Pinoys and financial literacy

By Randell Tiongson on July 2nd, 2013

I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.

I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.

The study was both encouraging and disturbing at the same time. Encouraging because it seems that many Pinoys are getting better at handling their finances and disturbing because the study shows we are so far from being financially able.

The study validate many of the things me and my co-advocates have been harping about — poor habits, lack of information and mindsets to be broken. The study is pretty extensive and here are some of the highlights that I found important:

1) Filipinos are generally confident about how they handle their finances with 20% claiming to be an expert — and yet, only 8% who took the financial literacy quiz actually passed.

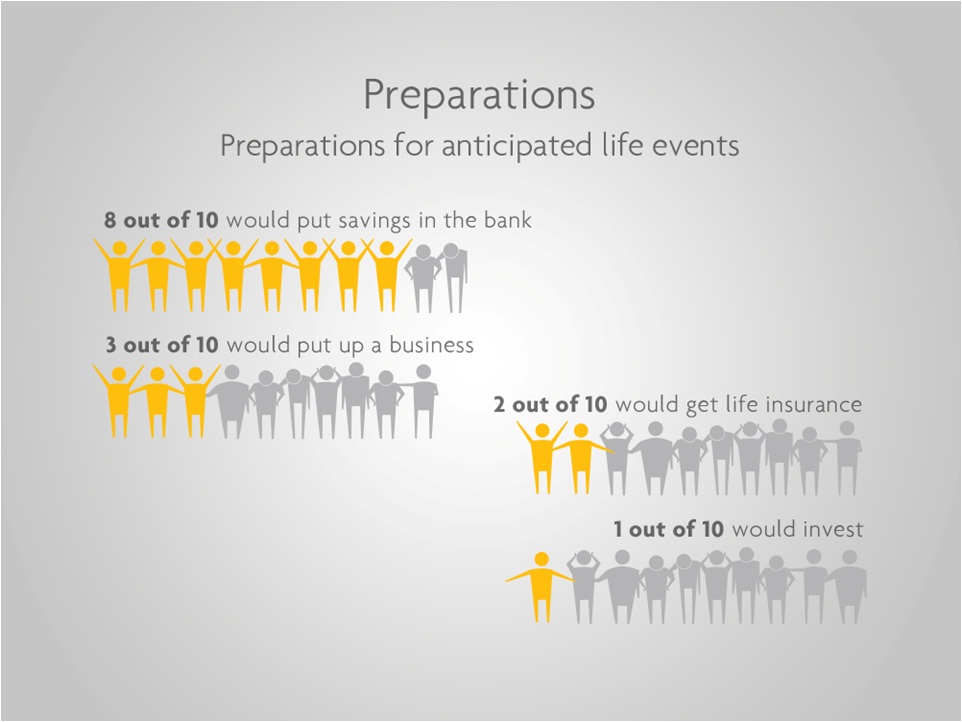

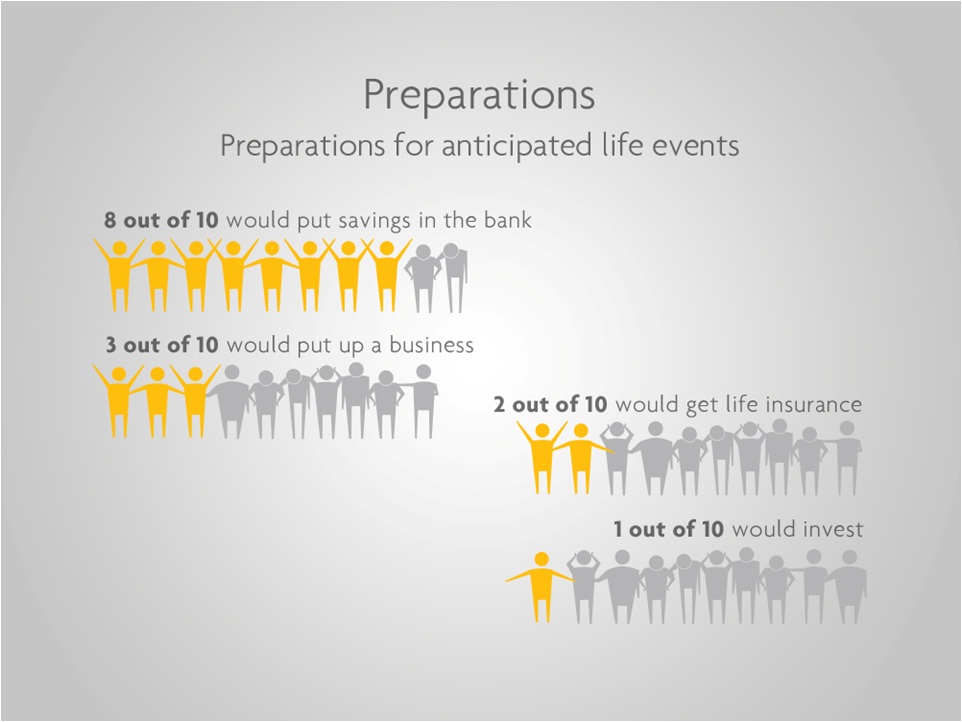

2) To prepare for anticipated life events, only 1 out of 10 Pinoys said he will invest.

3) 33% of Pinoys worry about their kid’s education; 20% on Food & 17% on family’s health.

4) Filipinos define financial security as “having enough bank savings.”

5) Among Pinoys top priority in the next 2 year – 37% said “Gadgets”!

6) 7 out of 10 Pinoys believe that everyone needs life insurance and yet insurance penetration in RP is only 1.14%

The reports indicated more results and I encourage everyone to get a copy of their report. It’s called SOLAR FLARe or the Financial Literacy Report.

———

Sun Life Press Release

Sun Life pioneers study on financial literacy

The Filipinos are an optimistic race. Amidst the recent stock market dip, there is widespread confidence about the country’s economic outlook. But are Filipinos prepared to face fluctuations and seize opportunities? Are they ready for the Brighter Life?

For the past five years, Sun Life has been conducting a nationwide Study of Lifestyles, Attitudes and Relationships (SOLAR) to gain insights on the public’s attitudes and behavior toward financial matters. This research has been instrumental in helping Sun Life pursue its thrust to raise financial literacy among Filipinos.

Uncovering a Paradox

Conducted during the first quarter of 2013 with 1,100 respondents coming from middle to upper income segments, the findings of this year’s SOLAR have been compiled in an account titled SOLAR FLARe or the Financial Literacy Report. Here, Sun Life discovered that Filipinos are confident about how they manage their finances, with 20% claiming to be an expert. However, test scores from a basic financial literacy quiz revealed a need for them to be educated further as only 8% scored above 80% and no one scored over 90%.

The report also looked into the priorities of Filipinos. When asked how they are preparing for these milestones, 8 out of 10 would rely on bank savings, overlooking other options such as life insurance and investments.

“While SOLAR FLARe reveals a lack of knowledge of some financial concepts, it does indicate an improving attitude towards life insurance. Life insurance is now considered by a third of the respondents as a priority purchase for the next two years,” said Sun Life Philippines President and Chief Executive Officer Riza Mantaring.

Advocating Financial Literacy

SOLAR FLARe upholds Sun Life’s tradition of understanding Filipinos and teaching them how to achieve lifetime financial security. It will be noted that Sun Life launched “It’s Time!” in 2009, the first multi-media financial literacy advocacy in the country, meant to educate Filipinos on financial preparedness.

During the official presentation of Sun Life’s report to the Insurance Commission, Mantaring expressed Sun Life’s desire to strengthen the partnership between public and private sectors in widening the reach of financial education.

“We want to reach out to all players in the insurance sector, like other financial services companies and the Insurance Commission, to unite in our noble mission of securing the future. Filipinos do need to know more about growing and securing their money, and this inspires us in Sun Life to continue and further expand our financial literacy advocacy,” affirmed Mantaring.

The Top Life Insurance Companies of 2012

By Randell Tiongson on June 11th, 2013

The Insurance Commission recently released the top Life Insurance Companies according to Total Premium Income as of December 31, 2012. There were a lot changes in the rankings from 2011, particularly in the top 5 rank.

Canadian insurer Sun Life Retains it’s number 1 position, a position it held since last year when they wrestled it from American insurance giant Philam Life. What is interesting to note is not only did they retain their ranking, the gap between the first and the second ranked company widened by a huge margin. In 2011, Sun Life surpassed Philam Life by a mere 300 Million by year end. By contrast, Sun Life’s difference from the runner-up in 2012 was a whopping 5 Billion Pesos with an astounding 44% growth from their 2011 numbers. It seems that Sun Life has been very productive and their various initiatives was bearing fruit, obviously — something her competitors are really seriously looking at for sure.

Coming in at 2nd place is the U.K. insurer Pru Life who had an astonishing growth and a jump of 2 notches from 4th in 2011 to 2nd in 2012. Last year was definitely a banner year for Pru Life who I noticed have been very active in its recruitment of more agents, among other initiatives. Moving 2 notches in the top 5 rank is no easy feat but Prulife of UK goes ahead of Philam Life who slips from number 2 in 2011 to number 3 in 2012. Prulife UK registered a huge growth of 57% from its previous year’s numbers which was enough to overtake Philam, albeit by a narrow margin of about 300 Million Pesos. Philam Life registered a growth of 13% from its 2011 premium base.

French insurer and one of the country’s pioneer in Bancassurance, Philippine AXA slips from it’s 2011 rank of number 3 to the 4th largest insurer by 2012 with a very respectable 23% growth in premiums from 2011 to 2012. Coming at the 5th place is BPI-Philam, the Bancassurance partnership between BPI and Philamlife who overtakes Insular Life who lands at the 6th spot. BPI Philam registered an incredible 78% growth from its 2011 numbers and was 800 Million Pesos away from Philippine AXA’s 4th rank. Insular Life delivered good numbers in 2012 with a growth of 23% from its previous year’s premium base.

Canadian insurer and the 2nd oldest life insurer in the Philippines Manulife and the Bancassarance organization Sun Life Grepa retains its 2011 rankings at 7th and 8th respectively. Both organizations also registered good growth in 2012.

Manulife Chinabank and PNB Life, both Bancassurance dominated organizations are in the top 10 ranks at number 9 and 10 respectively, also registering good growth numbers.

Cocolife and Generali Philippines slips out of the top 10 rankings by the end of 2012.

Some interesting facts:

1) 2 out of the top 5 insurers are predominantly Bancassurance organizations. Simply put, Bancassurance is an organization that can sell insurance products to the bank clients and are co-owned by an insurance company and a bank.

2) 5 out of the top 10 insurers are predominantly Bancassurance Organizations.

3) 3 companies in the top 10 are actually subsidiaries of 3 other companies in the roster.

4) Only 1 Filipino insurance companies makes it to the top 10, Insular Life making them the largest Filipino insurance company.

5) Total Premiums generated by all Life Insurance companies totaled to P119,454,550,174

Congratulations to all the Life Insurance companies. My prayer is that more and more Filipinos understand the benefits of life insurance and be protected from life’s uncertainties.

Choosing the right life insurance for you (Part 3)

By Randell Tiongson on August 25th, 2012

Question: What are the right criteria for choosing a good life insurance?—Jeremy Jessley Tan (@jeremyjessley) via Twitter

Answer: After discussing how much coverage you should have and talking about the different kinds of life insurance policies in parts 1 & 2 of this column, I will now close this series by discussing how you should choose your plan and provider.

Deciding on a type of plan should be consistent with your objective. If the only purpose of considering life insurance is protection, then a term policy is something you should consider. Further, if you just want to maximize insurance coverage and reduce cost, then a term policy is most prudent. Just make sure that you don’t mind paying premiums that will not be recovered unless a death claim is filed.

Deciding on a type of plan should be consistent with your objective. If the only purpose of considering life insurance is protection, then a term policy is something you should consider. Further, if you just want to maximize insurance coverage and reduce cost, then a term policy is most prudent. Just make sure that you don’t mind paying premiums that will not be recovered unless a death claim is filed.

If you would like some savings to go with your insurance coverage at the same time, you may opt to get a permanent plan instead of a term policy. Some people would want some recovery of the premiums they are paying when the time comes they feel they don’t need any coverage anymore.

A traditional plan like a whole life insurance will have cash values that will accumulate over the years, typically with a guaranteed cash value and a nonguaranteed portion via dividends. Unfortunately, the returns of traditional insurance policies are very low, comparable to a time deposit rate. Accumulations in traditional plans are also on a long-term basis and will take you many years to break even.

A variable universal plan (or investment link), on the other hand, will provide better accumulation of funds as they are market-driven instruments. The downside of this product is that it does not offer any guarantees beyond death benefits. Still, it is expected to outperform traditional life insurance products over a long period of time, making it more popular nowadays.

Assess your need thoroughly—Would you want to combine your insurance coverage with savings and investment or would you want to do it separately? You can buy term and invest the difference—or you can buy a variable universal life policy that will do that for you.

If you want insurance coverage with guaranteed savings and are willing to accept low returns, then a traditional life policy is for you. If you want better returns but with volatility, then go for a variable universal life. If you just want the plain vanilla insurance, go with a term plan. There is no such thing as a ‘best’ life insurance product—it really depends on your need or affordability.

As to insurance companies, I’d recommend that you consider life insurance companies among the top 10 in the country because they are usually more stable and are highly reputable. I posted a ranking of the top life insurance companies of 2011 here.

The Insurance Commission monitors the operations of all insurance companies and has strict standards, particularly on solvency. Most life insurance companies are well capitalized and it is comforting to know that no life insurance company in the Philippines has ever folded up. It might also be a good idea to ask around about experiences of others with regard to after-sales servicing and claims paying reputation of different insurers.

For me and many others, customer service is a very important criterion—especially since a life insurance coverage is long term in nature.

You may want to get proposals from three life insurance companies of the same product and look at the benefits they offer. I notice premiums of some companies are substantially higher than others so it will be a good idea to be thorough when you are reviewing. Compare benefits and riders, add on those that you need and remove those that you think are unnecessary. When you are considering a variable universal life policy, check out the management fees—some charges are much higher than others.

Finally, I urge you to also be selective in dealing with your insurance advisor. I will go with an advisor who knows his products thoroughly, can answer most of your inquiries, can conduct a good needs analysis and will put your interest first before his sale. Unfortunately, quite a few insurance advisors have issues like misrepresentation or, worse, nonremittance of premiums. It is important that you deal with a professional and it is easy to spot one by observing the way he conducts his business.

Whether you buy from an insurance agent or from a bank (via bancassurance), make sure you get a policy that you need, you can afford, from a company that is reputable and from an advisor that you trust. Tip: If you notice that the advisor is so much in a hurry to close a sale and is more concerned about meeting his sales quota than your welfare, you might want to look for another advisor.

My prayer is that more Filipinos will be like you. More Filipinos have to be covered considering the benefits of life insurance.

This post appeared in the Inquirer.

I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.

I was given a recent study commissioned by the insurer Sun Life Philippines on financial literacy.