On-line life insurance

By Randell Tiongson on August 18th, 2015

38 million Filipinos are now regular internet users, according to a report by the Internet and Mobile Marketing Association of the Philippines (IMMAP). With the increasing number of Filipinos online, it’s important that services are available online as where so people can avail of them anytime, anywhere, at their convenience.

38 million Filipinos are now regular internet users, according to a report by the Internet and Mobile Marketing Association of the Philippines (IMMAP). With the increasing number of Filipinos online, it’s important that services are available online as where so people can avail of them anytime, anywhere, at their convenience.

Over the last few years, local companies have been making strides towards giving access to their services online, such as retailers, car insurance providers, banks, and others.

In light of the need to be online, AXA Philippines launched AXA iON or AXA Insurance Online, the country’s first online insurance store, last September. Their aim is to make insurance available to people aged 18 to 45 who may not have time or may be too intimidated to go into a brick-and-mortar insurance office, or are out of the country and can’t apply otherwise, such as OFWs.

AXA iON offers four different plans, to present savvy online consumers with basic products for securing their financial futures: Savings Exentials, which is like a levelled-up savings account with a guaranteed payout; Academic Exentials, for saving up for your children’s education; Life Exentials, which pays out cash for up to 60 months in case of your death or terminal illness; and Health Exentials, which covers you for 35 critical conditions or illnesses.

Customers can pay their premiums via Visa or MasterCard credit cards, through an auto-charge facility.

The whole process is online, meaning anybody can apply from whatever device they’re using. Simply visit axaion.com.ph, fill out the online application form, and pay using your credit card. No need to submit any forms or talk to agents – although a representative will call you after your application to confirm the information you submitted.

If you’re still more comfortable talking to an agent, though, you can use the AXA iON platform as a starting point to explore the options available to you, and then you can go to an agent with more questions to help you choose the right insurance coverage.

This online application is also good for our OFWs, so that they can safeguard their earnings and provide for their family without having to fill out a million forms and wait very long for the process.

Hopefully, more providers follow this lead. When the application process for vital financial tools such as life insurance and health insurance becomes easier and more convenient, more people will be insured, and will be on their way towards financial freedom.

Your life is your greatest asset. Manage your risks by making sure you’re adequately insured.

Do we really need car insurance?

By Randell Tiongson on August 8th, 2015

Question: My wife and I just bought our first car and we need help choosing the right car insurance. Is the basic CPTL insurance offered by the LTO enough? Or is it worth buying a comprehensive car insurance? If we choose the latter, what are the things we should be looking out for? –John Santos via Facebook

Answer: Congratulations on the new car! It’s natural to feel unsure and overwhelmed when buying car insurance for the first time. Let me guide you through the process.

When you register your car with the Land Transportation Office, you are required by law to get basic Compulsory Third Party Liability (CTPL) car insurance to protect against possible liabilities to third parties. According to the Insurance Code of the Philippines, a third party is defined as any person other than a passenger, family member, or household member of the vehicle owner.

When you register your car with the Land Transportation Office, you are required by law to get basic Compulsory Third Party Liability (CTPL) car insurance to protect against possible liabilities to third parties. According to the Insurance Code of the Philippines, a third party is defined as any person other than a passenger, family member, or household member of the vehicle owner.

In other words, CTPL protects pedestrians from potential damages or injuries that arise from the use of the insured car. This is compulsory and covers any bodily injuries or deaths caused for of up to P100,000. However, CTPL does not cover loss or damages to property, and is very limited in this regard.

Many non-life insurance providers also provide comprehensive car insurance. Essentially, comprehensive car insurance has a wide coverage and insures you against damage, car theft, liabilities caused by collisions, fire, malicious acts, acts of God (and nature) and personal accident insurance of the passenger. While this is not mandatory, it provides some measure of financial security by covering car repairs and other damages should any unfortunate incidents occur.

It’s smart to get this type of insurance because risk is an everyday reality. Accidents can happen to you anytime, and if you’re driving to work every day, you’re exposed to risks that you do not have direct control of.

To illustrate, EDSA accommodates more than two million vehicles on a daily basis. If you take Edsa to work, you’re exposed to more than 27,000 public utility buses that figure in the worst traffic accidents.

Another good reason to get comprehensive car insurance is the fact that the Philippines endures an average of nine tropical storms in a year. It’s like saying your car is at major risk at least nine times in a year! I have a lot of friends who had damaged cars during the worst flooding in Manila. Those who had Acts of God or Acts of Nature in their policy were well-taken care of by their insurance providers.

If any of these unfortunate incidents makes your car inoperable, comprehensive insurance picks up the tab for repairs and does all the legwork for you. So instead of doing the paperwork and trying to get them stamped at one government office after another, the insurance company will take care of all this. Depending on your coverage, they’ll even foot the hospital bills in case any passengers got injured in the accident.

When getting your car insurance, make sure that you read the fine print and understand what’s included and what isn’t. Many “comprehensive” insurance policies don’t insure against all types of damages, like riots or typhoons. Coverage for these instances will require additional clauses:

Acts of God or Acts of Nature covers damage from flooding and other non-manmade incidents

Personal Accident provides a small amount for any injuries sustained during a road accident

Medical Reimbursement lets you reimburse medical expenses from injuries related to the accident

Other add-ons include riot (for protest or riot-related damage), upgrade (for upgraded car equipment), roadside repairs and towing

Before including these add-ons to your coverage, determine how and where you use your car. For example, if you live in a flood-prone neighborhood, the Acts of God clause is worth paying for. If you drive to work daily, it’s safe to include the Personal Accident or Medical Reimbursement additions.

Get to know the top car insurance providers in the Philippines and see what coverage they have to offer. As a shortcut to your research, there are several websites offering comparisons among the car insurance packages of various providers. A good comparative website you can use is Moneymax.

These websites will give you quotes from four or more companies, and do a side-by-side comparison. This makes it easier for you to analyze your options and make your choice based on price and your own needs.

Make sure that you compare premiums fairly and objectively before making your final choice. Some insurance companies may offer very low rates, but the claiming process can be difficult.

Ask your friends which providers they are using and find out how easy or difficult the claims process was. Personally, I don’t mind paying a few pesos more if my insurance provider rescues me during my time of need.

Be safe, be secured.

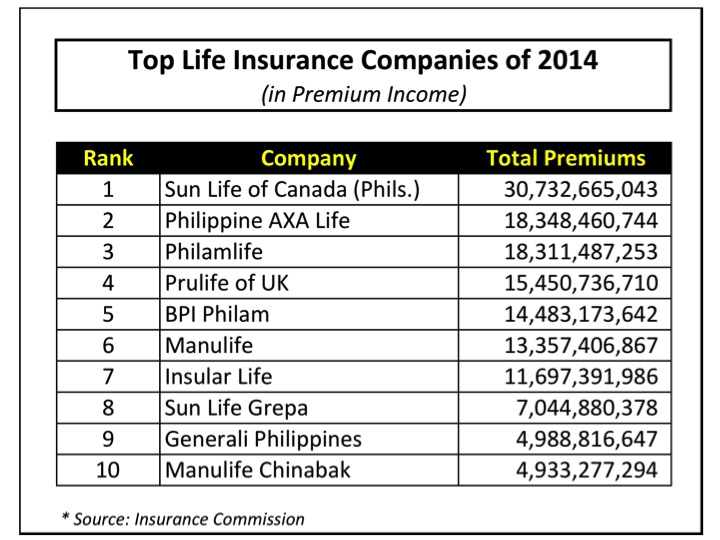

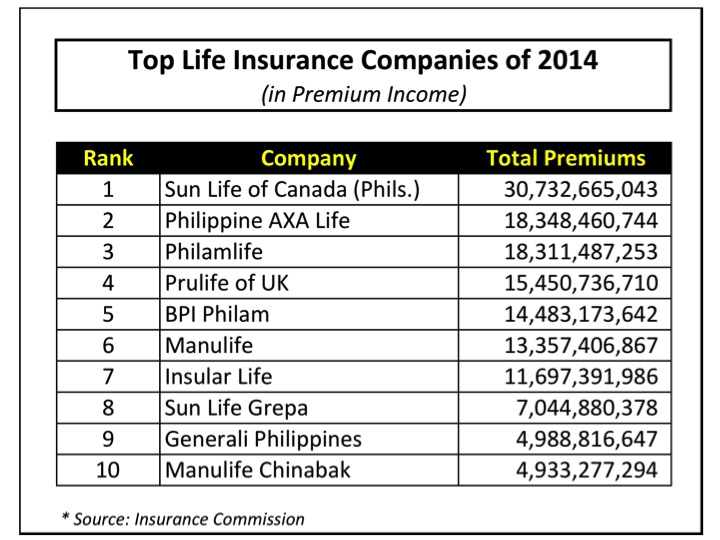

The Top Life Insurance Companies of 2014 in Premiums

By Randell Tiongson on April 7th, 2015

And the list of the Philippines’ top 10 life insurance companies in 2014 is released! Once again, Sun Life dominates the rankings for the 4th year in a row. With its increase in 2014 of a little over a billion pesos in total premiums, Sun Life proves to be among the most stable insurance companies. Apart from maintaining its prime spot, Sun Life has surpassed itself by creating a wider gap between the second top company, with a difference of little over twelve billion pesos in total premiums.

Having been in the insurance industry for over a century, Sun Life has been able to create products and services that are able to meet all the needs of people. Moreover this company is known for their relevant and significant marketing strategies, which have given them an edge in this industry, allowing the company to hold on tightly to that top spot.

While the top spot still remains the same, there has been a shift among the 2nd and 3rd spots. The year 2013 saw Philam Life and AXA Philippines at the 2nd and 3rd spot, respectively, with a difference of over a billion in total premiums. However this was not the case for 2014. AXA Philippines has bumped Philam Life off the 2nd spot and reclaimed the position they had held for many years, prior to 2013. With their aggressive and revolutionary marketing strategies, AXA Philippines proves, once more, why they deserve to be part of the top three.

Falling to the 3rd spot with just a small difference of thirty million in total premiums, the total premiums of Philam Life from America have dropped slightly from its phenomenal PhP 19 billion in 2013 to PhP 18 billion in 2014. Nonetheless, their performance is still top rate and noteworthy.

In the 4th spot is Prulife UK, which maintained its ranking of number 4. Although the total premiums of PruLife UK have decreased by PhP 3 billion from 2013, Prulife UK is still able to hold to its prime position in the rankings due to their strong marketing arm.

2014 has also seen a slight restructure in the rankings of BPI-Philam and ManuLife. Though they still performed well this year, ManuLife has fallen down a spot to the 6th ranking. With a little over a billion difference in total premiums, ManuLife is just a little behind BPI-Philam. Climbing to the 5th spot would be BPI-Philam. With its strong infrastructure and fantastic productivity, these two companies have been neck to neck, as seen in the rankings. SunLife Grepa’s performance has slightly gone down as seen in the rankings by being in the 8th spot. However the largest local insurance company improves and is seen to be going up the rankings by claiming the 7th spot.

Manulife Chinabank has also improved and is seen to have gone up the rankings to the 9th spot. However the 10th spot is now claimed by ManuLife Chinabak. Formerly held by PNB Life, the total premiums of PNB Life has gone down from its 6 billion in 2013 to 4 billion in 2014. A round of applause for ManuLife Chinabank though, for entering the top ranks.

Taking a look at the whole picture, 2014 produced premium income of P157,831,673,089. While this number is smaller than 2013’s total premium income of P170,280,660,057, it shows that there is stiff competition in the insurance industry and was brought about by lower single pay premiums. Ultimately, these numbers indicate that Filipinos are becoming smarter about their money, with more people seeing the value of setting some aside for their long-term financial security.

*Data from the Insurance Commission.

Complete rankings of all other categories (net income, net worth, assets, etc.) can be found at the Insurance Commission website or click HERE

38 million Filipinos are now regular internet users, according to a report by the Internet and Mobile Marketing Association of the Philippines (IMMAP). With the increasing number of Filipinos online, it’s important that services are available online as where so people can avail of them anytime, anywhere, at their convenience.

38 million Filipinos are now regular internet users, according to a report by the Internet and Mobile Marketing Association of the Philippines (IMMAP). With the increasing number of Filipinos online, it’s important that services are available online as where so people can avail of them anytime, anywhere, at their convenience.