Personal Finance Q&A

By Randell Tiongson on February 15th, 2019

I get a lot of personal finance questions on a daily basis which I always try to answer in the best possible way I can.

Let me share you some questions I received and my answers…

What are UITFs? Asked by Therese

UITF stands for Unit Investment Trust Funds, it is a kind of investment that is being offered by the trust departments of big banks. UITFs are pooled funds, where investors put money in a fund and there is a fund manager that will invest for them according to the objectives of the fund. Depending on where it is invested, UITFs can be conservative, moderate or high-risk investments. UITFs are good investments for long-term objectives such as retirement or the college education of young children. Though they are not guaranteed investments, they have proved themselves to be a good way to grow your money in the long-run. Remember that UITFs are long term investments so if you plan to use your money in the short term, do not put them in UITFs.

Should I invest my money in business or in the stock market?Asked by Jason.

Comparing a business and stocks is difficult, like comparing apples and oranges. While both are investments and both are risky ones at that, they operate and function differently. Owning a business means you are operating it yourself and you are on top of the company. You have a direct involvement on how the company operates. The benefit of having your business is that you own all the profits and the gains of the business. The downside is that should the business fail, you will bear all the losses and you may not have the competence and experience to make a business succeed. Stocks are fractional ownership of businesses, big ones at that. Buying stocks lets you have a part of a successfully big company or several companies and you stand to earn dividends or capital gain of your shares when you trade them in the stock market. Downside of stocks vs. business is your gain, an issue of scale. You stand to get a much better return for your money when your business succeeds as against stocks.

What the risks are in investing your money?Asked by Patrick

Well Patrick, the biggest risk involved in investing is capital loss. While some investments are guaranteed, the good ones where you can earn more are never guaranteed. Returns are always a function of the risk you take – the higher the risks are, the higher the potential returns. Some investments like stocks and mutual funds are fluctuating – they do not appreciate in a straight line and expect them to be fluctuating constantly. But if you invest over a long period, like over 5 years, the chances of loss of money is minimized as investments fluctuate up over the years. Low risk investments are not necessarily free of risk – the biggest risk for guaranteed or low investments is inflation. Low risk means low return and they are often below inflation rates.

Who should be in charge of the money, the husband or the wife? Asked by John

Our Filipino custom dictates that the wife should be in charge of the finances. However, our customs are not always right. Finances are conjugal and how to manage money should likewise be conjugal. I don’t think only one spouse should be given the sole responsibility on how to be in charge of the money – both should discuss and agree as to what to do with their finances. The operation of the family budget like payment of bills, balancing of the check book and the like can be delegated to the husband or the wife. Which spouse? Well, the one who is more financially disciplined should be the one – whether a husband or a wife.

Is there is a formula to be able to build wealth. Asked by Bianca

Yes Bianca, there is a formula — a fundamental process that you can follow that will allow you to build your wealth. Let me first say that achieving wealth is a process and there are no short cuts to wealth. In my book No Nonsense Personal Finance, I outlined 5 steps for wealth. First step is to increase cash flow; you can achieve this by earning more money and spending less money. Step 2 is getting out of debt – as debt will prevent you from achieving your goals. Step 3 is building your emergency fund – 3 to 6 months worth of your expenses is a good measure. Step 4 is getting insurance for your protection. Finally, the 5th step is learning to invest for your future.

Got more questions? Let me know and I will try to answer them!

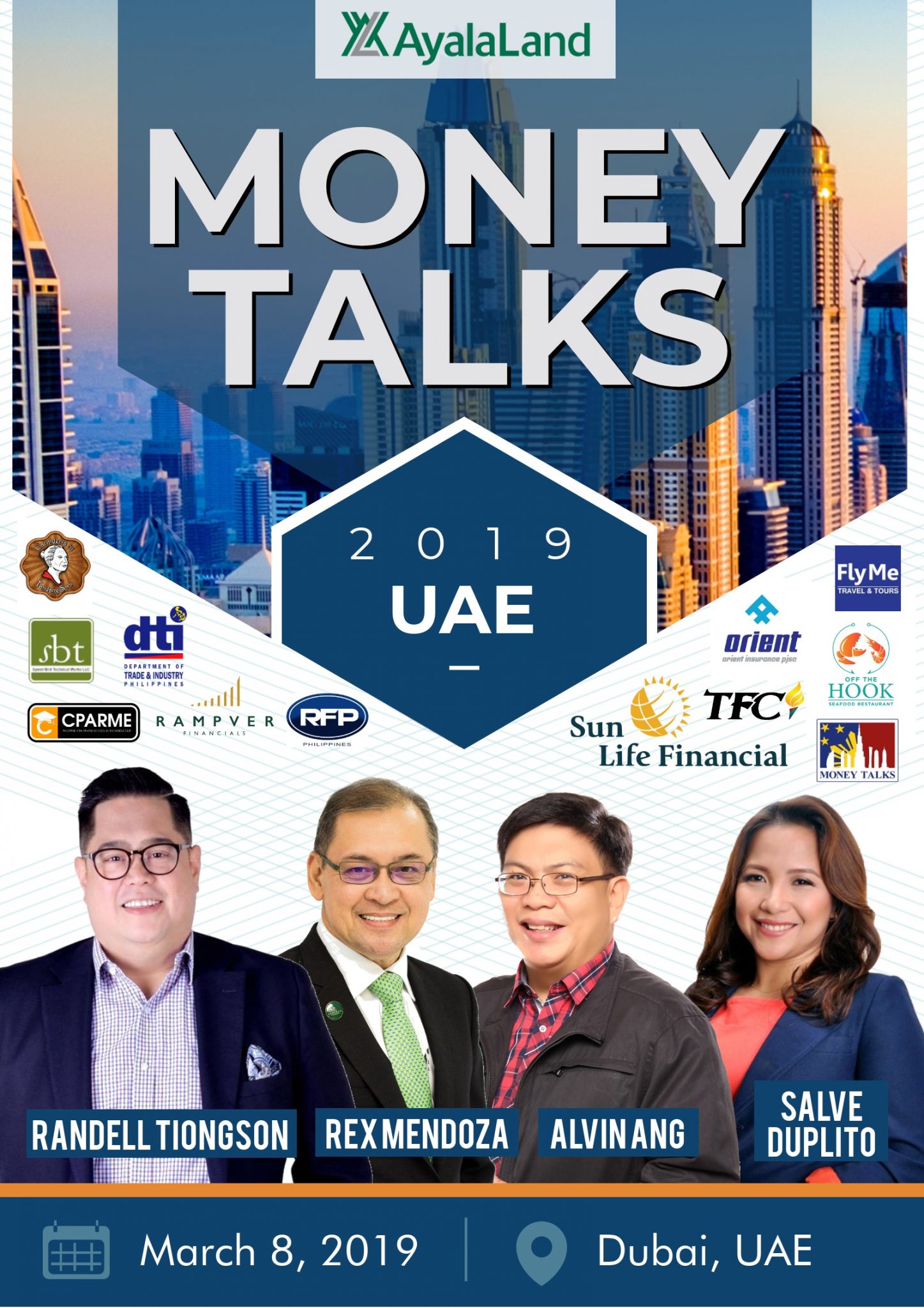

Catch me at my seminars in Dubai, Japan and Manila

Dubai – www.bit.ly/RFPUAE2019 Dubai – www.bit.ly/MTUAE2019

Dubai – www.bit.ly/MTUAE2019

Japan – www.bit.ly/investinginsightsjapan2019

Manila – www.bit.ly/ICON_2019

Can the Philippines go cash-lite?

By Randell Tiongson on December 4th, 2018

Question: I’ve been thinking of carrying less cash and becoming more cash-lite but I am not savvy enough to see my money on my smartphone rather than wallet. I’m not confident enough without my tangible asset. I am 42 years old and my kids are telling me to go online to manage our business. What is your advice?

Answer: Congratulations on that huge step of considering to go cash-lite! We all need that nudge from our children and peers. I fully understand that comfort of seeing your money within reach — whether be it in your wallet, safe or hidden under your pillows. Since you are managing a business, may I suggest that you opt for a cashless platform that can streamline your business.

Everywhere in the world, we are seeing societies move towards going cashless. Take a trip to a developed country and you’ll see that it’s more common to see residents paying with their cards or e-wallets instead of bills and coins like in Canada or China.

In the Philippines, although it is still an emerging economy, we are not far from becoming more cash-lite. In Asia, the Philippines is one of the hubs for online shopping. In fact, earlier this year, Visa conducted a Consumer Payments Attitudes Study, which revealed more and more Filipinos are going cashless due to its convenience.

The survey added that in 2018, more Filipinos use digital payments and are spending 15% more on their cards than they did in 2017. Of the survey respondents, 92% said that they shop online compared to 71% just two years ago. For majority of them, online shopping has become more than a once-a-month habit. The survey also found that Filipinos use online payments for their utility bills, clothes shopping, food delivery, and online streaming.

Looking at your situation, it appears that you have a conservative approach when it comes to digital transaction. While there are many payment providers nowadays, it is advisable that you check what are the latest digital banking options that your bank current offers.

Most if not all banks in the Philippines are now EMV-enabled meaning even if you’re not tech savvy enough, you can use your bank’s ATM or Credit card to facilitate online bank transaction including payment and money transfer. Top banks like BDO, BPI, and Metrobank have their own respective app you can download where you can keep track of your transaction and check your balances.

While the big three may be the obvious choices for newbies, there are banks like Security Bank that is ahead among the pack when it comes to offering online products and services catered to streamline business operations.

The bank caught my attention when it was named the Best Bank in the Philippines for 2018 by no other than New York-based Global Finance. The awarding body said that regardless of the bank’s size, Security Bank’s online banking service triumphed over the Big Three Banks.

The bank has upgraded its mobile app interface, allowing a seamless banking transaction from checking one’s account balance to transferring funds. It also has an eGive Cash feature, which allows real-time fund transfer from an account holder to its recipient, regardless if the receiver is a Security Bank account holder or not. eGive Cash can be withdrawn from any of Security Bank’s ATM.

Lastly, the one that is perfect for any businessman is the bank’s Digibanker platform. With high approval ratings, the platform houses a one-stop shop for bills payment, streamlining processes for your business’ financial obligations. It simplifies the payment of bills different deadlines, keeps track of undelivered check payments, and offers tax forms. Now you can go cash-lite and paperless at the same time.

Going cash-lite isn’t as scary as it is. It is important to examine, understand and find the right partner for your needs. As time goes by, a lot of platforms spring out as fast as mushrooms but instead of being intimidated.. embrace it!

7 practical ways to maximize your condo living experience

By Randell Tiongson on October 16th, 2018

It’s more than just putting furniture together, it’s about living smart without compromising style and function. Below are 7 tips to maximize your condo living experience.

Use multi-purpose fixtures or furniture – There’s a certain truism to the adage less is more. The smaller the furniture or fixtures you use the more space you can save. Allowing you to think of other stuff to bring in. If you are looking at bringing in large furniture, rethink your decision. There is a ton of other stuff which can be placed instead of those bulky cabinet or television set of yours. Fixtures or furniture are already available in the market that can literally shape-shift – a sofa can be a bed, a small table can be a dining table set, a coffee table with shelves, and many other more. You just need to be prepared financially as they don’t come in just mere hundreds of pesos.

If you have enough budget and planning on amping the function of your furniture to suit your taste, there are a variety of stores or companies that accommodate custom fabricating it for you.

Use pegboards – If you are working on a tight budget, then consider hanging things on the wall or making artificial walls. Pegboards or small wall décor holder normally does the trick. Coming in different sizes and easily customizable based on your preference and needs, these metal fixtures can be placed anywhere, used for anything, and a good organizer of stuff. What’s more, they are ambulant, should you decide to redecorate your unit, they are easy to take down and attach to a new wall. Using prongs, you can fit in anything to the pegboard. From organizing your books, kitchen backsplash, accessories, keys, and other stuff these handy metal friend of yours has got you covered.

Don’t forget to paint these pegboards!

Use colors that make your unit bigger – deception is everything. Paints help create optical illusions that make confined places look spacious and cozy. It is a generally known fact that light colors make rooms look lighter, brighter, bigger and more inviting. Soft tones such as off-white, blue, and green normally do the trick, while darker shades tend to absorb light making the room smaller and tighter. One caveat is to use lighter shades on wall trims and moulding. This makes walls appear farther back making your unit look spacious. To add to that, the right colors set the mood in the room. It can be a natural therapy for the eyes to reduce stress and boost your creativity and gives you more bandwidth to finish all your deadlines. But it all still depends on you. Choose the color that best reflects you as a person.

Use lights that promote a cozy ambiance – Cliché as it is, but proper lighting is everything. It affects the ambiance of the place and keeps the ball rolling for everything. Be it a dinner romantic date, studying for school, and beating all those deadlines, good lighting helps you achieve that. The psychological effect stimulates the creative region of our brains translating all those creative juices to your output.

If you have access to natural light, allow it to enter your room. It contributes to making the room bigger and admit it, nothing beats natural lighting!

Don’t forget the greens – while it can be a handful to take care of ornamental plants, but keeping one breaks the drudgery of life. Plants are natural stress relievers. It restores the balance of a chaotic place and the inner core of a person. On top of this, plants promote wellness. It reduces the chances of getting coughs, colds, and minor diseases. Enabling you to stay focused and ready for the daily grind.

Zone things – it all boils down to planning things out at the onset. By identifying and dividing your unit into areas based on needs and function, it is much easier to decide which furniture to buy, what are the things to add, and how much space do you need for each area. If you are in the creative industry, placing your workstation near the window helps you reboot your mind. The buildings, skyscrapers, the skies above, and glamorous lights of the city in nighttime can help stimulate something to cook up. If you live with a family, dividing the place will be a bit of a challenge but it will help you to plan well.

Always reinvent – redecorating is not just an avenue to maximize your space, but an opportunity to earn. Annual refurnishing allows you to revisit the things you still need and things you can dispose of. It helps you start anew and upgrade the furniture and assets you acquired the previous year/s. Online apps are available to help you dispense these lucratively.

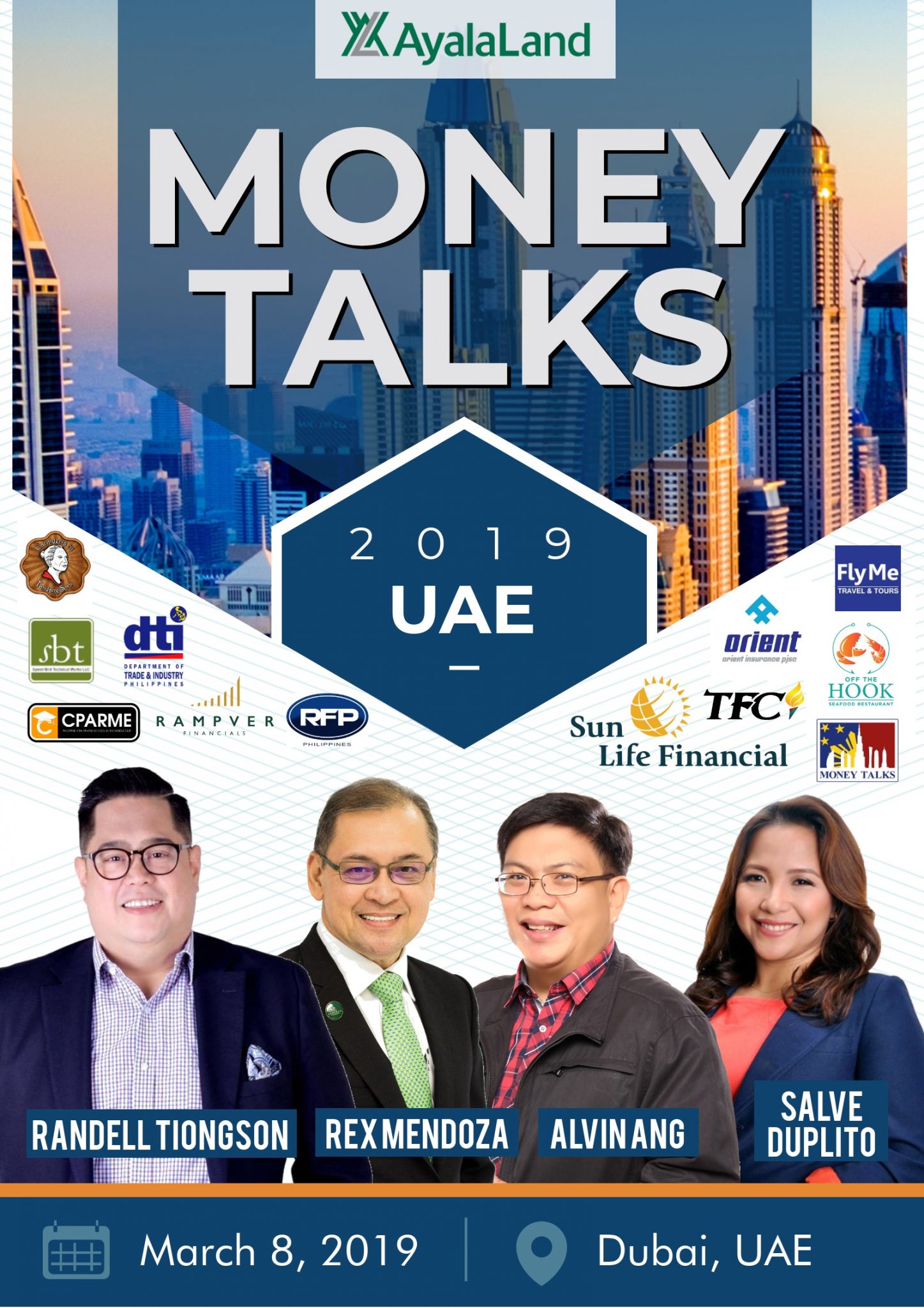

Dubai – www.bit.ly/MTUAE2019

Dubai – www.bit.ly/MTUAE2019