee or an entrepreneur, read here.

4) Get a skills upgrade. It is always wise to focus on learning and 2017 is a great time for you to do so. Why? Competition is becoming more and more fierce! Our economic growth has ushered much opportunities but it also made the battlefield more intense. Mediocrity will kill all of us, now more than ever. Attend more seminars, read more books, listen to more podcasts, watch more educational videos and find a mentor or two. The more you focus on building your skills, the better your financial future will be (assuming you know how to handle your money). You may want to start the year right and learn from Francis Kong. Visit www.successoptionsinc.com for details.

5) Be generous. Regardless of your situation, being generous is a good idea. Why? “The generous will prosper; those who refresh others will themselves be refreshed.” Proverbs 11:25, NLT. “And I have been a constant example of how you can help those in need by working hard. You should remember the words of the Lord Jesus: ‘It is more blessed to give than to receive.’” Acts 20:35, NLT

Have an amazing 2017 and it’s time to be a new creation!

10 Things to do with your 13th Month Pay

By Randell Tiongson on November 7th, 2016

QUESTION: It’s almost the end of the year, and I’m excited for my 13th month pay. I plan to use it to buy Christmas gifts for my family and friends, but I know I’m not supposed to spend all of it. What are the best ways to use the extra money?—Emily via e-mail

Answer: Ah, yes—the 13th month pay. For others, it even reaches the 15th month. That’s one to three months’ salary. There’s a lot you can do with the money, such as use it to buy Christmas presents, but I strongly suggest that you not spend it all. Aside from saving a part of the money, below are 10 things you can do with your 13th month pay:

1) Remove it from your payroll account

You probably have a question mark on your face, until you realize that inflation is eating up the value of your money. Unless you have P1 million in your account, you’re only earning 0.25 percent in interest yearly versus the 4 percent inflation rate in the Philippines last 2014. Withdraw a portion of your money from your payroll account and put it into higher-yielding accounts such as time deposits or investment accounts.

2) Plan and allot

According to research from the National Endowment for Financial Education, roughly 70 percent of people who come into windfalls end up broke within seven years. This is because they aren’t used to managing a large sum. Before you spend your 13th month pay, plan how you’re going to use it. Set a specific percentage which will go to savings, investments, and debt payments among others.

3) Increase your emergency fund

If you don’t have an emergency fund yet (roughly three to six months of living expenses), allocate a portion of your money to building one. This fund prepares you for unforeseen expenses such as emergency health costs, a sudden home repair, and even a job loss.

4) Build up your retirement fund

Your retirement fund is different from your emergency fund. Where the latter protects you from unforeseen events in the near future, your retirement fund prepares you for the more long-term future. As mentioned a while ago, remove the money from low-yielding accounts such as your savings or checking account, and put it in higher-yielding accounts such as investments.

5) Invest

There are many investments to choose from — mutual funds, unit investment trust funds (UITFs), stocks, variable universal life insurance and real estate to name a few. Your choice will depend on your risk tolerance. Whether you’re investing in mutual funds or the stock market, you’re sure to beat the 0.25 percent inflation rate of savings and checking accounts.

6) Pay off debt

Speed up your debt payment timeline and use a part of your 13th month pay to pay your debts, be it credit card debt, personal loans, car monthly payments, or what have you. Remember that the interest rates on these debts are sky high—it’s 3.5 percent a month for late credit card payments —so use the small windfall to tackle high-interest debt.

7) Important repairs

Your home may need a few repairs. For this, it’s best to resolve these sooner rather than later.

Taking preventive rather than corrective measures may save you big bucks in the future. If you put off repairing a plumbing leak, you may end up spending big bucks when your flooring or walls are affected by the leak.

8) Fund a fund

Whether it’s your travel or shoe fund, you can set a portion of your 13th month pay to fund items or experiences you’ve been saving up for.

If you love to save, you may have forgotten to treat yourself. You probably don’t remember the last time you went on a vacation or treated yourself to a nice dinner out. You deserve some relief from time to time, so set a portion to ramp up any ‘fun’ funds you have.

9) Spend on yourself

Related to the above, it’s hard to penny pinch all the time. It’s important to prepare for your future, but it shouldn’t be at the expense or to the detriment of your present self. Decades down the road, when you’re reliving your younger years to your grandchildren or to your friends during your university’s 50th-year reunion, you don’t want to stand on the sidelines without anything to say. Once you’ve made sure you’ve saved up for your future self, treat your present self to something nice. To have an easier time managing your ‘fun’ money from your savings or retirement fund, have separate accounts depending on what you’ll use the money for.

10) Bless others

Last but definitely not the least, share your blessings with others. Whether it’s donating to your local church or a cause you feel strongly about, never forget to give back. This develops the core value of sharing wealth with others in need and teaches you to appreciate the material goods you have. It’s also a reminder of stewardship and that money is really the Lord’s—we are merely managers.

There are many ways to use your 13th month pay. The bottom line is proper money management. Money is not a means to an end; it’s a vehicle for us to do what we want—whether it’s living a comfortable retirement or going on the vacation you’ve always dreamt of. When you receive your 13th month pay, don’t spend it all in one go. Budget and plan it, and if you can, share it.

“The wise have wealth and luxury, but fools spend whatever they get.” (Proverbs 21:20, NLT)

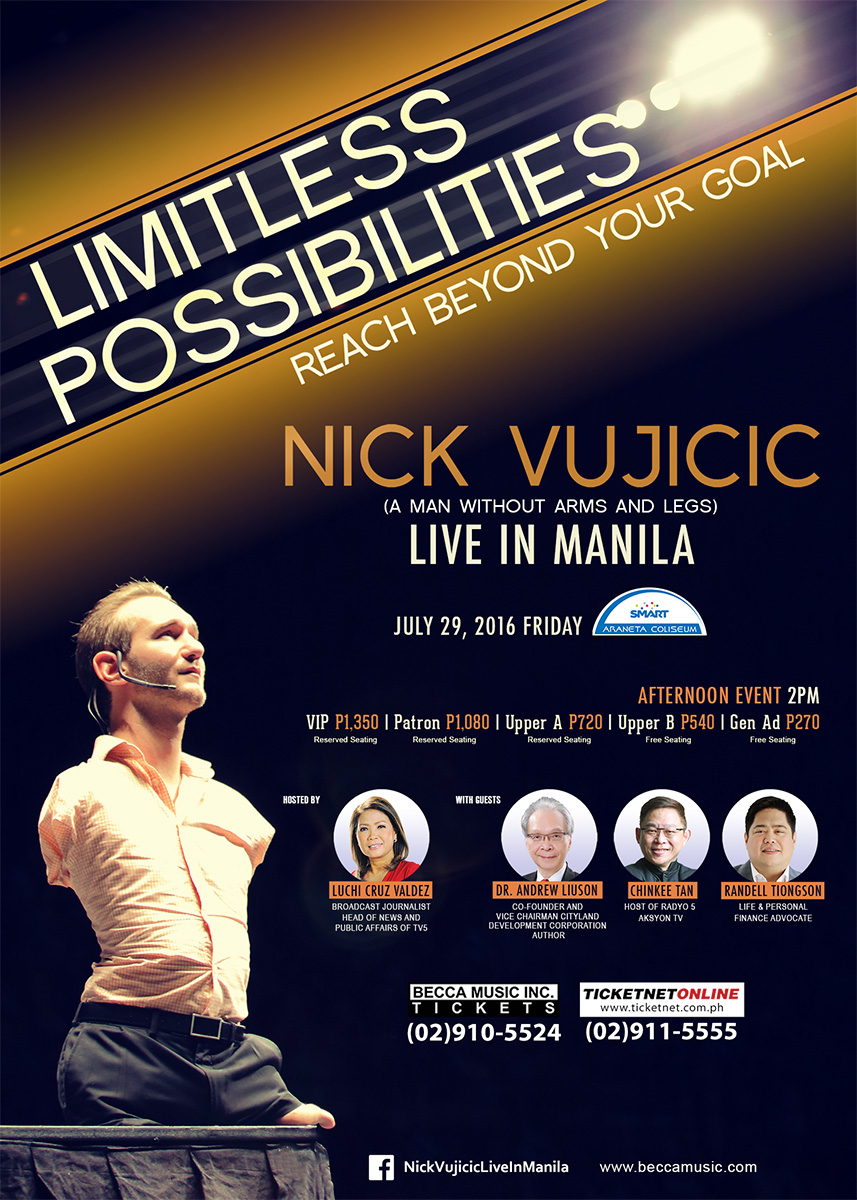

Nick Vujicic returns to Manila!

By Randell Tiongson on July 6th, 2016

Great news! One of the world’s most admired motivational and inspirational speaker will be returning to Manila again, Nick Vujicic!

Nick Vujicic has been inspiring millions of people all over the world, giving them hope and pushing them people to embrace that life has so much to offer.

I had the privilege of being an ‘opening act’ for him during his first visit here sometime ago. I will be part of his event once more on July 29, 2016 at the 2pm event in Smart Araneta Coliseum along with Chinkee Tan, Dr. Andrew Liuson and Ms. Luchi Cruz Valdez.

To know more about the event and how to buy tickets, visit HERE