What to do with your retirement fund

By Randell Tiongson on July 19th, 2016

Question: Where should my parents invest their retirement fund and savings?—James Magsumbol via Facebook

Answer: You and your parents are blessed to belong to the minority of Filipinos who have prepared for retirement. It is alarming to note that only a very small percentage of Filipinos prepare for retirement, so they end up being dependents of their children by the time they hit their golden years.

It is a good idea that you are asking about how to invest the retirement fund and savings of your parents. Many retirees make the mistake of not investing money during retirement for they fear they will lose their money or they just want to keep their cash.

While I agree that the bulk of retirement fund and savings should be liquid, part of the fund should be invested not for the sake of capital growth but as a means to preserve the purchasing power of your parents’ funds.

Inflation will not retire just because your parents did. Their retirement funds will still need to grow to catch up with inflation, which is why I recommended investing in some investments that can outperform inflation like bond funds or even balanced funds (mutual funds or UITFs).

Many retirees become short-term oriented when it comes to their money. But the fact is, they will probably live about 15 to 20 years more during retirement (longer hopefully). However, it is crucial to limit the allocation to maybe a maximum of 20 percent of their total money to the investments I mentioned as they are not guaranteed.

I would recommend that you sit down with your parents and take a look at their finances. Establish their monthly needs and go over their forecasted expenditures.

You may want to put as much as 12 to 24 months’ worth of expenses in cash or near cash instruments like savings accounts, time deposits or even money market funds. The rest of the funds can be allocated to other kinds of investments, but always be mindful of the investment risks involve.

After allocating for cash and near cash investments, you may want to consider some mutual funds or UITFs—a good ratio would be 70 percent on bond funds and 30 percent on balanced funds.

Bond funds are relatively safe and, while they are not guaranteed, they are the least volatile among the pooled investment funds. Since bond funds are relatively low-risk investments, don’t expect very good returns from them—they will perform better than inflation but not much better; 2 percent above inflation is a more realistic expectation of bond funds.

The remaining 30 percent can be placed in balanced funds, which are a combination of bonds and equities making them riskier than bond funds. However, the risk also means better returns, and you will need such growth to combat the diminishing impact of inflation to your parents’ retirement funds.

Since you did not specify the age of your parents, my recommendations are meant for retirees that are still not too senior. As your parents age, say 70 to 75, you may want to scale down their investments to lesser risk by removing the balanced funds, reducing the bond funds and greatly increasing their cash and near cash investments. As your parents hit 80 years old, you may want to keep all their funds in cash or near cash investments.

My recommendations are really just some benchmark figures as every situation is unique and people may have different objectives. Be prudent with your parents’ retirement fund. I hope this helps.

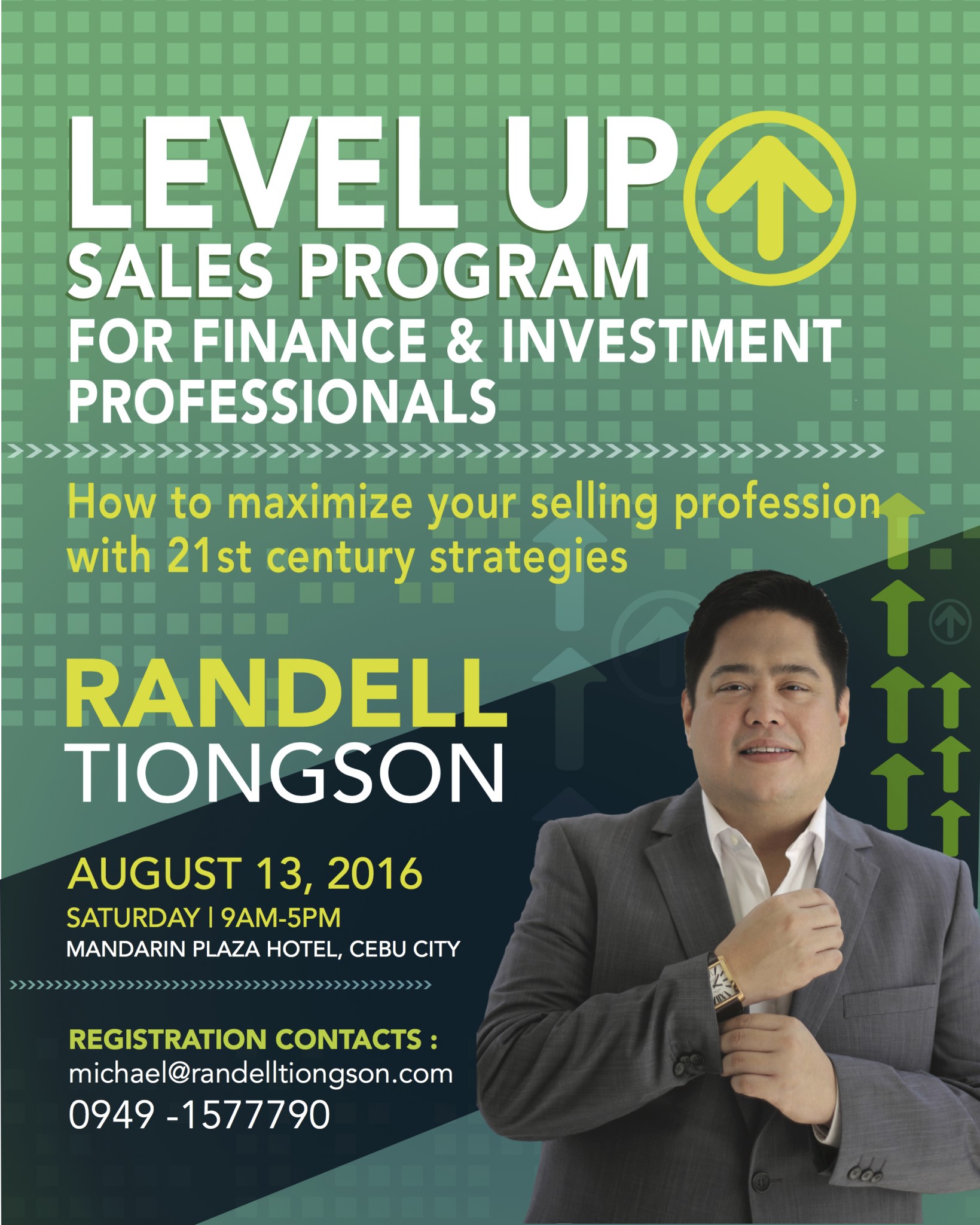

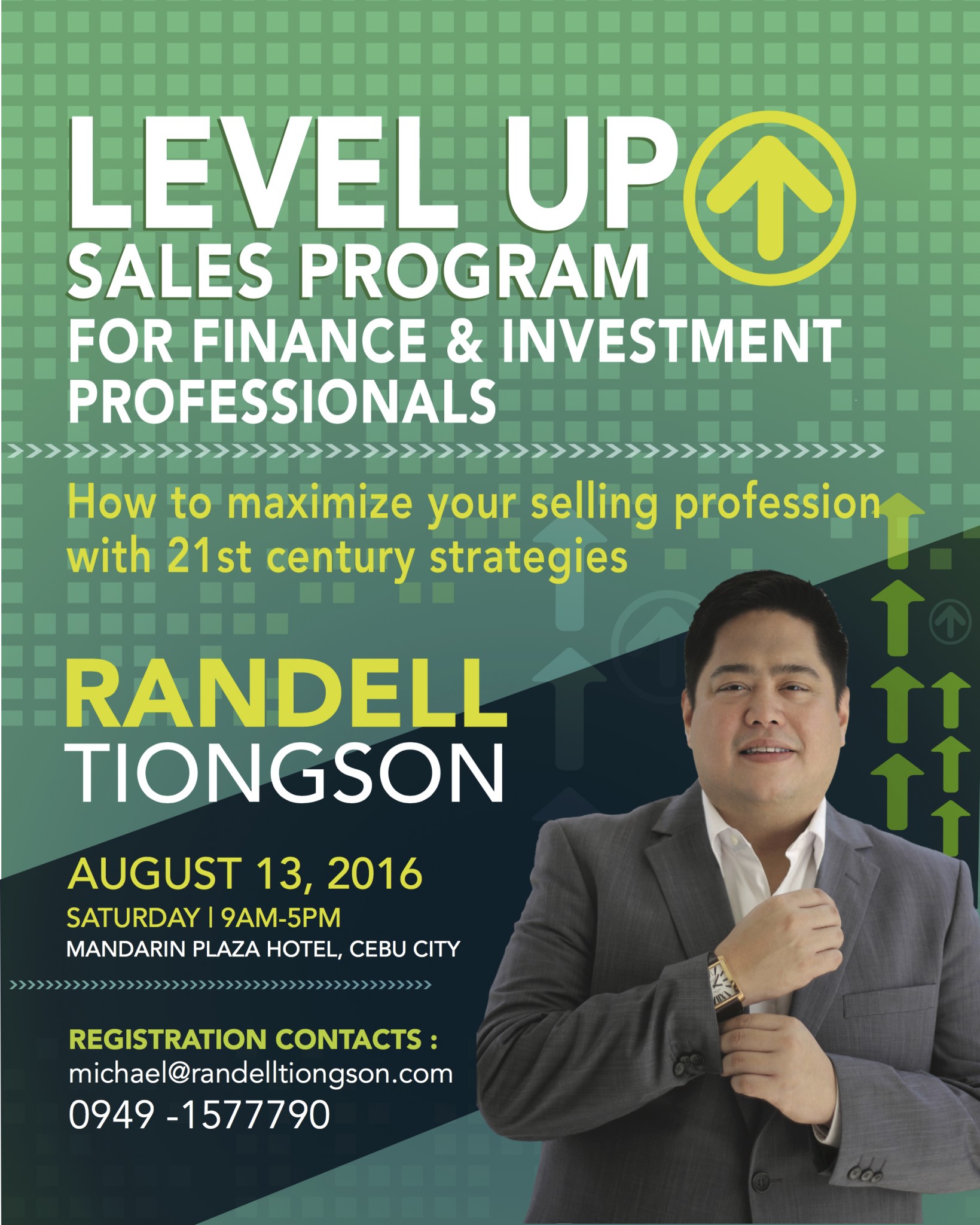

Level Up Sales goes to CEBU

By Randell Tiongson on July 6th, 2016

Are you in the profession of finance and investment sales and you are from Cebu? Join me as I bring my high value sales program that will help you level up!

Due to many requests for me to conduct my sales program in Cebu, I will be running the program on August 13, 2016 at the Mandarin Plaza Hotel, J. Solon Drive, Cebu City. The program will run from 9:00 am to 5:00 pm and will truly be an empowering program for the sales professional.

What do the participants say about this program?

“Randell Tiongson’s Level Up Sales Program is both timely and relevant because it provided key concepts on how to address the needs and behavior of the market today. I highly recommend it to sales professionals who would want to augment their skills and improve their sales performance”. – Ramon King III, Sales Director of Alveo Land Corp.

“Randell’s Level Up Program is highly recommended to all sales professionals. Satisfaction guaranteed!” – Jess Uy, Global Investing Advocate

“Randell’s Level Up program is for the serious minded financial planner who’s now ready to spread her wings and soar to new heights. Randell had condensed into a whole day program his many years of valuable experience in selling and financial planning. Let’s go pick his brains – it’s a highly recommendable program”. – Marian Goquingco, Financial Wealth Planner of FWD Philippines

“The session was very helpful especially for the sellers of investments. We were reminded to put the interest of the clients first before anything else. I also learned new sales techniques during the training.” – Jason Gutierrez, Team Leader at Rampver Financials

Why did I develop this program? I have often been asked for advise and guidance as to how to properly & effectively succeed in the sales profession– specifically in the industry of finance and investments. My answer? You should have the proper knowledge and develop the right skills as a foundation.

Many people believe that selling is an art and it is limited to those who are very good in soft-skills. While I agree that soft-skills are important for the sales profession, the science of proper selling is just as important, if not even more important.

If you are in the selling profession, specifically on financial services and investments such as insurance, mutual funds, UITF, stocks, real estate and other related industries and you feel that it’s time to “level-up”, you should attend my upcoming program: Level Up Sales Program for Finance & Investment Professionals in CEBU

The comprehensive program will cover 4 areas which I believe are 21st century strategies to thrive in sales:

- Buying Cycle

- Selling Cycle

- Behavioral Finance

- Powerful Sales Presentations

This program will incorporate effective theories validated by my 28 years of experience in the financial services industry.

Level Up Sales Program will only have a limited seating capacity to make it effective so make sure you register immediately.

The learning fee of the program is only P6,000.00 — an investment that will have exponential returns. Lunch and snacks are provided.

If you will register before July 22, 2016, you can avail my early bird rate of only P4,000.00

Follow the simples steps to secure your slot

- Deposit the training fee to my BPI Savings Account #0249-1113-09

- Send the photo of the deposit or transaction slip to michael@randelltiongson.com along with the following additional information:

- Full name

- Contact details (email and mobile phone)

- Company Affiliation

- Brief job description

- Years of experience

Join the program in Cebu and let me help you level-up!

Invest or pay your debt first?

By Randell Tiongson on June 27th, 2016

Question: Hi Sir Randell! I’m sorry to take up a few minutes of your time, but I’d like to ask you a question since based from research, you are one of the best personal finance experts in the country, and my concern is very much related to your expertise. My question is: Should I pay my debt first or should I invest, and then use the returns on the investments to pay the debt? I have friends who have been telling me to invest “today rather than tomorrow” but is that smart considering I have debts?—Lia via Facebook

Answer: Hi Lia! I’m always happy to help! My dream is for every Filipino to become financially free, and that starts with education—teaching the basics of personal finance.

However, education is only the first step. Execution is what is important.

The advice I give here will be useless if there’s no follow through, so I deeply suggest that after you read the column, you practice what you read.

Moving on to your question, so should you pay your debts first before you invest?There are numerous aspects to consider, but one of the more significant factors is the interest rate.

Interest rate and ROI

What is the interest rate offered by your credit card company? What is your possible return on investment (ROI)?

If the interest rate on your credit card debt is 3.5% monthly, or 42% annually, and your ROI by buying a “hot stock pick” is 100%, the answer seems like a no-brainer. Invest first and use the 100% ROI to pay the debt.

However, you have to remember the interest on credit cards is guaranteed, while returns on investments are not. You can gain 100%, but you can lose your money as well.

You’ll definitely be accruing interest payments by not paying your full credit card balance. In this case, it would be advisable to pay your debt first and invest later.

Can’t you do both? Invest and pay debt?

Yes, you can if:

You have a surplus of money coming in.

If your bonus or 13th month pay is only a few weeks away, you can use the money to pay both your credit card debt and open an investment account. If you have a credit card debt of P10,000 and are expected to receive your 13th month pay of P20,000, you can use 50% to fully pay your debt and the other 50% to open an investment account.

Your debt amount is small.

If your debt is P10,000 and you are earning much more than that, you have the room to pay your debt and invest at the same time (provided you already have an emergency fund).

Lia, I hope the guidelines here have given you more clarity when it comes to making a decision.

So should a person pay his or her debts first and then invest later? Or he or she can do both?

As you can see from the points above, it really varies and depends on a person’s situation and circumstance. Just remember that if you decide to pay your debts, invest, or balance doing both, you’re taking yourself one step closer to financial freedom.

As always wisdom is needed.