Robbing yourself of future paychecks

By Randell Tiongson on September 22nd, 2016

How would you take the thought that you are stealing money from your future paychecks? Do you think that’s okay because you’ll have a bigger paycheck by then or the thought of it bothers you a lot?

That is what bad debt will do to you if you’re not careful with how you spend.

I will classify bad debt as money borrowed for debts that were spent on non-emergency situations. Some may think that a broken down smartphone or a travel getaway to another country with your friends. A funny definition of a bad debt is “using money you don’t have, to buy things you don’t need, to impress people you don’t like.”

But how will you avoid reckless spending that leads to debt? Here are some ways:

Change the way you see money.

The reason why most people go on a spending ban and binge spend after a month or so is because they view budgeting not as a lifetime goal but a short-term goal. There are instances when you’d do it for a trip or for an immediate purchase but not as a lifetime habit.

This is just the same as being in a debt cycle. You weren’t born wanting to have debt for unnecessary purchases. This is fostered through time and repeated actions.

Make the most of your age.

Are you below 30 years? This is the time that it will be beneficial for you to start investing and saving. You have more time to build your savings for retirement. If you are over 30, don’t fret. There is still time for you to build your funds.

It will be challenging at first because it is not mainstream to live below our means. Achievement will be looked partially through your new gadgets or new car by your peers. Remember that your true friends will not care whether you have the latest models of anything but for your friendship. Avoid giving in to peer pressure.

This is also the best time to begin investing. Do you know that investing only P2,000 a month with an average yield of only 8% p.a. will give you over a million in 20 years? Imagine if you invest more and in diversified investments? You may want to look at pooled equity funds like mutual funds or UITF; or you can start buying select stocks yourself. Remember, study the investment first and never invest in something you don’t comprehend.

Protect your loved ones.

This doesn’t mean that you will stop causing debt, but this can go on until you die. I don’t think you’d want your loved ones to pay for your wrong financial decisions.

Look through your life insurance coverage you have. Can this be used as collateral commitment to your loans so that no one will be bugged by this in the event that you die? Look at every debt you have and assess if this will be stretched until 20 to 30 years. Discuss this with your family members and your co-makers so they will get an idea of this and provide their insights on how you can bring this down.

Don’t borrow money which will not help you make more money.

If you are borrowing money to put up a business, then that’s good debt. If you are borrowing just to keep up with your neighbors or siblings, then that’s a bad one.

Ask yourself these questions before buying anything with borrowed money:

- Do I really need this?

- Can I find a more affordable option?

- Will this make me more money?

Compare prices before making major purchases.

Compare prices of smartphones with the same specifications so you’ll avoid overspending. Compare flights so you can get the cheapest rate to your destination. Never buy anything if you have not compared 2 to 3 option first so you’ll be sure that you got value for your money. I never buy anything on impulse, I try to check out all options before making any purchase.

Find other streams of income.

Let’s face it: one definite way to avoid debt is to have multiple sources of income since this can empower you to buy items in cash. Find ways to get other sources of income through online portals like Raket.ph, Kalibrr, and other job boards. Multiple streams of income is a a good idea!

Final Thoughts

You can achieve anything you concentrate and focus on and avoiding bad debt is no exception. Keep in mind that having bad debt robs you of your future income so avoid it as much as you can. Debt can can be good, bad or ugly; wisdom dictates you know which is which.

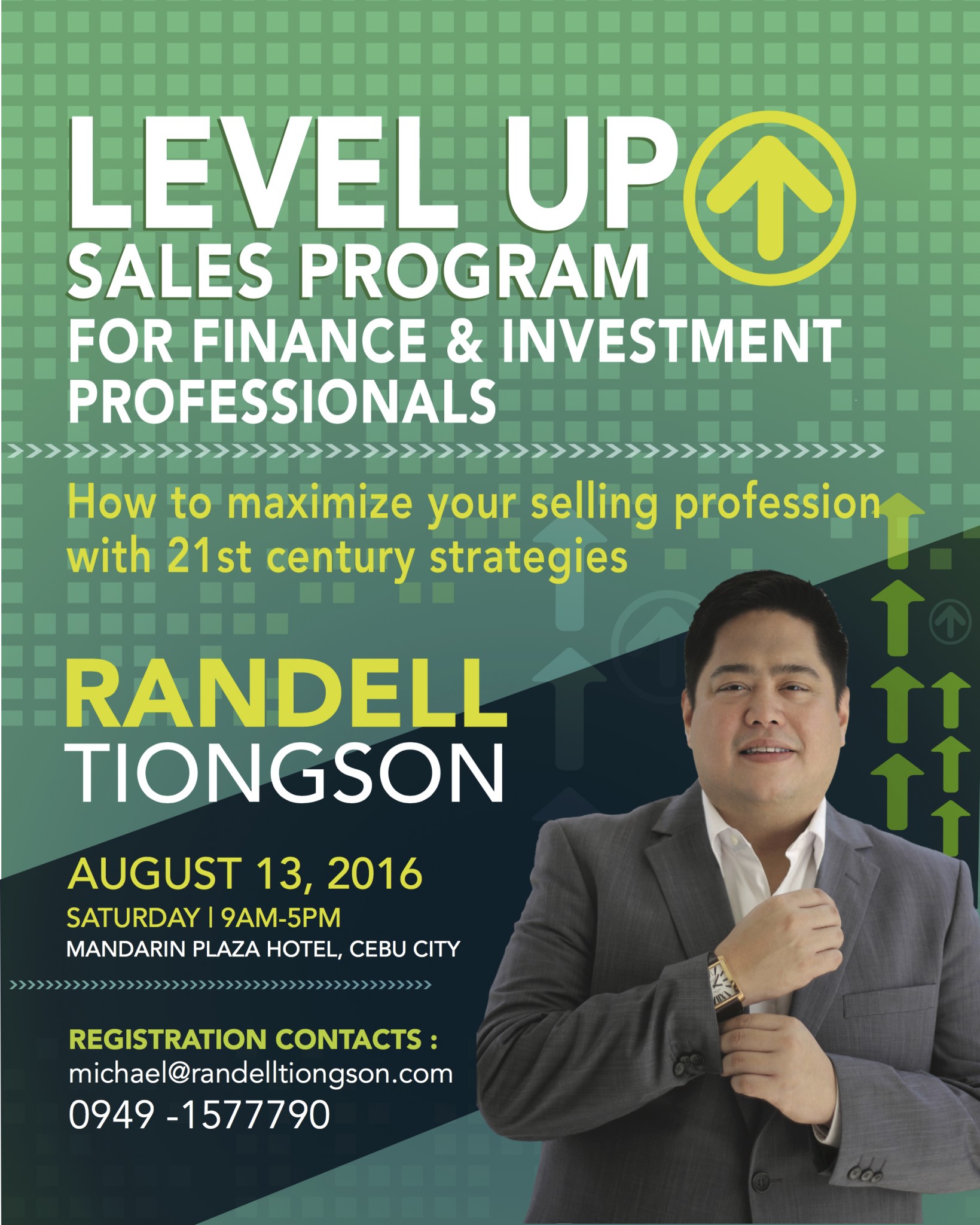

Level Up Sales goes to CEBU

By Randell Tiongson on July 6th, 2016

Are you in the profession of finance and investment sales and you are from Cebu? Join me as I bring my high value sales program that will help you level up!

Due to many requests for me to conduct my sales program in Cebu, I will be running the program on August 13, 2016 at the Mandarin Plaza Hotel, J. Solon Drive, Cebu City. The program will run from 9:00 am to 5:00 pm and will truly be an empowering program for the sales professional.

What do the participants say about this program?

“Randell Tiongson’s Level Up Sales Program is both timely and relevant because it provided key concepts on how to address the needs and behavior of the market today. I highly recommend it to sales professionals who would want to augment their skills and improve their sales performance”. – Ramon King III, Sales Director of Alveo Land Corp.

“Randell’s Level Up Program is highly recommended to all sales professionals. Satisfaction guaranteed!” – Jess Uy, Global Investing Advocate

“Randell’s Level Up program is for the serious minded financial planner who’s now ready to spread her wings and soar to new heights. Randell had condensed into a whole day program his many years of valuable experience in selling and financial planning. Let’s go pick his brains – it’s a highly recommendable program”. – Marian Goquingco, Financial Wealth Planner of FWD Philippines

“The session was very helpful especially for the sellers of investments. We were reminded to put the interest of the clients first before anything else. I also learned new sales techniques during the training.” – Jason Gutierrez, Team Leader at Rampver Financials

Why did I develop this program? I have often been asked for advise and guidance as to how to properly & effectively succeed in the sales profession– specifically in the industry of finance and investments. My answer? You should have the proper knowledge and develop the right skills as a foundation.

Many people believe that selling is an art and it is limited to those who are very good in soft-skills. While I agree that soft-skills are important for the sales profession, the science of proper selling is just as important, if not even more important.

If you are in the selling profession, specifically on financial services and investments such as insurance, mutual funds, UITF, stocks, real estate and other related industries and you feel that it’s time to “level-up”, you should attend my upcoming program: Level Up Sales Program for Finance & Investment Professionals in CEBU

The comprehensive program will cover 4 areas which I believe are 21st century strategies to thrive in sales:

- Buying Cycle

- Selling Cycle

- Behavioral Finance

- Powerful Sales Presentations

This program will incorporate effective theories validated by my 28 years of experience in the financial services industry.

Level Up Sales Program will only have a limited seating capacity to make it effective so make sure you register immediately.

The learning fee of the program is only P6,000.00 — an investment that will have exponential returns. Lunch and snacks are provided.

If you will register before July 22, 2016, you can avail my early bird rate of only P4,000.00

Follow the simples steps to secure your slot

- Deposit the training fee to my BPI Savings Account #0249-1113-09

- Send the photo of the deposit or transaction slip to michael@randelltiongson.com along with the following additional information:

- Full name

- Contact details (email and mobile phone)

- Company Affiliation

- Brief job description

- Years of experience

Join the program in Cebu and let me help you level-up!

Should I prioritize insurance or investments?

By Randell Tiongson on June 14th, 2016

Should I prioritize insurance or investments? Can’t I do both at the same time?

Those are questions I get asked a lot, and I understand why a few people may get confused. Whether you scour the web for personal finance resources or read books on how to handle and manage your money, there are different answers to the same questions. Other resources suggest doing both (insurance and investments) if you have a surplus of money. In my book, No Nonsense Personal Finance, insurance, which is step 4 in my 5-step ladder system, actually comes first before investments, which is step 5.

When to get insurance first?

I advocate getting insurance first over investments if you have people depending on you. Are you an OFW supporting a family back home? Are you the breadwinner of your family? If you are, then life insurance is vital for you. You are your own greatest asset, and if something unfortunate happens to you, what will happen to your dependents – your children, your spouse, your aging parents? Life insurance is there to give you and your dependents the peace of mind that if something happens to you (e.g. critical illness, disablement, etc.), that they will have the financial ability to face challenging times. Don’t take the risk and wait for something unfortunate to happen. Your monthly insurance payments are a small price to pay if you (for critical illness) or your dependents need to make a claim.

When to invest first?

As mentioned above, life insurance is for those with dependents. If your situation is the opposite (read: zero dependents), no one will benefit from your insurance policy. When you’re a fresh graduate still living in your parents’ house, how can you expect to support dependents when you cannot fully live independently? If this is the case, then you may opt not to apply for life insurance yet until you grow older and have dependents. Another option is to apply for term life insurance instead (versus permanent life insurance) which provides coverage for a certain time.

Can’t I do both?

Yes, you can do both. There are actually financial products which combine both insurance and investments. These are called VULs, or variable universal life insurance. With a VUL, you have both an insurance policy and investment account. This is perfect for those who do not trust themselves to maintain the discipline with investing. This is because if you invest outside of a VUL such as stocks or mutual funds, it’s up to you when you want to deposit more money into your investments. If you see yourself using a surplus of money to shop instead of invest, then VULs would be a better option for you. With a VUL policy, you are forced to make your monthly payments every month because you’re paying for both an insurance policy and your investments.

However, VULs are not for everyone, and it may be better to separate your investments from insurance. This is especially so if you have already built the habit to contribute to your investments and savings regularly. If you’re the type to save first before you spend, then you’re better off opening a separate investment account instead of a VUL policy. An alternative strategy that can work for you is BTID (Buy Term, Invest the Difference). You can buy a term policy which is cheaper than a VUL and invest the difference in a mutual fund ,UITF or stocks.

Buying a VUL or employing a BTID strategy will both work for you; it’s just an issue of preference.

No Nonsense Personal Finance

Insurance and investments are only 2 out of 5 aspects of my personal finance ladder system; however, all five aspects (learning to manage money, avoiding debt, saving, getting insurance, and investing) are interrelated. If you want to achieve financial freedom or become a winner when it comes to your personal finances, it’s important to learn and practice all five. You cannot invest and insure yourself if you cannot save a portion of your salary to pay the premium. In the same way, investments become futile if your debt is greater than your investments. What is important is you learn to balance the different aspects of personal finance. Before you know it, you won’t have to ask which you should prioritize first – insurance or investment – because the answer will come to you naturally.

Want to get a copy of my book No Nonsense Personal Finance: A Step by Step Guide? You can order from us directly and we will send it to your doorstep with no shipping cost! To order, simply follow the simple steps:

- Deposit P500.00 to BPI 0249-1113-09 under John Randell Tiongson

- Take a photo of the deposit slip or transfer advise as proof of payment.

- Send proof of payment along with your complete address and contact number to michael@randelltiongson.com

- Expect your book in a few days and enjoy the beginning of your quest for financial peace.