Is diversification difficult?

By Randell Tiongson on February 7th, 2019

You often hear the word “diversification” when investments are discussed. Diversification is important; in fact, it is considered one of the most effective risk-management tools, minimizing investment losses.

What does Investopedia (a favorite online site for investment stuff) say about diversification?

“A risk-management technique that mixes a wide variety of investments within a portfolio. The rationale behind this technique contends that a portfolio of different kinds of investments will, on average, yield higher returns and pose a lower risk than any individual investment found within the portfolio.

“Diversification strives to smooth out unsystematic risk events in a portfolio so that the positive performance of some investments will neutralize the negative performance of others. Therefore, the benefits of diversification will hold only if the securities in the portfolio are not perfectly correlated.”

Diversification is often misunderstood and its execution has always been a mystery to many. To many of us, diversification is just putting your money in different banks or buying different pieces of property in different areas. However, diversification is much more than that and here are some ways to diversify:

1) By asset class — Cash or near cash (savings or checking accounts, time deposits, treasury bills or money market accounts); fixed income (government securities, corporate bonds); equities (stocks); real estate (properties); collectibles (paintings, jewelry, etc.); enterprise (business)

2) By time frame — short term (about a year); medium term (up to about five to seven years); long term (over seven years)

3) By risk — conservative, moderate, high or speculative

4) By liquidity — highly liquid vs. non-liquid

Above are just a few ways to consider classifying your assets/investments regarding diversification. Here are some diversification tips: vary your asset classes; combine short-, medium- and long-term investments; combine highly liquid and non-liquid assets.

By practicing diversification, you are also practicing sound risk management. A properly constructed diversification strategy will minimize the risks of your investments and, at the same time, give you better yields as compared with taking an ultra-conservative position. With a good diversified portfolio, the risk of totally wiping out your wealth is highly unlikely, but at the same time, allow you to experience better growth which will be more than inflation.

But diversification also has its downside. Sometimes, a portfolio that is too diversified can also prevent you from earning properly, as the volatility of many of the players in your portfolio can cancel each other. However, having a very risk-averse position can be just as dangerous as taking a risky option, as inflation can erode the value of your wealth. The more prudent option then would be to learn diversification.

Do not be too afraid to try out diversification, it is not rocket science. Come up with a diversified program that is consistent with your investment objective, risk tolerance and time frame and you are on the road to achieving financial peace.

I really like the way the Bible talks about diversification. Yes, the Bible is a good source of investment wisdom and here’s proof: “But divide your investments among many places, for you do not know what risks might lie ahead.”—Ecclesiastes 11:2 (New Living Translation). Since the Bible advocates diversification, I am assured that it’s a great idea.

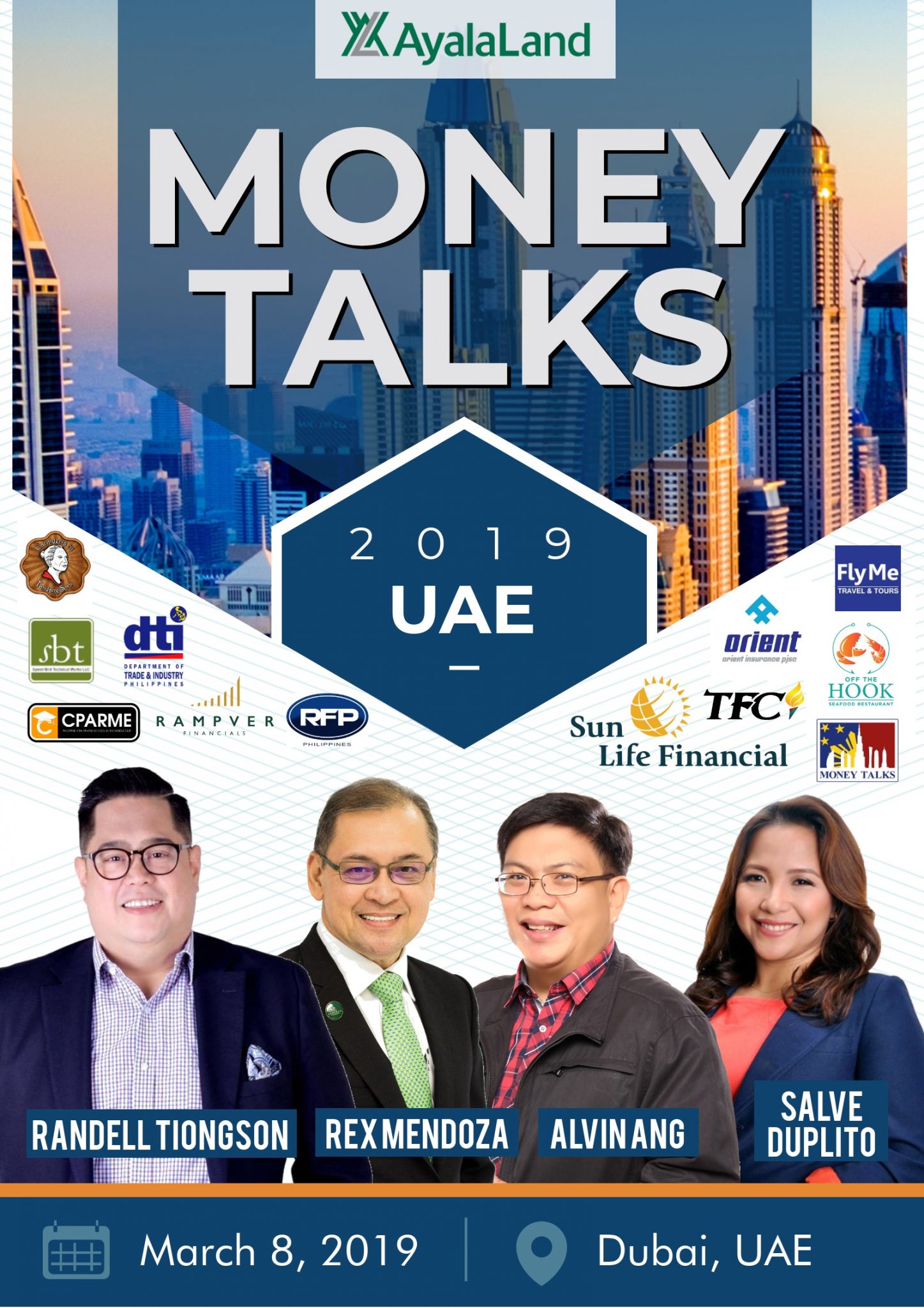

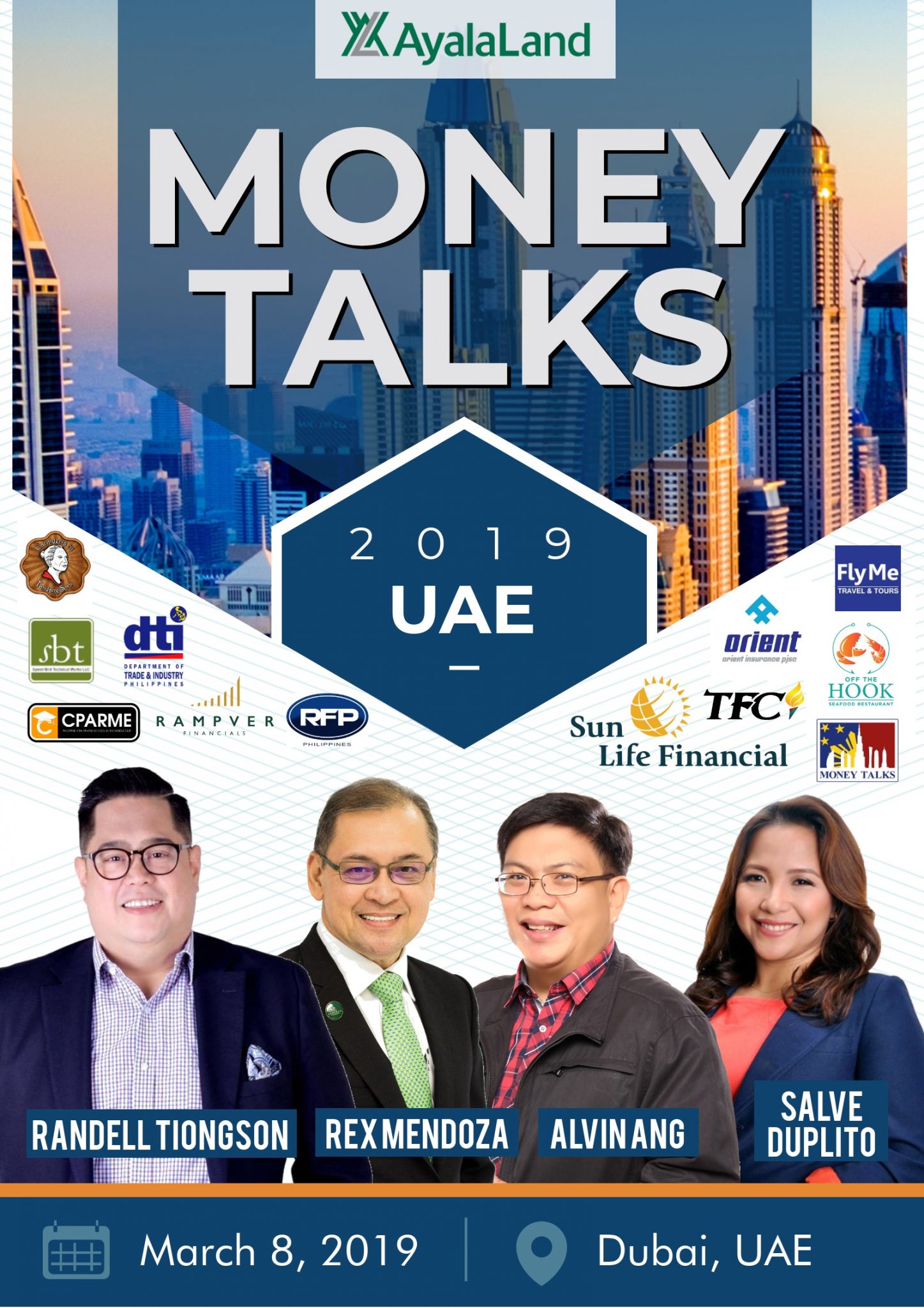

Catch me at my seminars for our Overseas Filipinos in the UAE and Japan this March and April 2019.

Registered Financial Planner Program UAE – www.bit.ly/RFPUAE2019

Money Talks UAE 2019 – www.bit.ly/MTUAE2019

Investing Insights Japan 2019 – www.bit.ly/investinginsightsjapan2019

The 2018 Christmas Book Promo!

By Randell Tiongson on December 11th, 2018

EXTENDED until January 7, 2019!

Give yourself and your loved ones the gift of financial peace this Christmas!

Due to a lot of requests, I will be having a special Christmas book bundle promo sale! Instead of paying P1,300.00 for No Nonsense Personal Finance (P500.00), Everyday Moneyfesto (P300.00) and Build Your Future Today (P500.00), you can get all 3 books for only P1,000.00 for a limited period of time! Get it delivered directly to your address for FREE if you are using a Metro Manila address and only an additional of P120.00 for provincial addresses.

For those who plan on giving my books as gifts this season, here’s even better news! You can get one (1) free bundle when you order five (5) bundles, that’s a total savings of P1,500.00. Here’s more: you can get three (3) free bundles when you order ten (10) bundles and save P4,500.00

My books are fundamentally sound and yet very practical and easy to read to help you get on the road to financial freedom. They are also meaningful Christmas gifts.

Hurry! Promo ends on Tuesday, December 18, 2019.

To order, follow our simple process:

- Deposit or transfer to BPI 0249-1113-09 or BDO 006440069496 under John Randell Tiongson

- Take a photo of deposit slip or screen shot of transfer advise to michael@randelltiongson.com along with your requested orders, full name, complete address and contact numbers.

- You may follow-up status of your order via Mike Enero at 0917-1520506

Ready, Set, Retire!

By Randell Tiongson on October 29th, 2018

Did you know that less than 10% of Filipinos prepare for retirement? Despite the growth of the Philippine economy and the growing wealth of many Filipinos, preparation for retirement is still not a priority to many.

Retirement planning is not rocket science but it requires a process and much understanding to find ways to properly prepare for it.

Attend READY, SET, RETIRE! A No Nonsense Retirement Planning Workshop and learn how to properly prepare for your retirement. At the end of the half day workshop, you will be able to understand how to plan for retirement and what learn the tools that will give you a life you deserve. Find out how you can truly live a life of comfort & learn about the proper investments that is best suited for your needs objectively.

Joining me at this workshop are two of the country’s most sought after experts in the are of finance and economics: Rex Mendoza and Dr. Alvin Ang

Mr. Rex Mendoza is the President & CEO of Rampver Financials, a dynamic niche player in financial services specializing in investments, and one of the biggest distributors of mutual funds and other financial products in the Philippines. He sits as a director of Globe Telecom, Prime Orion Properties, Inc., Esquire Financing, Inc., the Cullinan Group, TechnoMarine Philippines, Seven Tall Trees Events Company, Inc., Mobile Group, Inc., and Trustee of the Bataan Peninsula State College. Rex is also a member of Bro. Bo Sanchez’ Mastermind Group, and is cited by many as one of the best leadership and business speakers in the country. He served as the President & CEO of Philam Life, one of the country’s most trusted financial services conglomerates and was Chairman of its affiliates and subsidiaries. Prior to this, he was previously Senior Vice President and Chief Marketing and Sales Officer of Ayala Land, Inc. He was also Chairman of Ayala Land International Sales, Inc., President of Ayala Land Sales, Inc., and Avida Sales Corporation.

Dr. Alvin Ang, PhD is a professor of the Economics Department of the Ateneo de Manila University and a senior fellow of the Ateneo Eagle Watch. Currently, he sits on the Board of the Philippine Economic Society after serving as President in 2013. He was also the Director of the Research Cluster for Cultural, Educational and Social Issues at the University of Sto. Tomas. He has over two decades of professional experience in public and private sectors spanning development planning, policy formulation and analysis, investment research and economic forecasting, academic, consultancy and teaching. Dr. Ang is one of the most sought after though leader in economics.

Attending this program will truly help you prepare for the future. The learning fee for this amazing program is only P3,500.00 per participant, a small fee that can give you exponential returns. Here’s some great news, if you register and pay before November 15, 2018, you can attend the program for only P2,000.00!

Here’s how you can join the program:

- Pay the fee via BPI 0249-1113-09 or BDO 006440069496 (under John Randell Tiongson)

- E-Mail your screenshot or copy of deposit slip to michael@randelltiongson.com along with your full name and contact details.

Hurry, slots are limited!