Should I prioritize insurance or investments?

By Randell Tiongson on June 14th, 2016

Should I prioritize insurance or investments? Can’t I do both at the same time?

Those are questions I get asked a lot, and I understand why a few people may get confused. Whether you scour the web for personal finance resources or read books on how to handle and manage your money, there are different answers to the same questions. Other resources suggest doing both (insurance and investments) if you have a surplus of money. In my book, No Nonsense Personal Finance, insurance, which is step 4 in my 5-step ladder system, actually comes first before investments, which is step 5.

When to get insurance first?

I advocate getting insurance first over investments if you have people depending on you. Are you an OFW supporting a family back home? Are you the breadwinner of your family? If you are, then life insurance is vital for you. You are your own greatest asset, and if something unfortunate happens to you, what will happen to your dependents – your children, your spouse, your aging parents? Life insurance is there to give you and your dependents the peace of mind that if something happens to you (e.g. critical illness, disablement, etc.), that they will have the financial ability to face challenging times. Don’t take the risk and wait for something unfortunate to happen. Your monthly insurance payments are a small price to pay if you (for critical illness) or your dependents need to make a claim.

When to invest first?

As mentioned above, life insurance is for those with dependents. If your situation is the opposite (read: zero dependents), no one will benefit from your insurance policy. When you’re a fresh graduate still living in your parents’ house, how can you expect to support dependents when you cannot fully live independently? If this is the case, then you may opt not to apply for life insurance yet until you grow older and have dependents. Another option is to apply for term life insurance instead (versus permanent life insurance) which provides coverage for a certain time.

Can’t I do both?

Yes, you can do both. There are actually financial products which combine both insurance and investments. These are called VULs, or variable universal life insurance. With a VUL, you have both an insurance policy and investment account. This is perfect for those who do not trust themselves to maintain the discipline with investing. This is because if you invest outside of a VUL such as stocks or mutual funds, it’s up to you when you want to deposit more money into your investments. If you see yourself using a surplus of money to shop instead of invest, then VULs would be a better option for you. With a VUL policy, you are forced to make your monthly payments every month because you’re paying for both an insurance policy and your investments.

However, VULs are not for everyone, and it may be better to separate your investments from insurance. This is especially so if you have already built the habit to contribute to your investments and savings regularly. If you’re the type to save first before you spend, then you’re better off opening a separate investment account instead of a VUL policy. An alternative strategy that can work for you is BTID (Buy Term, Invest the Difference). You can buy a term policy which is cheaper than a VUL and invest the difference in a mutual fund ,UITF or stocks.

Buying a VUL or employing a BTID strategy will both work for you; it’s just an issue of preference.

No Nonsense Personal Finance

Insurance and investments are only 2 out of 5 aspects of my personal finance ladder system; however, all five aspects (learning to manage money, avoiding debt, saving, getting insurance, and investing) are interrelated. If you want to achieve financial freedom or become a winner when it comes to your personal finances, it’s important to learn and practice all five. You cannot invest and insure yourself if you cannot save a portion of your salary to pay the premium. In the same way, investments become futile if your debt is greater than your investments. What is important is you learn to balance the different aspects of personal finance. Before you know it, you won’t have to ask which you should prioritize first – insurance or investment – because the answer will come to you naturally.

Want to get a copy of my book No Nonsense Personal Finance: A Step by Step Guide? You can order from us directly and we will send it to your doorstep with no shipping cost! To order, simply follow the simple steps:

- Deposit P500.00 to BPI 0249-1113-09 under John Randell Tiongson

- Take a photo of the deposit slip or transfer advise as proof of payment.

- Send proof of payment along with your complete address and contact number to michael@randelltiongson.com

- Expect your book in a few days and enjoy the beginning of your quest for financial peace.

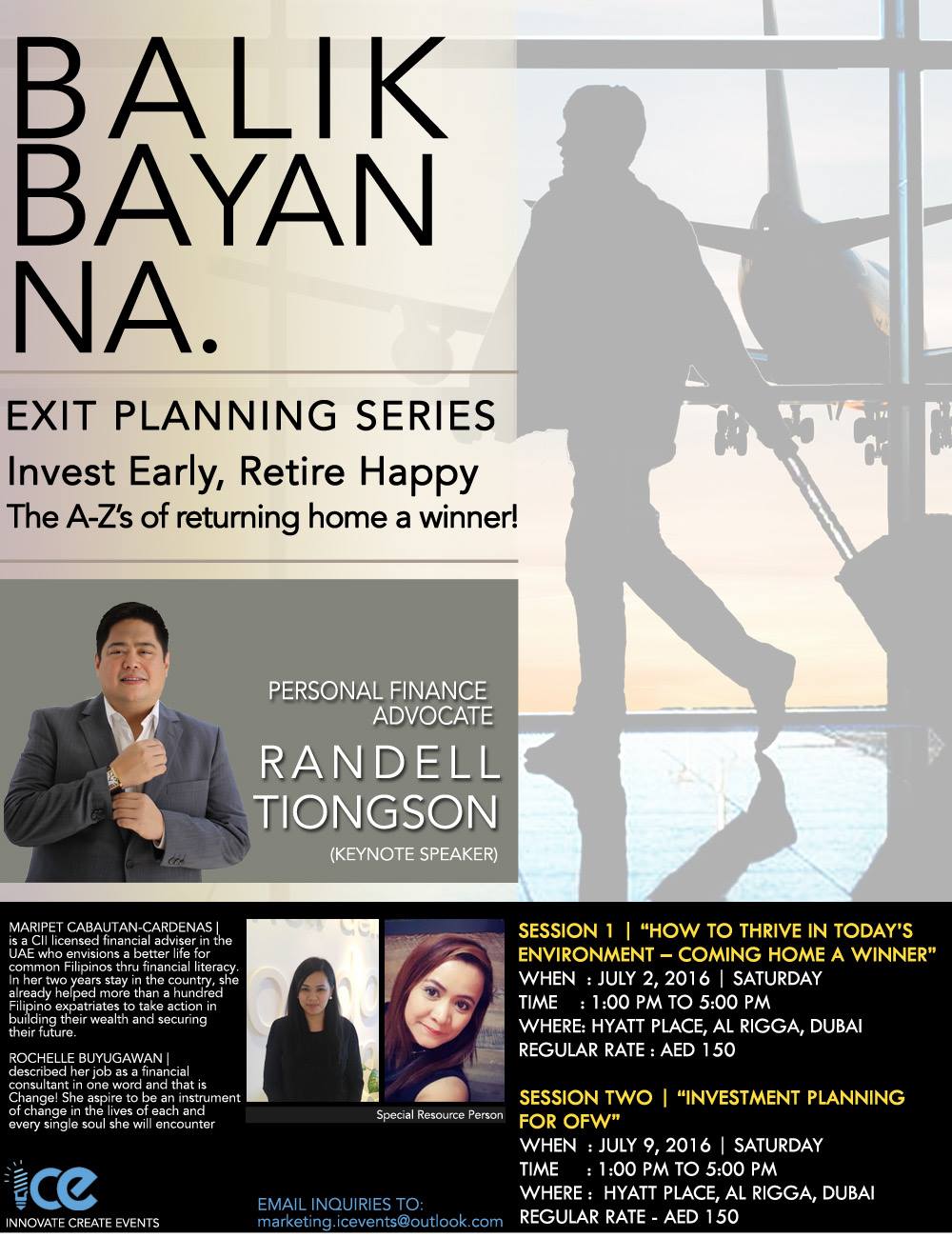

Exit Planning Series for Filipinos in Dubai

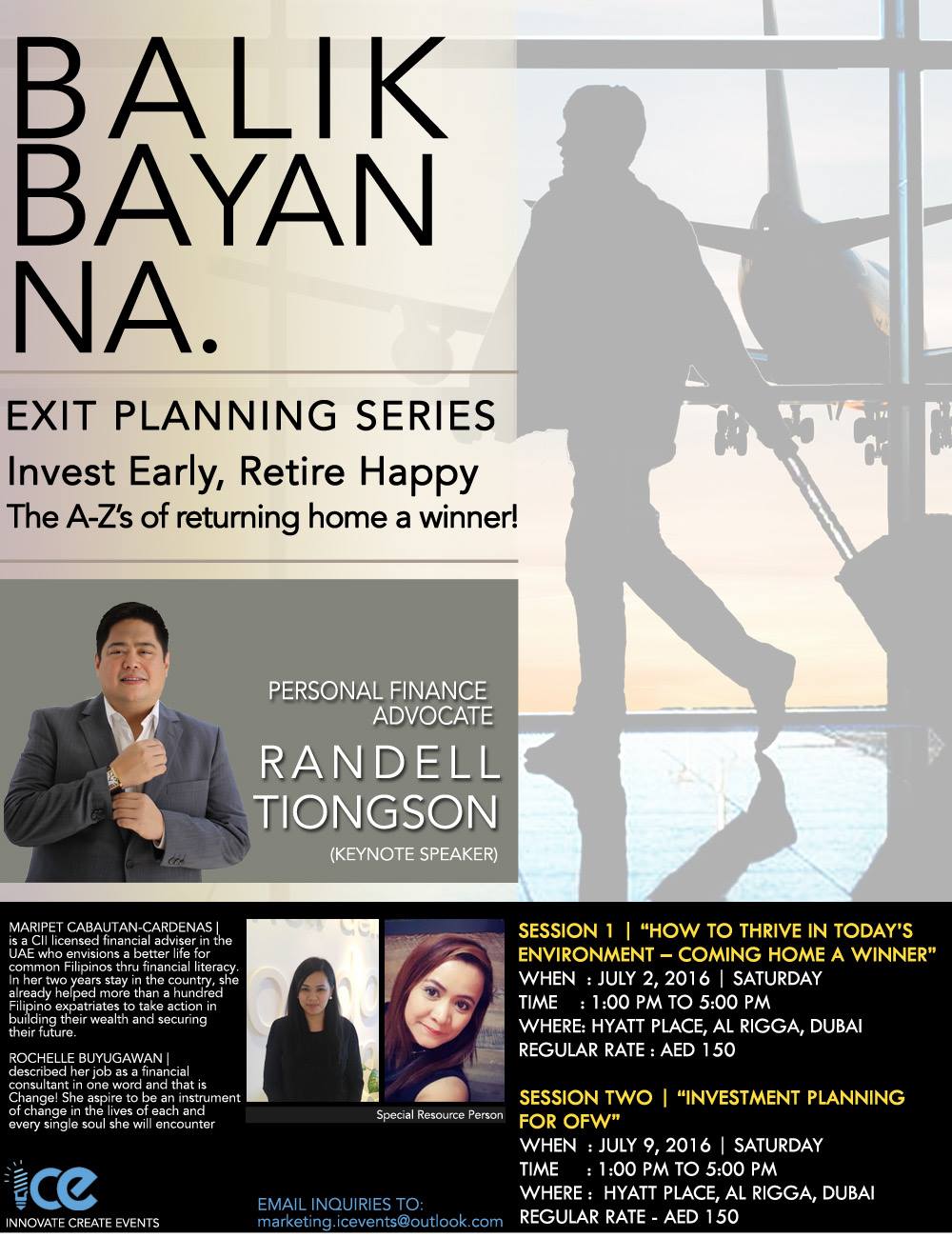

By Randell Tiongson on June 13th, 2016

Did you know that many Filipinos plan to work abroad but very few are prepared to go home eventually? Do you have the skills needed to be reintegrated back to the homeland requires? Are you prepared financially?

Join me this July 2016 for a 2-part “Exit Plan Series” which are life-changing as well as life-saving programs!

“How to Thrive in Today’s Environment” will be on July 2, 2016 and it will tackle the necessary skills and attitude to come home as a winner!

“Investment Planning for OFWs” will be on July 9, 2016 and it is all about building your wealth the right way.

Both programs will be a big help for the Filipinos in Dubai to be properly prepared with their “Exit Plan”.

To register, click HERE

Are you on the right path to financial freedom?

By Randell Tiongson on May 24th, 2016

What is financial freedom? It sounds like a heavy word. In reality, financial freedom is being able to afford and do what you want, when you want it. This could be having the ability to buy material things without thinking about the cost. This could be retiring early, way before you hit sixty. This could be having the power to quit your job and pursue passion projects, be it starting a business or giving back to the community. Financial freedom sounds like a dream, but if you look around, you may know of some people living the dream, living financial freedom. Do you want to reach financial freedom as well?

Here are 5 points to determine if you are on the right path to financial freedom:

1) You don’t worry about last-minute emergencies

Car broke down? Are you feeling aches and need a trip to the doctor? Other people may hold off having car repairs and medical trips because of the expenses they will incur; however, if you have an emergency fund and even health and car insurance policies, you won’t even think twice of taking your car to the shop or having a doctor’s appointment. If you find yourself panicking during emergencies because of finances, then that’s a sign that you have money problems. If you’re on the right path to financial freedom, you find yourself having the monetary means to pay for last-minute emergencies.

2) You have a positive money mindset

There are people who balk at the idea of having credit cards or loans. “Credit is evil and should be avoided at all cost” is an exaggeration but a very true statement you may hear. It’s time to change that mentality. Credit can be good for you if you use it to your advantage. This means paying your credit card balance in full or taking out loans to set up your future, such as taking out a house loan to buy an investment property. By having a positive money mindset, you’ll learn to make money work for you.

If you want to build a positive money mindset, you can start with reading online blogs, such as mine, and educate yourself on personal finance. At present, self-education is easier than ever what with the multitude of resources available. Even when it comes to applying for a credit card or a house loan, the information and resource you need can be found through comparison websites, such as MoneyMax.ph. The availability of finance-related resources makes talking about money more accessible. The more you read about personal finance, the more you realize that money isn’t as scary or evil as you may have originally thought.

3) You have a healthy savings account

Do you know someone who earns so much and yet always complains about being broke? At the same time, do you have a friend who may not earn so much and yet never complains of not having enough? Between the high and the low-earner, the latter is the one closer to financial freedom. Having a large salary becomes futile if you save 0%. What happens during retirement when you’re not earning a salary anymore? To be closer to financial freedom, start with having a healthy savings account. This means saving a portion of your salary every month. It’s even better if you have a large income; this means you’ll be able to save more. Remember, you cannot invest what you do not save.

4) You know how to say ‘no’

Whether it’s saying ‘no’ to that new pair of shoes or saying ‘no’ when your friends chide you to treat them to another round, having the ability to say ‘no’ can do wonders for your finances. If you track your expenses, you will notice that the little things add up. A cup of Php 100 coffee may not seem much, but drinking one every day of the working day adds up to Php 2,200 a month, or Php 26,400 a year. By learning to say ‘no’, you’ll be able to do your finances some good. Learning how to control your impulses and building the habit will have positive effects not only when it comes to your finances but yourself as a person.

5) You’re making money while you sleep

You may find yourself raising an eyebrow. ‘Making money while I sleep? Is that even possible?’ Yes, it is, and it can be done through investing. I mentioned earlier that employees lose their primary source of income when they reach retirement. This means they won’t be earning a salary anymore, and yet, they’ll continue to spend. If you reach retirement and you have insufficient savings, how will you cover your expenses? You can start investing.

However, don’t start investing when it’s already too late, start as soon as possible. To stay on the right path to financial freedom, make you money work for you while you sleep, and this can be done through investing. You can put your money in a time deposit or a bond wherein you’ll earn interest. You can also invest in stocks, real estate, or a business wherein the value of your investment grows; however, it’s best to note that investments are not guaranteed, and you can lose money as well. This is the importance of starting as soon as possible. The earlier you start investing, the more time you have to spread your risk through the years. The longer your investment, the less riskier they become.

The road to financial freedom

The road to financial freedom is not easy but nothing worth it ever comes without hardships and difficulties. What is important is you take the first step, be it opening a bank account or saving a small percent of your monthly salary. Once you take the first step, you’ll start building the discipline and the habit to continue making smart money choices, and before you know it, you’re already financially free.

As you experience financial freedom, always remember that money is only a tool, not the end goal. Be generous and always be a blessing to others. Wealth and the ability to create wealth comes from the Lord, and it is not for our own purpose, it is for His.

Join the biggest investment conference of the year – iCon2016! Visit www.iCon2016.info or contact 09266910126 for details.

Want a copy of my life-changing book No Nonsense Personal Finance: A Step by Step Guide? E-mail michael@randelltiongson.com on how you can order a copy.