Euro nations borrow from Philippines’ IMF fund

By Randell Tiongson on April 6th, 2015

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!

A recent post at the Manila Bulletin, it said that “the central bank reported that nine countries in Europe had withdrawn $439.50 million from its credit facilities with the International Monetary Fund (IMF).”

As a young elementary student in the 70’s and a high school and college student of the 80’s, I remember having to hear a lot about the International Monetary Fund and how the Philippines was so dependent on it for funding. The IMF was always mentioned as one of the main culprits why the Philippines was poor and how it was enabling the Marcos regime to enslave the nation. Wow, how things have changed from those times!

As a creditor member of the International Monetary Fund, drawing of funds from the fund is the Philippine’s participation to global financial stability. Can you imagine the Philippines contributing to provide ‘global financial stability’? There are 2 funds: IMF’s Financial Transaction Plan (FTP) and New Arrangements to Borrow (NAB). EU member nations Portugal, Ireland, and Greece were the biggest recipients from IMF’s FTP while other nations like Greece, Portugal, Tunisia, Cyprus and Ukraine was also accessed. The Philippines earns from said drawdowns by way of interest payments.

The country continues to register very strong Gross International Reserves (GIR’s) at $ 81.336 as of February 2015.

Another big change from before is our nation is not as indebted as it was before! In fact, the Philippines latest Debt to GDP ratio has improved to 37.3% as compared to 39.7% a year ago. The growth in the Philippine economy has made our debt management easier and we are outperforming many other nations. Our debt to GDP ratio is better than our ASEAN counterparts. The US’s debt to GDP ratio stands at 102.47%, Japan at 227.2%, France at 92.2%, Italy at 132.10%, Singapore at 105.5% and Thailand at 45.7%.

Admittedly, there are much more that needs to be done to ensure sustainable economic gains for the Philippines, one of which is the issue of inclusive growth. However, one cannot argue that the economic condition of the Philippines today is in a much better place than where it was decades ago. Let us continue to work hard at improving our nation, and having the faith to see real and sustainable progress in this generation… our gift for the next generation.

Ph economy to zoom past peers

By Randell Tiongson on April 2nd, 2015

We have been reading a lot of positive news about the Philippine economy. Despite the cynicism of many, our economy continues to grow and has been attracting a lot of deserved attention. For 2015, we are poised to continue to grow and not only are we expected to perform well, we are expected to outperform our peers.

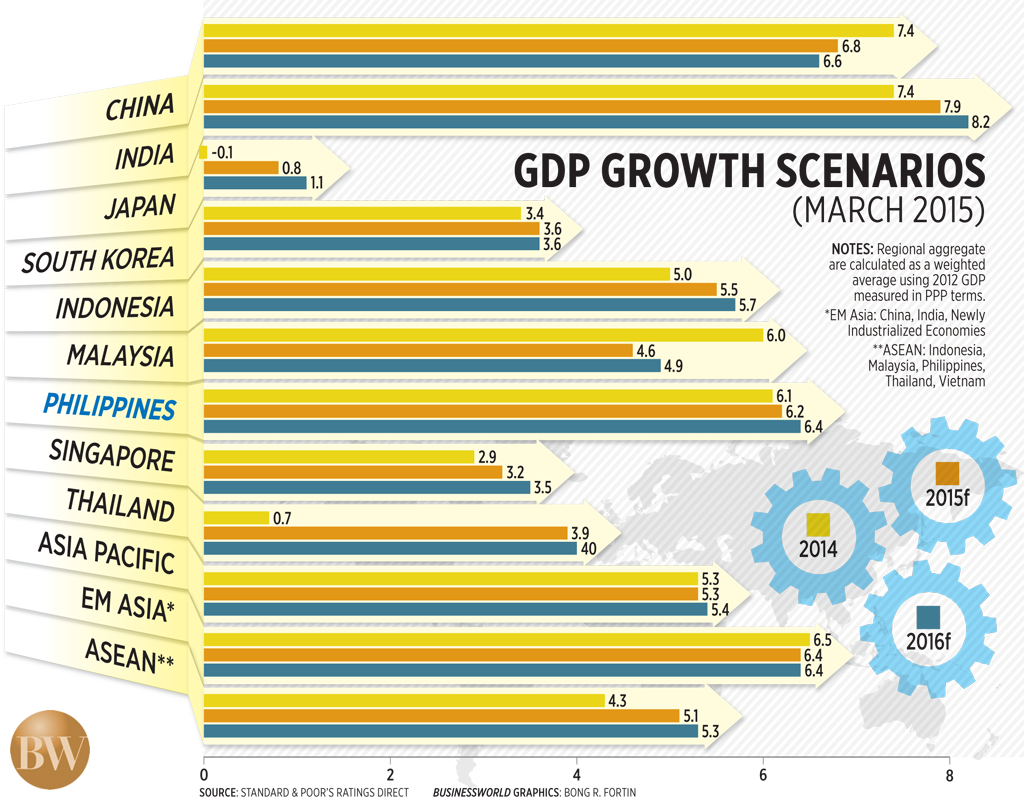

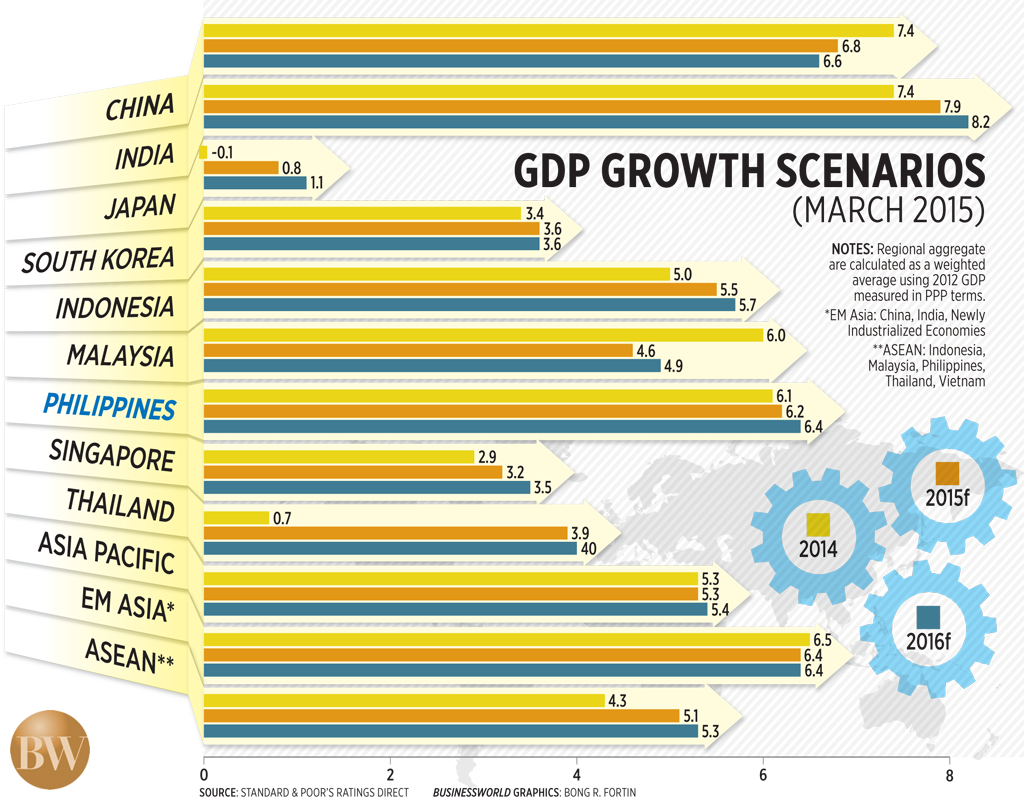

In a recent article by the Business World, it stated the we are to outpace our peers. Click HERE to read the article.

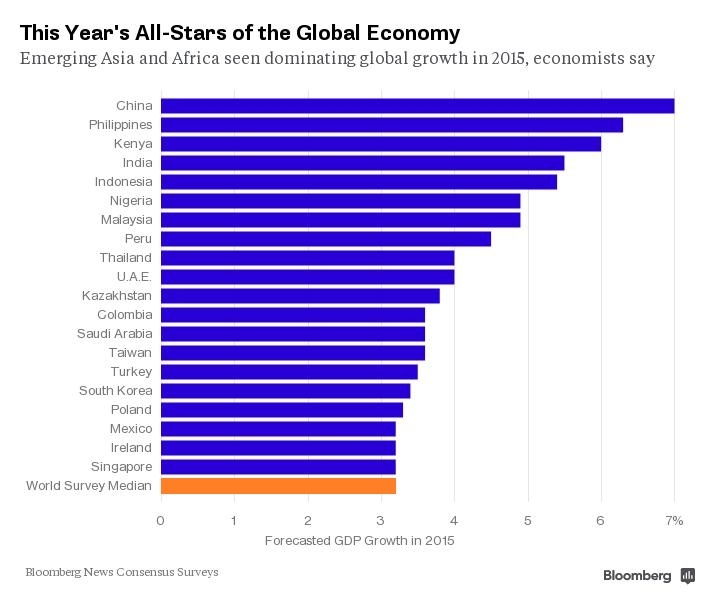

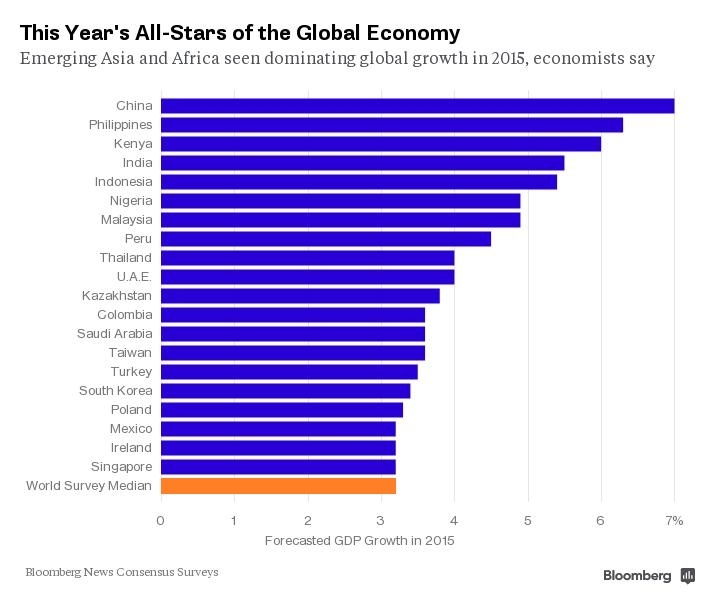

Bloomberg, a leading finance media also reported that the Philippines is expected to place 2nd in terms of economic growth, just below the economic behemoth China. To read Bloomberg’s article, click HERE

Despite the bullishness, the Philippine economy is not without any threats:

- Poverty and high un/underemployment

- Rising inflation

- Power deficits

- Natural disasters

- Logistic problems – port congestion, truck bans, etc.

- ASEAN – more competition from foreign companies (for market share and skilled labor and professionals)

- Political uncertainties (going into 2016 elections); continuation of economic and governance reforms

However, the economic threats are shadowed by opportunities:

- Transiting to higher levels of economic growth

- Sectoral and regional growth drivers)

- Increasing GDP per capita

- Peace dividends – expanded markets in Mindanao

- ASEAN integration – larger market for expansion and FDI attraction

- ASEAN – lower import prices for inputs

- Demographic Sweet Spot (majority of population now in the working/productive age)

I grew up always hearing that there is little hope for the Philippine economy, that we are buried in debt and that we are the ‘sick man of Asia’. Today’s ‘millennial’ generation are hearing another story and I pray that they will pass on the nation to their next generation in an even better shape.

Let us continue to honor the Lord for what He has been doing to our nation…

“Blessed is the nation whose God is the LORD, the people he chose for his inheritance.” — Psalm 33:12, NIV

2015 Outlook, part 12

By Randell Tiongson on February 4th, 2015

Years of steady structural reforms under 4 Presidents, improved demographics, technology shifts and many other factors have been factors behind the Philippine growth story. I would like to personally thank the BSP for being a strong institution that has made all this growth a reality.

As I close this 2015 Outlook series, I believe that the best way to do so is to feature the views of one of my favorite economic icons in the country, BSP Deputy Governor Diwa Guinigundo. How I wish more and more people can learn from him which will not only give you wisdom, it will help you with your faith.

The 2015 Outlook of BSP Deputy Governor Diwa Guinigundo

I continue to see the Philippine economy performing in accordance to its higher potential capacity. Four factors support this trend that many people may not be exactly aware.

One, with sustained technology application, total factor productivity has improved over the years. Two, economic efficiency has gained more traction. Three, labor market dynamics have been favorable with more educated, more trained graduates joining the labor pool. And finally, demographic factor has been supportive with more young people keeping the dependency ratio relatively low.

What drove these growth-positive factors have been the twenty years of steady policy and structural reforms. These are  clearly a demonstration that the Philippine Government has attained a good sense of governance. Four presidencies have continued with building institutions. If nations fail because of bad institutions, one can therefore argue that the Philippines has achieved strong resiliency because it has been heavily engaged in institution building even through the Global Financial Crisis in 2007-2009.

clearly a demonstration that the Philippine Government has attained a good sense of governance. Four presidencies have continued with building institutions. If nations fail because of bad institutions, one can therefore argue that the Philippines has achieved strong resiliency because it has been heavily engaged in institution building even through the Global Financial Crisis in 2007-2009.

It should not therefore be surprising if I will uphold the government target of 7-8 percent economic growth in 2015 and 2016. I see more diversified sources of growth: more investment and public spending supporting private consumption, manufacturing, construction and agriculture contributing to the growth process complimentary to services. That growth range has been achieved at some point in the past, I don’t see any reason why that should be elusive in the future. What we need to see is more infrastructure and infrastructure.

With investment grade continuing to go up, both domestic and foreign investment should remain bullish about the Philippines. Infrastructure including power should remain the focus of these investments.

With good supply prospects and pro-active monetary policy, helped by the decline in oil and other commodity prices, I see inflation averaging at a rate comfortably within the lower target range of 2-4 percent for both 2015 and 2016. The BSP and the national government have good monetary and fiscal space, respectively, to continue promoting price stability and good public finance.

On the external front, I see our initial forecast of sustained external payments surplus continuing to be broadly appropriate. The balance of payments should be able to bounce back strongly from a shortfall in 2014 to a surplus in both 2015 and 2015, with the current account expected to show increasing positive position of at least $6.0 billion.

These are premised on one, recovery in the global economy but at an uneven pace. This dimension is important because unevenness should lead to divergent monetary policies. US is turning the corner so I expect it to start preparing the stage for some tightening which could result in some capital outflows in the Philippines. Europe and Japan remain soft so monetary policy is needed to be accommodative which could drive some capital to flow to emerging markets including the Philippines. China and India are the other difficult challenges with structural issues threatening to pull them down so we should see a generalized easing among many central banks. All told, the asynchronous policies could pull each other apart and generate some volatilities in the global and regional financial markets. The Philippines should be very vigilant in monitoring these developments and should be prepared to act decisively as necessary.

I also expect to see our strong and stable banking system continuing to provide additional resiliency to the economy. Financial intermediation is expected to remain supportive of economic growth. With key reforms in place and expected to be pursued, market confidence should remain strong and this is something that does not come by easily.

There would always be some risks even at the tail end. This is the reason why the BSP is always doing stress tests and scenario building exercises to ensure we are not surprised by external shocks. This is the reason why we have a stable of early warning systems on the key sectors of the economy including the business cycle.

So paraphrasing Einstein, let me say that what is incomprehensible about the economy is that it is comprehensible.

Mr. Guinigundo is the deputy governor of the Bangko Sentral ng Pilipinas in charge of monetary policy and operations, international relations and operations, currency management and regional monetary affairs. He was the Philippines’ representative at the IMF, Washington, DC as alternate executive director. Previously, he was head of research at the Southeast Asian Central Banks Research and Training Center in Kuala Lumpur. At present, he chairs the SEACEN Experts Group on Capital Flows and a member of the SEACEN Executive Committee. He sits at the NEDA Board, National Food Authority Council and National Home Mortgage Finance Corporation Board.

Mr. Guinigundo is the deputy governor of the Bangko Sentral ng Pilipinas in charge of monetary policy and operations, international relations and operations, currency management and regional monetary affairs. He was the Philippines’ representative at the IMF, Washington, DC as alternate executive director. Previously, he was head of research at the Southeast Asian Central Banks Research and Training Center in Kuala Lumpur. At present, he chairs the SEACEN Experts Group on Capital Flows and a member of the SEACEN Executive Committee. He sits at the NEDA Board, National Food Authority Council and National Home Mortgage Finance Corporation Board.

Outside government, Mr Guinigundo is the senior pastor of a local Christian church, Fullness of Christ International Ministries, and advises the BSP Christian Fellowship. He leads in the nationwide Touching Heaven Changing Earth which aims to unite the body of Christ in the Philippines.

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!

Here’s something very interesting to read: 9 EU Nations borrowed nearly over $400M from the Philippine’s IMF fund!