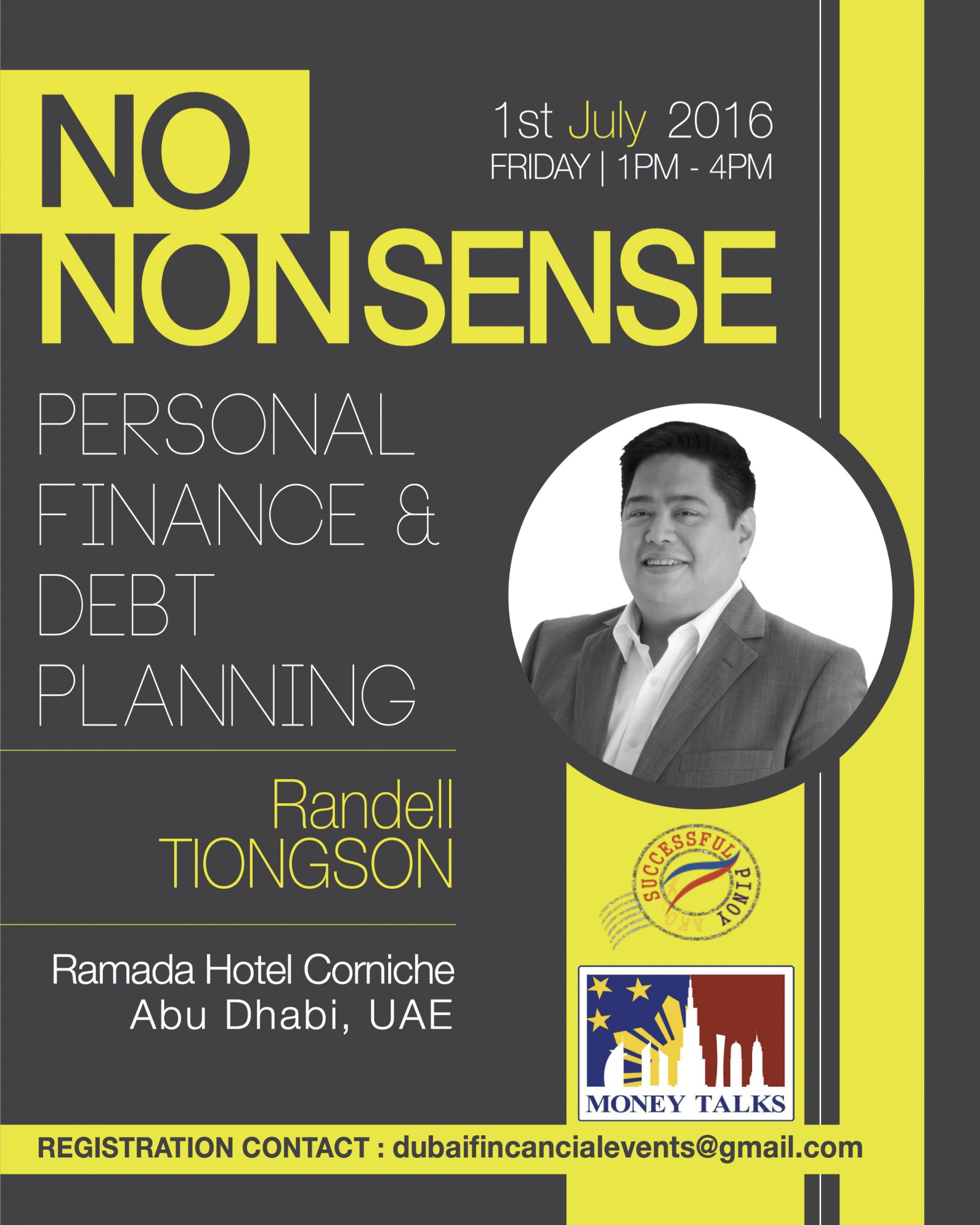

No Nonsense Personal Finance in Abu Dhabi

By Randell Tiongson on June 13th, 2016

Are you a Filipino based in Abu Dhabi and you would want to have a better financial future? Are you burdened with too much debt? Do you want to learn how to better control your spending?

If you want to embrace financial freedom, join me this July 1, 2016 at Ramada Hotel Corniche, Abu Dhabi, UAE for a life-changing seminar.

To register for this event, kindly e-mail dubaifinancialevents@gmail.com or call/sms Cherry – 056 919 6776 or Franz – 050 983 7696 or click HERE

How to build your emergency fund

By Randell Tiongson on June 3rd, 2016

Question: Hi sir Randell! I attended iCon last year, and I can’t wait for this year’s conference. Since 2015, I’ve been reading a lot about personal finance, and one of the basic lessons I learned is building up an emergency fund. However, no matter how much I read, I still find a hard time growing my savings. Every time I save a portion of my monthly income, a surprise expense comes up, and I dip into my e-fund. Because of that, my emergency fund never seems to grow. What can I do? I wish to build a fund equivalent to my six months’ worth of living expenses by the end of 2016.—Miggy via Facebook

Answer: Hi, Miggy! Thank you for the message. I’d like to answer your question here so more people can read and learn about it. I also look forward to seeing you in May in iCon, and we have lots of surprises in store for you. Going back to your question, yes, six months worth of living expenses would be ideal for an emergency fund. However, for those who have just started handling their personal finances, six months’ worth is a lot of money. It’s daunting and may feel like you’re never going to reach your target. To make the journey a little easier and less scary, start slow. As they say, ‘slow and steady wins the race.’

Here are five tips to help you build your emergency fund:

1) Use it only for emergencies

An emergency fund is to be used only for emergencies. Your prized running shoes breaking is not an emergency—unless you are a professional or varsity athlete. An emergency fund is to cover unforeseen expenses, such as medical bills or car repair. To keep building your emergency fund, do not dip into it. Once you put money into your e-fund, treat it as a ‘forgotten fund’ until the need arises.

2) Take baby steps

Start small until you acquire the habit. As with crash diets, where withdrawals are highly likely, you ease yourself into a new routine (in this case, saving) if you start small. Forcing yourself to save 50 percent of your income may ruin your mood and turn you into a Grinch because it feels like a burden rather than blessing; however, if you start small and save 5 percent of your income, it doesn’t create that big of an impact on your expenses (and life in general), and as you end up saving more through the months, you’ll get used to the habit and will be ready to increase the amount you save.

3) Save first, spend later

“Do not save what is left after spending. Spend what is left after saving.” It’s one of the most notable quotes on personal finance, said by none other than legendary investor Warren Buffett. If you spend first then save second, you cannot maximize your monthly earnings because more will be going to your expenses rather than savings. By saving first and spending later, chances are you’ll hit your monthly savings target.

4) Automate your accounts

In relation to the point above, automating your accounts curbs your self-control. You cannot spend money you do not have, and this is a mind trick you can use if you have your bank automatically transfer money from your payroll account to your savings account every payday. Short-term investments, such as money-market mutual funds or UITFs, are more liquid and have no minimum holding period. This means you can store your emergency fund in these short-term investments, and have your bank automatically transfer money from your payroll account to your investment account through their Regular Subscription Plan (BPI) or Easy Investment Plan (BDO).

5) Increase your income

The fastest way to save more is to earn more. This may require more time and effort but there really is no substitute for hard work. If you’re an employee, you can perform exceptionally well to keep you in the running for promotion or pay raise. If you have a wide network, you can tap your friends and family and earn on the side through freelancing. Use your strength to increase your income. If your photos on your Instagram and Facebook are getting praises, that may mean you have a knack for photography. You can use this skill to cover events such as parties and weddings for a price. This way, you generate income on the side doing what you enjoy and are able to save more for your emergency fund.

To all those planning to or are currently building their emergency funds, the five steps above will get you into the habit of saving, and as a result, enable you to build your emergency funds. Once you have six months’ worth of living expenses covered, you can still use the tips above to cover other aspects of your personal finances, such as growing your investment, paying down debt, or saving for a big-ticket items.

“A prudent person foresees danger and takes precautions. The simpleton goes blindly on and suffers the consequences.” Proverbs 27:12, NLT

Here’s a thought: Would Jesus have an emergency fund? Read HERE.

3 Tips to Curb Impulse Spending

By Randell Tiongson on May 31st, 2016

It’s a challenge – saying ‘no’. This is so very true especially when it comes to shopping. You pass by the mall, and you see the big red ‘SALE’ sign. You instantly go in, and come out with a bag or two in hand, or even when it comes to online shopping. You check a website, add a number of things into your cart, and then click the check-out button. With the ease and accessibility of shopping, it has become almost effortless to spend, and you might find yourself falling into the trap of impulse spending.

The habit of impulse spending may be hard to break, but once you learn to say ‘no’, you’ll find yourself wishing you broke the habit sooner. Today, I will share 3 tips to curb impulse spending. These tips may be easy to start yet hard to maintain, so it’s important to keep building the habit. In a study done by the University College of London, it took the 96 participants between 20 to 84 days to form their habits of choice. The number of days varied depending on the activities participants wanted to turn into habits. Eating healthier took a shorter time as compared to exercising regularly. That aside, here are three activities you can turn into habits to curb impulse spending:

1) Track your expenses

This is one of the easiest ways to curb impulse spending. You can download a tracking app on your phone, so you can record your expenses quickly and conveniently. With this, you also need to know your budget. If you find yourself close to your spending limit, this should give you the push to stop buying unnecessary things. Even more, if you add up your expenses and find that you’re spending too much on a certain category, you might start feeling guilty and start avoiding buying unnecessary things.

2) Leave your credit cards at home

Credit cards make it easier to spend. With a single swipe of your card, you can buy what you want. Even better (or worse), you can buy something for X amount as long as it’s within your credit limit. It doesn’t matter if you don’t have the cash to pay. Your credit card isn’t connected to your ATM account. This can lead to a dangerous path if you cannot control your spending, so one of the easiest ways to curb impulse spending is to leave your credit cards at home and only bring enough cash to cover your transportation costs and food expenses. By leaving your cards at home and only bringing enough cash, you can’t afford to shop at the last-minute.

3) Stay focused on your goal

Have you ever wanted something so bad that you were willing to do everything to achieve that? If you have a money-related goal, such as buying a car or a house or travelling the world, staying focused on your goal will allow you to curb your impulse to spend. If you’re browsing through an ecommerce website and find a number of items you like, just remember that you have a goal to reach, and that if you end up spending, it will take you a step back from that goal.

So how do you stay focused on your goal? You can write it down and put it in a place where you’ll see it every day. You can keep reading online resources and join groups or forums to talk with like-minded individuals. This way, you’ll surround yourself with information that and people who can influence you to reach your goals.

Saying ‘no’ to impulse buying may be a challenge at first try; however, once you build the habit, you’ll find it easier to curb. Furthermore, this discipline will trickle down to other aspects of your life, from building the habit to eating healthier or exercising regularly.

Plan carefully and you will have plenty; if you act too quickly, you will never have enough. (Proverbs 21:5 TEV)