Ready, Set, Retire!

By Randell Tiongson on October 29th, 2018

Did you know that less than 10% of Filipinos prepare for retirement? Despite the growth of the Philippine economy and the growing wealth of many Filipinos, preparation for retirement is still not a priority to many.

Retirement planning is not rocket science but it requires a process and much understanding to find ways to properly prepare for it.

Attend READY, SET, RETIRE! A No Nonsense Retirement Planning Workshop and learn how to properly prepare for your retirement. At the end of the half day workshop, you will be able to understand how to plan for retirement and what learn the tools that will give you a life you deserve. Find out how you can truly live a life of comfort & learn about the proper investments that is best suited for your needs objectively.

Joining me at this workshop are two of the country’s most sought after experts in the are of finance and economics: Rex Mendoza and Dr. Alvin Ang

Mr. Rex Mendoza is the President & CEO of Rampver Financials, a dynamic niche player in financial services specializing in investments, and one of the biggest distributors of mutual funds and other financial products in the Philippines. He sits as a director of Globe Telecom, Prime Orion Properties, Inc., Esquire Financing, Inc., the Cullinan Group, TechnoMarine Philippines, Seven Tall Trees Events Company, Inc., Mobile Group, Inc., and Trustee of the Bataan Peninsula State College. Rex is also a member of Bro. Bo Sanchez’ Mastermind Group, and is cited by many as one of the best leadership and business speakers in the country. He served as the President & CEO of Philam Life, one of the country’s most trusted financial services conglomerates and was Chairman of its affiliates and subsidiaries. Prior to this, he was previously Senior Vice President and Chief Marketing and Sales Officer of Ayala Land, Inc. He was also Chairman of Ayala Land International Sales, Inc., President of Ayala Land Sales, Inc., and Avida Sales Corporation.

Dr. Alvin Ang, PhD is a professor of the Economics Department of the Ateneo de Manila University and a senior fellow of the Ateneo Eagle Watch. Currently, he sits on the Board of the Philippine Economic Society after serving as President in 2013. He was also the Director of the Research Cluster for Cultural, Educational and Social Issues at the University of Sto. Tomas. He has over two decades of professional experience in public and private sectors spanning development planning, policy formulation and analysis, investment research and economic forecasting, academic, consultancy and teaching. Dr. Ang is one of the most sought after though leader in economics.

Attending this program will truly help you prepare for the future. The learning fee for this amazing program is only P3,500.00 per participant, a small fee that can give you exponential returns. Here’s some great news, if you register and pay before November 15, 2018, you can attend the program for only P2,000.00!

Here’s how you can join the program:

- Pay the fee via BPI 0249-1113-09 or BDO 006440069496 (under John Randell Tiongson)

- E-Mail your screenshot or copy of deposit slip to [email protected] along with your full name and contact details.

Hurry, slots are limited!

Basic economic facts you should know

By Randell Tiongson on October 10th, 2018

Economics is often a subject matter people talk about with passion and yet there are also many who will shy away once the word “economics’’ shows up.

Investopedia.com defines economics as “… a social science concerned with the production, distribution and consumption of goods and services. It studies how individuals, businesses, governments and nations make choices on allocating resources to satisfy their wants and needs, and tries to determine how these groups should organize and coordinate efforts to achieve maximum output.”

I know definitions sometimes do not help so let me try to help you be a little more ‘economics’ smarter by discussing basic facts you should know.

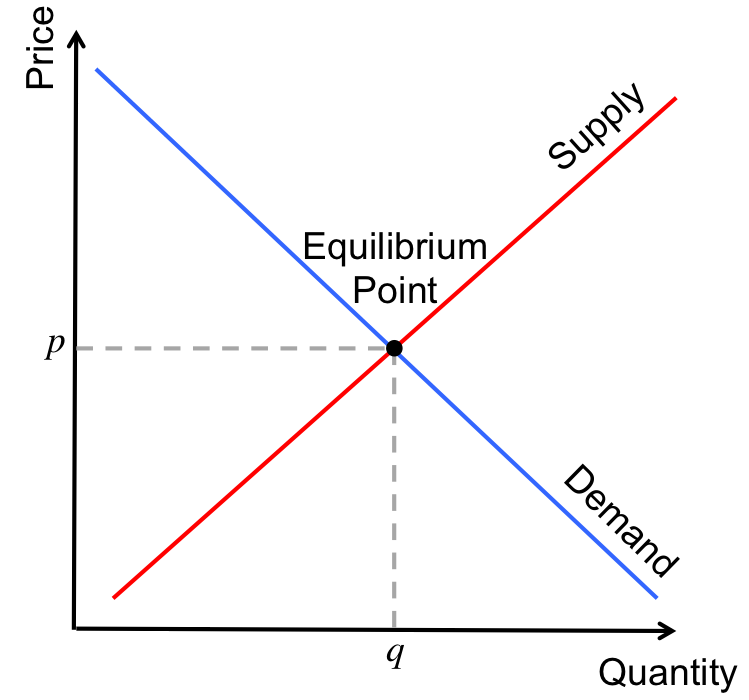

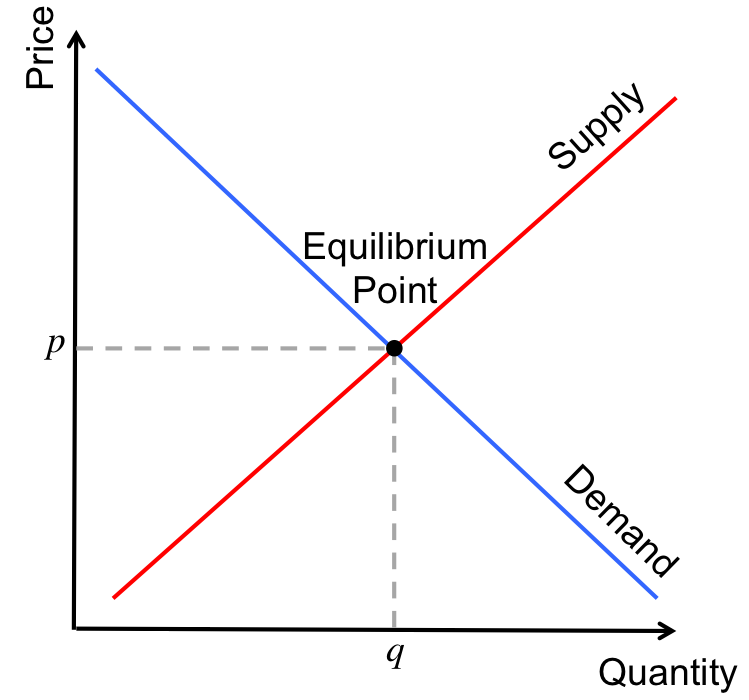

1. The foundation of economics is the “Law of Supply and Demand.”

Whenever supply of something increases its price decreases and whenever demand increases price increases and the reverse. The main reason why certain commodities are becoming expensive is because of the lack of supply and demand is constant or even increasing. For example, the price of rice becomes expensive because of lack of supply brought about by poor food production or lack of imports. When the supply of rice increases, you can expect the price to begin to go down. Sometimes, supply remains constant but demand goes down which will result to oversupply and you can expect prices to also go down. Once you get this fundamental law, you pretty much understand a whole lot more about economics.

2. Economics has two main streams: Microeconomics and Macroeconomics.

Microeconomics studies individuals and firms’ behavior, incentives, pricing, margins, etc. which helps in deciding allocation of scarce resources. Macroeconomics studies how the aggregate economy behaves. It deals with larger things such as interest rates, Gross Domestic Product (GDP), inflation and other stuff you would hear or read about in business news. Microeconomics is more useful for managers and macroeconomics is more used by investors.

3. Inflation.

We already know the prices gets goes up over the years. A bottle of your favorite soft drink was much cheaper when your father was young and it will be more expensive by the time it will be your child’s time. Inflation (measured in percent) is a measure of how much a bunch of products have increased in price from last year, or more commonly known as inflation rate. Mature economies like the U.S., Japan, U.K. and the like will usually have inflation rates of about 2% per year. Emerging economies like the Philippines will have higher inflation rates. One of the key roles of the Bangko Sentral ng Pilipinas (BSP) is to manage this rate and to keep it low. Obviously, this is easier said than done and there are many factors that can affect inflation, internal and external.

4. Gross Domestic Product or GDP.

This is the basic measure of the size of an economy. This is conceptually equal to the sum of incomes of all people in the country or sum of the market value of all goods & services produced within a country’s borders for a specific time period. GDP is computed on an annual and a quarterly basis. To simplify, GDP is a broad measurement of a country’s overall economic activity – the leader of the indicators.

5. Interest Rates.

When you lend money to someone, you expect to get some form of extra payment and that is essentially what interest is. Generally, the short term interest rates are being set by the BSP which they use to help manage economic activities such as inflation and money supply. If the BSP wants more money in the system, it lowers interest rates and if they want to map out excess cash in the system (which can contribute to inflation), they increase the rate. The BSP of late has been increasing the interest rates as a way to curb the very high inflation rates we are experiencing now. As to how effective this is in actually affecting economic activity is a discussion for another time.

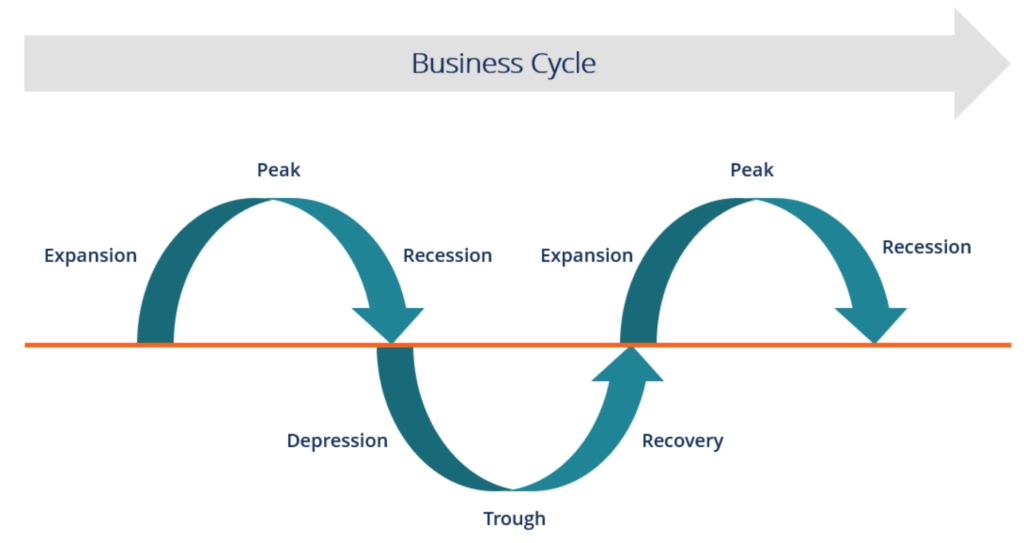

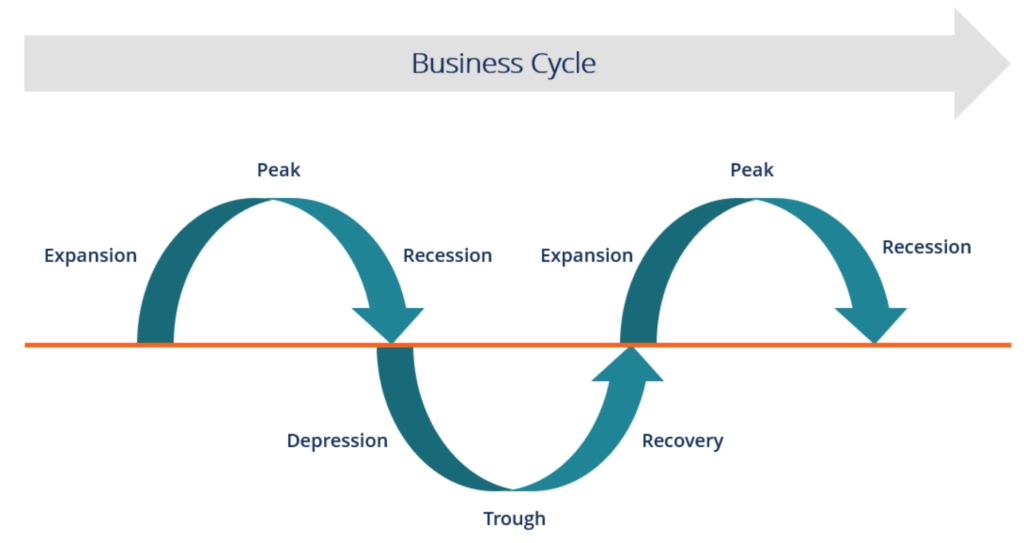

6. Business or Economic Cycle.

Economies have their periods of growth and decline in cycles of a few years with some economies experiencing longer cycles over some. The start of the cycle is recovery, followed by expansion, then by decline (or contraction) and finally by recession which is a period of negative growth and/or increasing unemployment. And the cycle goes on again, and again, and again.

7. Fiscal Policy.

To a great degree, the government can affect the growth of the economy by the way they spend. When the government spends more, it can lead to more demand which can increase price, thus high growth and higher inflation and vice-versa. Theoretically, governments try to spend more during periods of low growth & low inflation and cut spending during periods of high growth & high inflation. But then again, that’s only in theory it seems.

8. Monetary Policy.

Basically, it consists of the actions of the BSP, the Monetary Board and other regulators. Their actions lead to the growth or contraction of the money supply by setting interest rates, buying and selling of government securities and setting bank reserves. After all, money is the life blood of the economy so when you fiddle with money supply, you influence the economy as a whole. Again, that is in theory.

There you go, 8 fundamental facts you need to know about economics. It really isn’t as difficult as we thought it would be, right? Knowing more about these things will make you wiser in handling your finances and investments.

Now try to discussing these ideas with your friends next time you have coffee with them and they will think of you as more ‘economics’ smarter than they are, ha, ha!

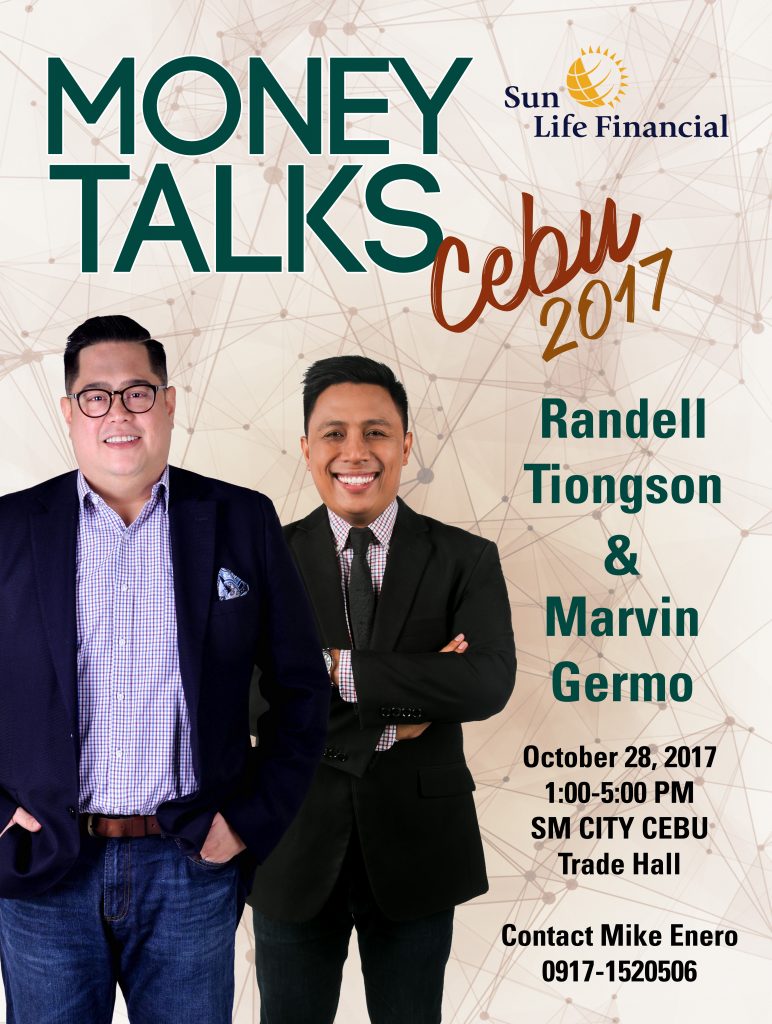

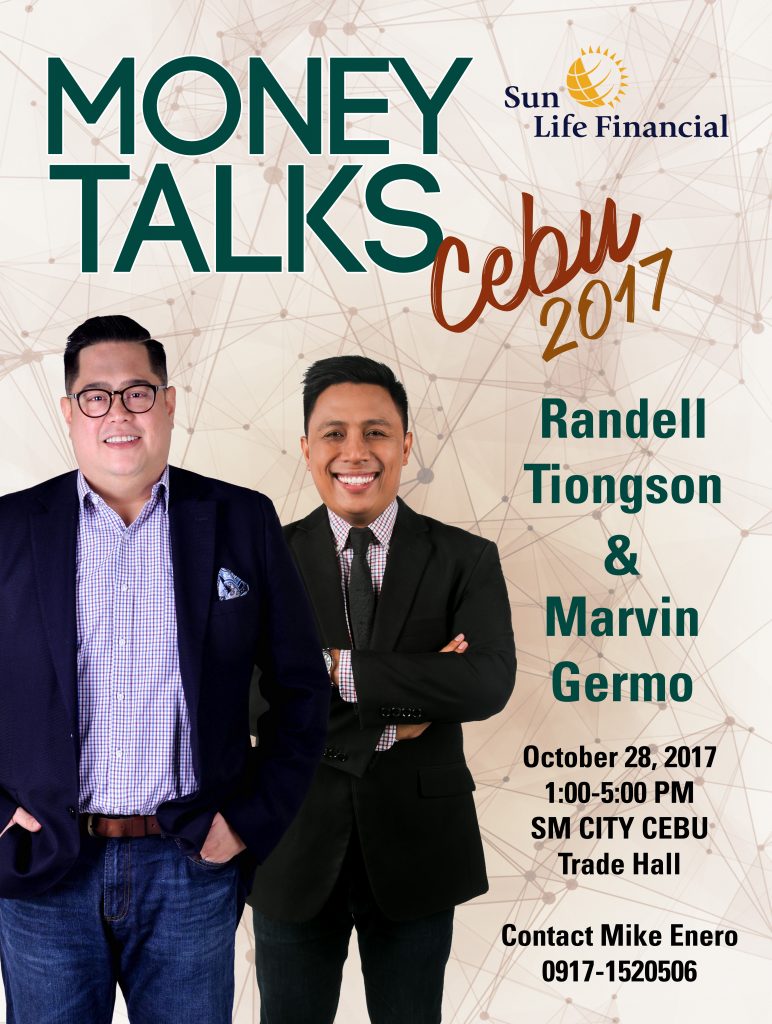

Money Talks CEBU 2017

By Randell Tiongson on October 13th, 2017

CEBU friends, it’s time to future-proof your future!

Join me and Mr. Stock Smarts Marvin Germo on Saturday, October 28, 2017 for a financially empowering seminar at the SM City Cebu Trade Hall from 1 to 5 p.m.

Topic 1: Future Proof Your Finance & Investments

Topic 2: Stock Market Investing Made Easy

Learning fee for this event is only P800.00 but slots are limited so you will need to secure your slot soon.

Here’s how you can join this event:

- Deposit P800.00 (per person) to BPI 0249-1113-09 or BDO 006440069496 (John Randell Tiongson).

- Get a screen shot of your deposit slip or transfer advice and email to [email protected]

- You can claim your ticket at the entrance of the event on the event date.

See you in CEBU!