Associate Financial Planner UAE 2016

By Randell Tiongson on August 4th, 2016Just 3 years ago, we launched the Associate Financial Planner (AFP) ® program for the Filipinos in the Middle East and held our first certification class in Doha, Qatar. More than 20 participants from Qatar and the UAE joined the milestone initial program. Since 2013, the AFP program has been helping improve the financial lives of many Filipinos in the Middle East by way of objective and structured financial education. To date, there are almost 200 AFP’s from Qatar and the UAE and these AFPs are really making a difference.

We are pleased to announce that the AFP will be holding 2 runs in the UAE this September 2016.

Abu Dhabi – September 9 & 10, 2016

Dubai – September 10 & 11, 2016

Why the AFP?

Because of the increasing financial awareness and prosperity of many Filipinos, the demand for financial products and financial advisors has been growing through the years. However, while there have been many who claim to be financial advisors, there has been a need for certified advisors to be differentiate a properly trained advisor from one who is not.

This differentiation can be achieved by choosing to become an Associate Financial Planner (AFP®), a professional designation awarded by the Registered Financial Planners Philippines, the Philippine’s leading financial planning institute.

Become an Associate Financial Planner (AFP)®

The public is looking for a financial planner who has demonstrated a commitment to competency, and financial professionals want an established certification that will set them apart in the globally expanding financial planning profession. As an AFP®, you can energize and revitalize your career by leveraging the knowledge and prestige associated with one of the world’s most recognized financial planning certification.

Benefits of the AFP® Certification

– Immediate recognition from clients, peers and employers with AFP® designation after your name.

– Strict eligibility criteria mean only a selected few are privileged to hold this designation.

– Provides a good starting point for professional who have the necessary skills sets and knowledge in basic personal financial planning.

– Provides an interim designation while you are pursuing the Registered Financial Planner (RFP®) quantification in the future.

– Become part of the preeminent financial planning organization in the country, the Association of RFPs in the Philippines with numerous benefits, including access to technical sessions, events, seminars and conferences.

What will be discussed during the AFP® Program?

- Personal Finance Steps

- Insurance Planning

- Behavioral Finance

- Investment Planning

- Time Value of Money

- Stock Market Investing

After completing the training program, a qualifying examination will be performed within 1 to 2 months after the program. Those who pass the exams can apply for membership to the AFP®

Who will be conducting the AFP® Program?

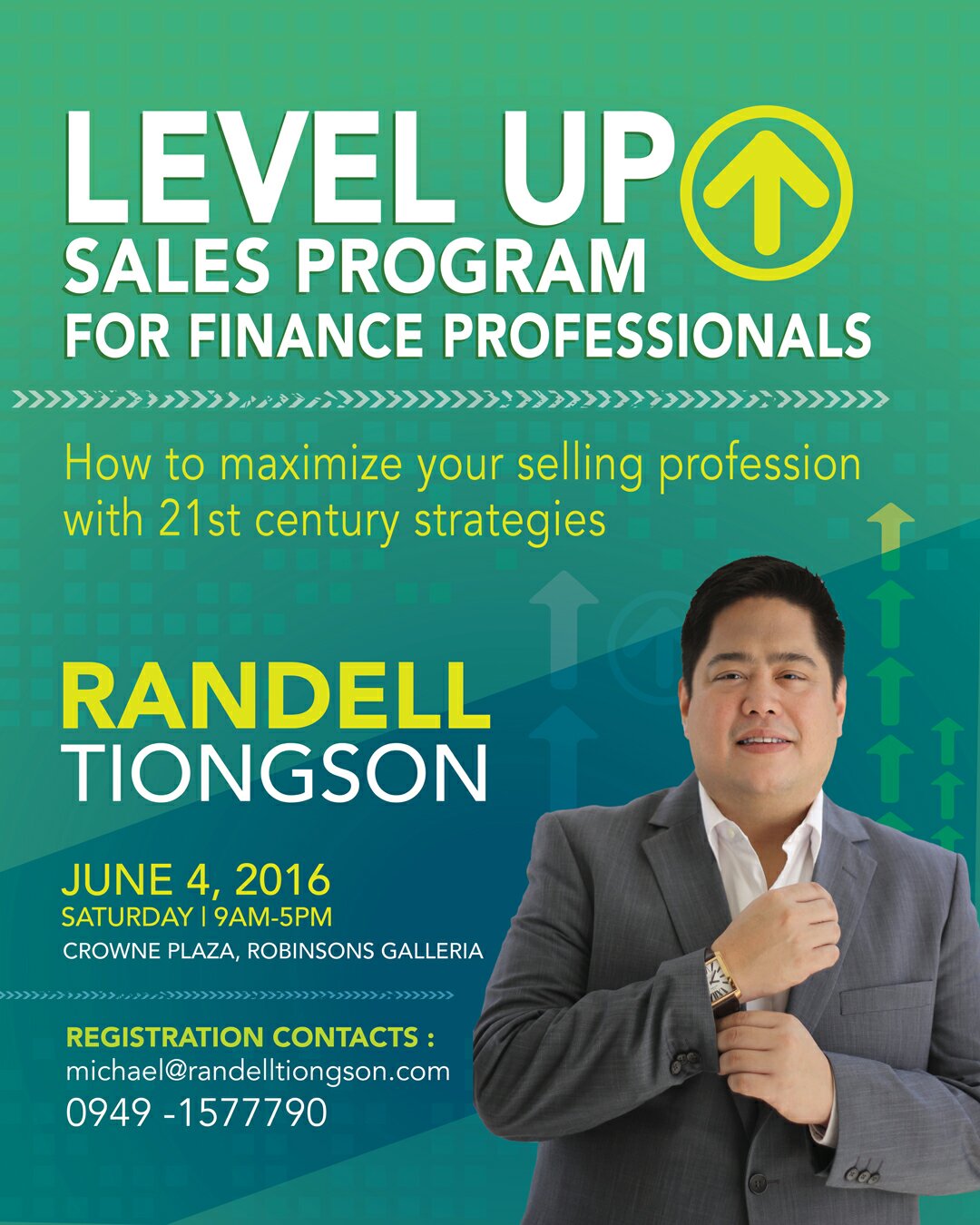

Randell Tiongson, RFP is the director of the Registered Financial Planner Philippines and has been engaged in the financial services industry for nearly 3 decades. He is one of the most respected personal finance speaker and educator in the Philippines and has given over 1000 lectures & training on finance through the years. He is a columnist of the Philippine Daily Inquirer, best-selling author of 4 finance books.

Marvin Germo, RFP is the Philippine’s most in demand speaker and educator on stock market investing. He has given hundreds of seminars on investing in equities for Filipinos across the globe. He is frequently seen in Philippine media on the subject matter of investing and he is also a best-selling author of 4 books on investing and the stock market.

If you are interested to become an AFP®, please send an email afpdubai@yahoo.com or click HERE

Testimonials from the AFP®’s from the UAE

“The AFP® helps me pursue my personal commitment in helping others with their financial journey (giving back to the community) as a form of social responsibility. The AFP® has also served as a venue for me and my fellow Overseas Filipinos to find and validate opportunities of investment vehicles where we grow our hard-earned money.”

Francis Medina, AFP (Business Manager and entrepreneur)

“I initially wanted to join the Program just to advance my knowledge in money management and get a clearer view of my own total financial life. I have attended a few talks provided by financial institutions and naturally most of them are product-driven. I yearn for unbiased views on personal finance and was in search for programs where the focus is on the concepts and not on the products. This is what AFP has provided me – Financial Planning, which is customized and goal-focused, thereby providing need-based solutions to an individual’s financial circumstances.”

“Through the AFP I have been equipped with the tools and knowledge to navigate the complex landscape of personal finance. The program has somehow boosted my confidence and has also facilitated the establishment of strong networks within the Filipino finance community. What I’ve learned at the AFP was something wonderful that I just had to share it to my immediate community. Today, as a community leader, I am imparting what I’ve learned to my fellow Filipino Expats in the UAE by pushing financial education. For me the AFP is not just a title; it has become a way of life.”

Charry Dela Cruz, AFP (Private Banking & serial investor)

“The AFP program is more than just a professional certification program. Being an AFP means being a life-long advocate of financial literacy.”

Gemmy Lontoc, AFP (Remittance Manager & community builder)

“The AFP taught me 3 things: To connect, to grow, and to contribute.”

“The AFP helped me connect with people who share the same passion. These same people helped me grow my expertise and contribute to my fellow OFs by helping them cross the bridge to financial security.”

Josh Mallo, AFP (Oil & Gas industry & stock market investing aficionado

“My affiliation with the AFP made me more confident and courageous in sharing financial literacy among my church group. An answered prayer indeed, 50 of my church mates and our beloved Pastor attended our financial literacy event last 3rd of June, 2016.”

Ivy Datanagan, AFP (Accountant & financial education advocate)

The AFP gave me a more structured way of handling my personal finance and paved my way to more investment opportunity. The AFP became a n opportunity for me to meet like minded persons who aims to make a difference in the life of OFWs.

Jermain Poncardas, AFP (Registered Nurse & personal finance advocate)