Everyday Moneyfesto now available

By Randell Tiongson on November 29th, 2015

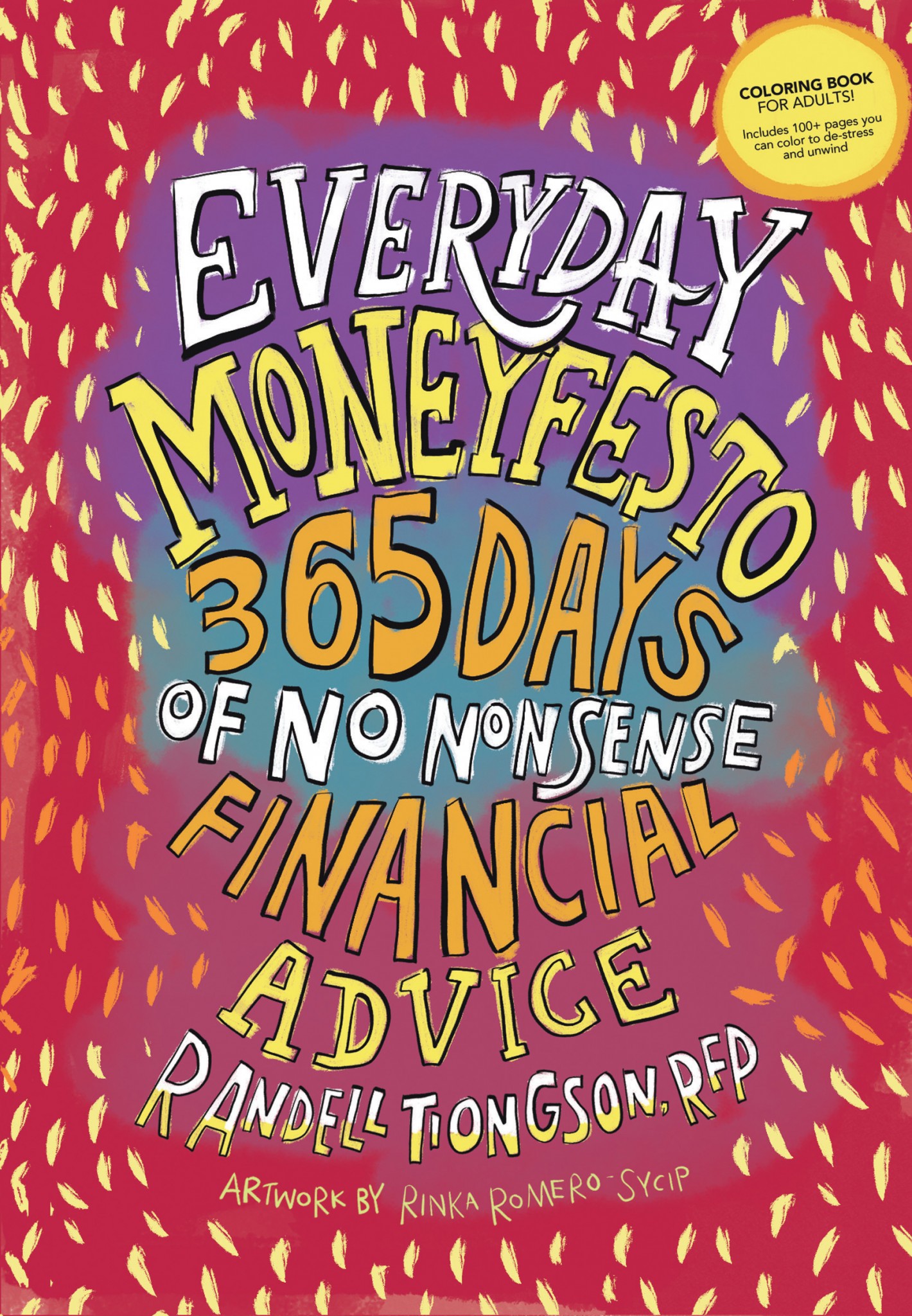

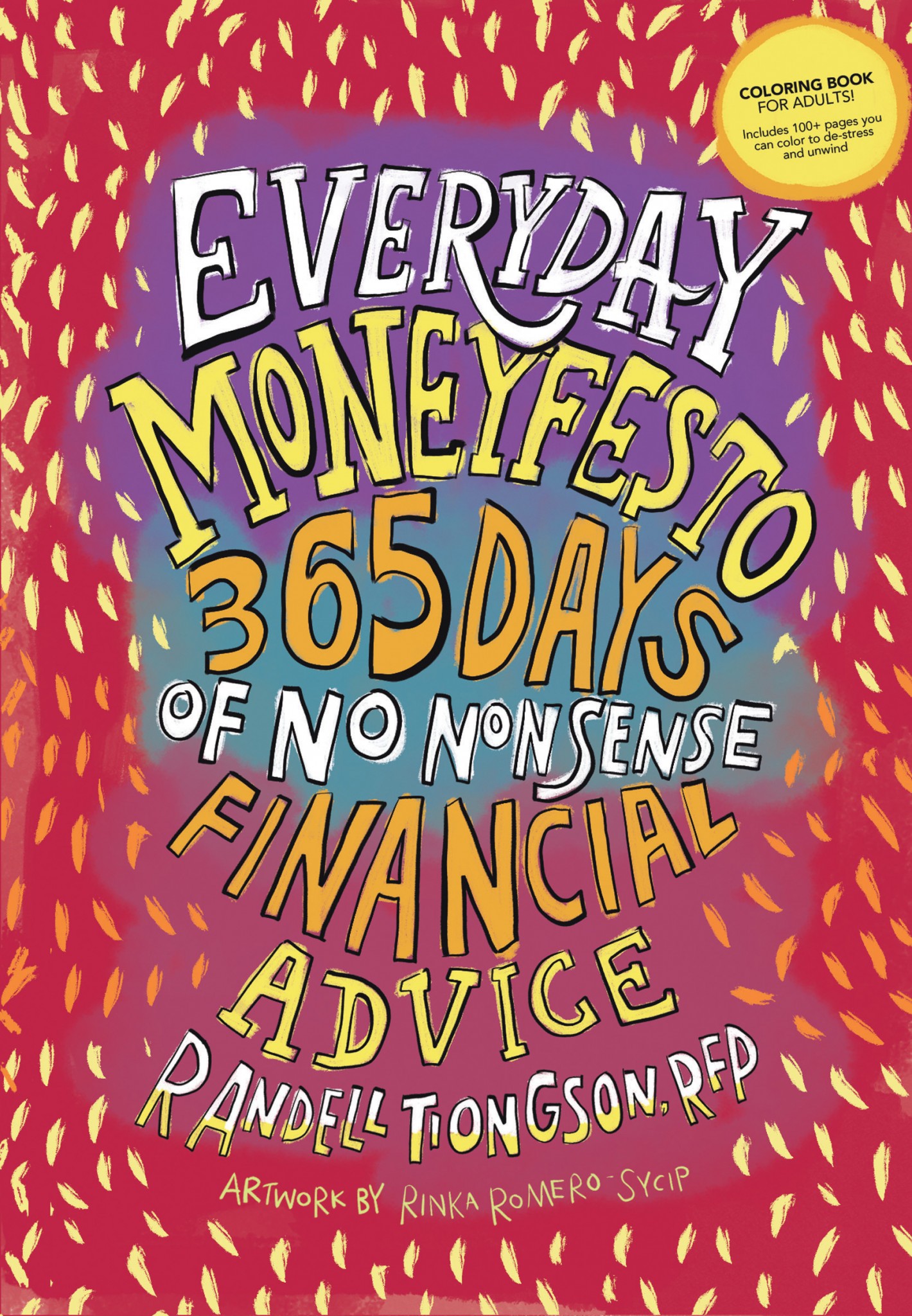

After a long wait, my newest book is now available!

Everyday Moneyfesto: 365 Days of No Nonsense Financial Advice is a unique book that focuses on financial wisdom. It is a book that will guide you, motivate you and inspire you on a daily basis to help you achieve financial peace.

Other than my daily advices, the book also shares the financial wisdom from the biggest names like Francis Kong, Bo Sanchez, Marvin Germo, Efren Cruz, Chinkee Tan, Coney Reyes, Miriam Quiambao, Rex Mendoza, Ardy Abello, Edric Mendoza, Salve Duplito, Alvin Ang, Dennis Sy, Jayson Lo and many more!

This is a unique book where you can also show your creativity with over 100 pages which you may want to color, featuring artwork by Rinka Romero-Sycip.

Be one of the first to get a copy of this life-changing and empowering book for only P600.00 per book and for a limited period, shipping is for free for Metro Manila orders. For provincial orders, please add P100.00.

To order, follow these easy steps:

- Deposit payment to BPI 0249-1113-09 under John Randell Tiongson

- Send a photo of the deposit slip to mia.tiongson08@gmail.com along with your complete address and contact number.

- Wait for your book/s in a couple of days.

Get a copy of my latest book and be encourage with your journey towards financial freedom!

Kick the 13th Month Habit

By Randell Tiongson on November 25th, 2015

QUESTION: It’s almost the end of the year, and I’m excited for my 13th month pay. I plan to use it to buy Christmas gifts for my family and friends, but I know I’m not supposed to spend all of it. What are the best ways to use the extra money?—Emily via e-mail

Answer: Ah, yes—the 13th month pay. For others, it even reaches the 15th month. That’s one to three months’ salary. There’s a lot you can do with the money, such as use it to buy Christmas presents, but I strongly suggest that you not spend it all. Aside from saving a part of the money, below are 10 things you can do with your 13th month pay:

1) Remove it from your payroll account

You probably have a question mark on your face, until you realize that inflation is eating up the value of your money. Unless you have P1 million in your account, you’re only earning 0.25 percent in interest yearly versus the 4 percent inflation rate in the Philippines last 2014. Withdraw a portion of your money from your payroll account and put it into higher-yielding accounts such as time deposits or investment accounts.

2) Plan and allot

According to research from the National Endowment for Financial Education, roughly 70 percent of people who come into windfalls end up broke within seven years. This is because they aren’t used to managing a large sum. Before you spend your 13th month pay, plan how you’re going to use it. Set a specific percentage which will go to savings, investments, and debt payments among others.

3) Increase your emergency fund

If you don’t have an emergency fund yet (roughly six months of living expenses), allocate a portion of your money to building one. This fund prepares you for unforeseen expenses such as emergency health costs, a sudden home repair, and even a job loss.

4) Build up your retirement fund

Your retirement fund is different from your emergency fund. Where the latter protects you from unforeseen events in the near future, your retirement fund prepares you for the more long-term future. As mentioned a while ago, remove the money from low-yielding accounts such as your savings or checking account, and put it in higher-yielding accounts such as investments.

5) Invest

There are many investments to choose from—mutual funds, unit investment trust funds (UITFs), stocks and real estate to name a few. Your choice will depend on your risk tolerance. Whether you’re investing in mutual funds or the stock market, you’re sure to beat the 0.25 percent inflation rate of savings and checking accounts.

6) Pay off or reduce debt

Speed up your debt payment timeline and use a part of your 13th month pay to pay your debts, be it credit card debt, personal loans, car monthly payments, or what have you. Remember that the interest rates on these debts are sky high—it’s 3.5 percent a month for late credit card payments —so use the small windfall to tackle high-interest debt.

7) Important repairs

Your home may need a few repairs. For this, it’s best to resolve these sooner rather than later. Taking preventive rather than corrective measures may save you big bucks in the future. If you put off repairing a plumbing leak, you may end up spending big bucks when your flooring or walls are affected by the leak.

8) Fund a fund

Whether it’s your travel or shoe fund, you can set a portion of your 13th month pay to fund items or experiences you’ve been saving up for. If you love to save, you may have forgotten to treat yourself. You probably don’t remember the last time you went on a vacation or treated yourself to a nice dinner out. You deserve some relief from time to time, so set a portion to ramp up any ‘fun’ funds you have.

9) Spend on yourself

Related to the above, it’s hard to penny pinch all the time. It’s important to prepare for your future, but it shouldn’t be at the expense or to the detriment of your present self. Decades down the road, when you’re reliving your younger years to your grandchildren or to your friends during your university’s 50th-year reunion, you don’t want to stand on the sidelines without anything to say. Once you’ve made sure you’ve saved up for your future self, treat your present self to something nice. To have an easier time managing your ‘fun’ money from your savings or retirement fund, have separate accounts depending on what you’ll use the money for.

10) Donate or Bless others

Last but definitely not the least, share your blessings with others. Whether it’s donating to your local church or a cause you feel strongly about, never forget to give back. This develops the core value of sharing wealth with others in need and teaches you to appreciate the material goods you have. It’s also a reminder of stewardship and that money is really the Lord’s—we are merely managers.

There are many ways to use your 13th month pay. The bottom line is proper money management. Money is not a means to an end; it’s a vehicle for us to do what we want—whether it’s living a comfortable retirement or going on the vacation you’ve always dreamt of. When you receive your 13th month pay, don’t spend it all in one go. Budget and plan it, and if you can, share it.

“The wise have wealth and luxury, but fools spend whatever they get.” (Proverbs 21:20, NLT)

Debunking 5 Money Myths Pinoys Believe

By Randell Tiongson on November 12th, 2015

In the recent ‘Enhancing Financial Capability and Inclusion in the Philippines’ report by the World Bank, Filipinos answered merely 3.2 out of 7 personal finance related questions correctly. That’s a score of 45% – way below passing mark. The results show that there’s room for improvement when it comes to financial literacy in the Philippines. Because of hearsay and the flood of information available, oftentimes people experience analysis paralysis – when too much information makes it all the more difficult to understand said information or separate fact from fiction. Because of this, many money myths have popped up which some Filipinos fall prey to.

Today I am going to try to debunk 5 money myths many Pinoys believe:

- Hindi pwedeng pagkatiwalaan ang mga bangko

In the World Bank report, 41% of the Filipinos surveyed don’t use any formal commercial or financial product – with 18% of those having no need for such products. In the World Bank’s Global Findex Database 2014, the Philippines ranked last in banking penetration rate among Indonesia, Thailand, Malaysia, and Singapore. This shows that Filipinos aren’t 100% confident in formal financial products be it bank deposit accounts or credit cards.

Debunking the myth: The Philippine Deposit Insurance Corporation (PDIC) insures up to Php 500,000 per depositor. This covers bank deposit accounts and does not include investment accounts such as UITFs. If you keep Php 500,000 in your home vault, and in the unfortunate event that it is stolen, it’s hard to get that money back. If you keep the Php 500,000 in a bank deposit account instead, you have the peace of mind that you’re insured.

- Hindi ko kailangan ng insurance

Some Filipinos consider the monthly premium payments of insurance policies as unnecessary expenses. It’s either they don’t want to think about the unfortunate circumstances that can arise (who wants to talk about death?) or their budgets can’t make room for the monthly payments.

Even when it comes to non-life insurance, you’re a defensive driver and are extremely careful on the road. You don’t see the need for car insurance. In the event of an accident, you believe a healthy emergency fund should be enough to cover expenses, right?

Debunking the myth: One emergency can wipe out your entire savings. A hospitalization bill, including operation costs and medicines, can skyrocket your expenses at a fast rate. Totaling your car in a highway accident just rendered your million-peso car worthless. Insurance, be it both life and non-life insurance policies, give you the peace of mind that your you and your assets are protected. The payout you’ll get when you make a claim is much greater than your monthly payments. MoneyMax.ph, the Philippines leading comparison platform for financial products such as insurance, interviewed three victims of motor accidents and how car insurance saved them.

Life insurance is also a must for anyone who has dependents. It will give you security at a time you will need it most.

- Magandang investment ang time deposit

Filipinos are risk-averse and prefer to keep their money in guaranteed and low-yielding accounts such as bank deposit accounts and time deposits. If you put Php 1 million in a time deposit with an annual interest rate of 1.125%, you earn Php 11,250. Great? Wrong.

Debunking the myth: The average inflation rate in the Philippines last year was 4.1%. That’s almost 3% more than the interest you earn in your time deposit. This means you’re actually losing money because of inflation. Good investments are supposed to make your money grow and combat inflation, which isn’t the case with time deposits.

- Real estate lang ang investment na tutubo ka ng malaki

Related to the above, Filipinos are risk-averse and prefer to put their money in tangible assets which they can touch and feel such as real estate properties and cars. Paper assets, such as stocks and bonds, scare them because what’s a paper certificate versus a home you can live in? Real estate is both an emotional and financial investment. You live in it for x number of year and sell it for millions down the road. If you bought your house for Php 5 million and sell it 15 years later for Php 15 million. Your investment grew by the 200% after 15 years? A 200% gain after 15 years makes it the best investment? Think again.

Debunking the myth: What many fail to account for in real estate investing is the cost of maintenance, repairs, homeowners’ association fees, and the like. If you take those into account, you’ll see your 200% gain fall a little. More than that a 200% gain over 15 years spreads out to a 13% annual profit. It’s much better than what you’ll get from time deposits but less than what you’ll get with stocks (when done right). If you invested in Double Dragon stock during its April 7, 2014 opening price of Php 2.00 and sold your shares last Oct 30, 2015 at Php 20.85 a share. You would have made a 943% gain in less than two years. Whilst the Double Dragon experience is more of an exception, investments if other stocks or stock funds like mutual funds or UITF have been giving good returns in the last few years.

- Makaka-retire ako sa SSS pension

Do you want to know how much SSS pension you’ll get? You can read the MoneyMax.ph article entitled ‘How Much Will You Get from the SSS When You Retire’. You’ve been contributing monthly to the SSS since you were in your 20s. You’re sure to get a large payout come retirement, right? The sad truth is that whatever pension amount your receive won’t be enough to sustain your retirement.

Debunking the myth: Take note that the SSS has a monthly salary credit threshold of Php 16,000. This means that if you’re earning Php 16,000 a month, you’ll be contributing the same amount (Php 581.30) as someone earning Php 100,000. This means that when it’s time to receive your monthly pensions, the amount will be in proportion to the Php 16,000. You won’t get more than Php 20,000 in monthly SSS pension for sure. Will you be able to sustain your retirement living on Php 20,000 a month? I encourage everyone to have SSS (or GSIS if you are a government employee) as every peso counts during retirement… but programs like the SSS are not designed for you to live a life of comfort during retirement, just a life of survivability.

Throwing away the myths

Myths are just that – myths; they’re based more on hearsay than real facts. It’s time to throw away those five money myths and learn more about personal finance. By learning more on financial literacy, you can secure your financial future, and at the same time, share your knowledge to other Filipinos for a more financial-literate Philippines. Be wise, be prudent. Learn more about personal finance and throw away the nonsense things that prevents us from achieving financial peace.

Order my books No Nonsense Personal Finance: A Step by Step Guide and Money Manifesto: Lessons in Personal Finance. Send an email to mia.tiongson08@gmail.com for book orders.