Hong Kong event for the OFW 2016

By Randell Tiongson on January 8th, 2016

My first foreign finance seminar for the year will be in HONG KONG this January 17, 2016.

If you are an OFW based in Hong Kong, attend my very practical but life-changing talk at Room 602, Boys & Girls Club, 3 Lockhard Road, Wanchai, HK. The seminar will start at 3:30pm and limited to only 40 participants.

To register, please email pierre_v70@yahoo.com or call +852 9512 3422. See poster for details.

See you!

How to get out of a credit card debt problem

By Randell Tiongson on January 4th, 2016

Question: Because of emergency and other unforeseen expenses, I have racked up credit card debt. I hate the feeling of having debt. It scares me that I may never be able to pay them down, and the interest rates are discouraging. I would love to get some tips from you on how I can pay down my debt. Thank you so much for your help. – Johnny via e-mail

Answer: Ah yes, when you have credit card debt, it can feel like there’s a heavy weight on your shoulders. You want to do a number of things, but you can’t because you’re always thinking about the debt you have. It feels hard to relax when you pay more on interest month per month. Eradicating credit card debt will take a heavy weight off your shoulders. If you’re up to neck in debt, here are 5 easy tips to get out of credit card debt:

1) Use the snowball method

The snowball method is a method used to tackle debt by attacking your credit card with the smallest balance first. Just as a snowball is rolled and piled together to create a bigger snowball, the snowball debt method lets you start with the smallest balance to give you the confidence to attack bigger balances in the future. Paying off the smallest balance will make it easier and faster for you to pay down debt. For those who are new to saving and budgeting, starting small (read: paying the smallest balances first) will ease you into the habit of paying debt. If you start big and pay off the biggest balance with the highest interest rate first, this can shock you and make you feel like you’re not making any progress and you might fall back into the trap of accumulating more debt.

2) Automate payments

“Out of sight, out of mind” right? If you set up your account, so that your credit card dues will be automatically debited from your bank account, you’ll treat the money as if you never had it at all. If you choose to pay your credit card balance manually, you may be tempted to pay the minimum balance only to give way to other expenses you prioritize. By automating your credit card payments, you’ll feel like you didn’t even have the money in the first place. Even better is that you’re paying the full balance each month, which avoids extra fees. Multiple banks, such as BDO, BPI and HSBC, offer this auto-payment service. Just log on to your online account to apply.

3) Track your expenses

A lot of people get into credit card debt because they treat it as free money. It’s easy to hand that plastic to the register, swipe it, then sign. Until the billing statement comes. Then, you find yourself searching every corner of your home for spare change to pay your balance. By tracking your expenses (pro tip: have a separate category for credit card expenses), you’ll see where your money is going, and you’ll realize just how much you’ve racked up in purchases using your credit card. Tracking your expenses avoids adding to the debt you already have. Multiple phone applications, such as Expense Manager, Mint and You Need a Budget, allow you to track your expenses in a comprehensive manner (e.g. by timeline, by category, current balance, etc.).

4) Transfer balances

Multiple banks provide this service of transferring and consolidating all your credit card debt into one bank. To get the most out of balance transfers, transfer all your balances to the bank that offers the lowest interest. This way you’ll be paying less in interest, which can save you a lot. Late fees for credit card dues start at around 3 percent a MONTH, so it’s best to avoid sky-high interest rates as much as possible. By transferring your balance from one account with a high-interest rate to the one with the lowest, just imagine how much you can save. It’s best to remember that there’s no such thing as free money and the interest rates on credit cards will make you wish you never had a credit card in the first place.

NOTE: However, this suggestion doesn’t really solve the root cause of your debt problem. I only recommend this when you have identified and rectified the root case of your getting into debt in the first place. Many people think this method is the answer to the problem but it really isn’t as you use a another problem to solve your previous one. When you transfer balances, make sure you have corrected your cash flow issues and have the discipline not to over-use your credit card again, otherwise you just swept the dirt under the rug, as the saying goes.

5) Use a part of your savings

Have an emergency fund, it’s one of the basics of personal finance. This e-fund must be used ONLY for emergencies, nothing less; however some rules can be broken. If your e-fund is well-padded, if you have a continuous flow of income, if you have a partner that has his or her own income and emergency fund, if you have investments, THEN you can use a portion of your emergency fund to make a lump sum payment. Remember that in a savings account, you only earn 0.25 percent in interest a year, humiliatingly less than the 3 percent a month you pay in credit card interest. Consider using a portion of your savings to pay your debt down faster and avoid incurring the 3-percent interest a month.

Road to financial freedom

It’s a different feeling when you don’t have to worry about debt. You don’t feel like you have a rope tied around your neck. You feel like you’re able to save and invest earlier and faster. Having zero debt maximizes your opportunity to live a life free of worries. That portion of your income you used to pay down debt? Use that money to go on a much-needed vacation that is not funded by debt. Even better, use the money to start investing, saving for a house down payment, or whatever financial goals you may have. The bottom-line is once you pay down all your credit card debt, you’re on the fast track to reach a life free of money worries.

“The rich rules over the poor, and the borrower is the slave of the lender.” – Proverbs 22:7, ESV

Book bundle promos! EXTENDED!

By Randell Tiongson on December 11th, 2015

Due to many request, the book bundle promo has been extended! You can avail the books with a discount until January 18, 2016!

————–

Thinking of a great gift for Christmas that will really make a difference? Why not give the gift of financial education!

Here’s great news! You can get my books with bundled promos.

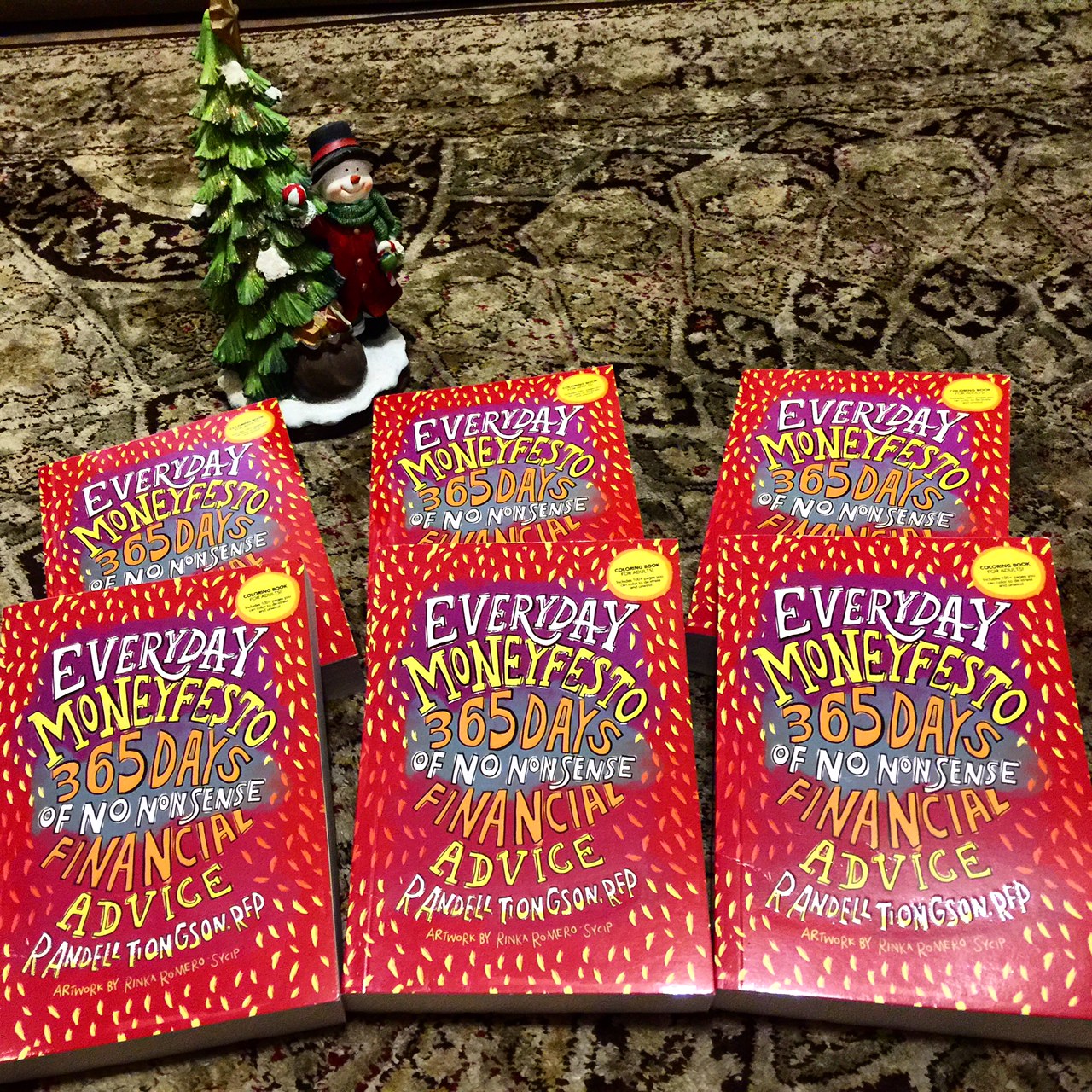

Bundle Offer #1

My newest book Everyday Moneyfesto: 365 Days of No Nonsense Financial Advise is available at P600.00 — buy 5 and get 1 FREE with our 5+1 offer. It’s now just P3,000.00 instead of P3,600.00 or a savings of P600.00 per bundle.

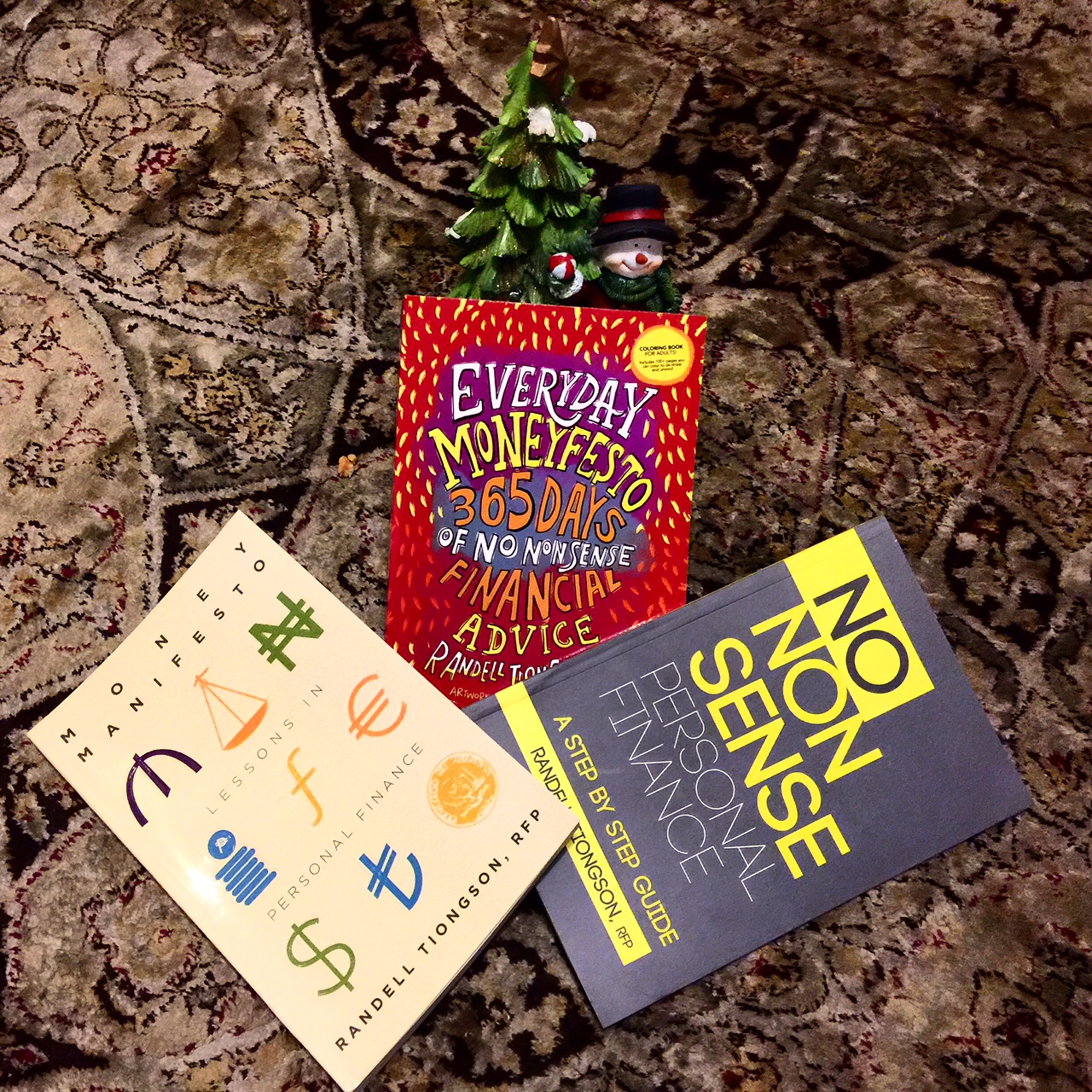

Bundle Offer #2

You can also get all my 3 books – Everday Moneyfesto, Money Manifesto and No Nonsense Personal Finance in one bundle. Bundle promo price is only P 1,400.00 instead of P1,700.00 or a savings of P300.00.

- Free shipping for Metro Manila orders, for provincial orders please add P100.00

Here’s how you can order:

- Select you bundle offer

- Deposit or transfer to BPI 0249-1113-09 under John Randell Tiongson

- Take a photo of the deposit slip or transfer advise to michael@randelltiongson.com

This bundle offer promo is only until December 28, 2015.